Sa103s PDF 2022

What is the SA103S PDF?

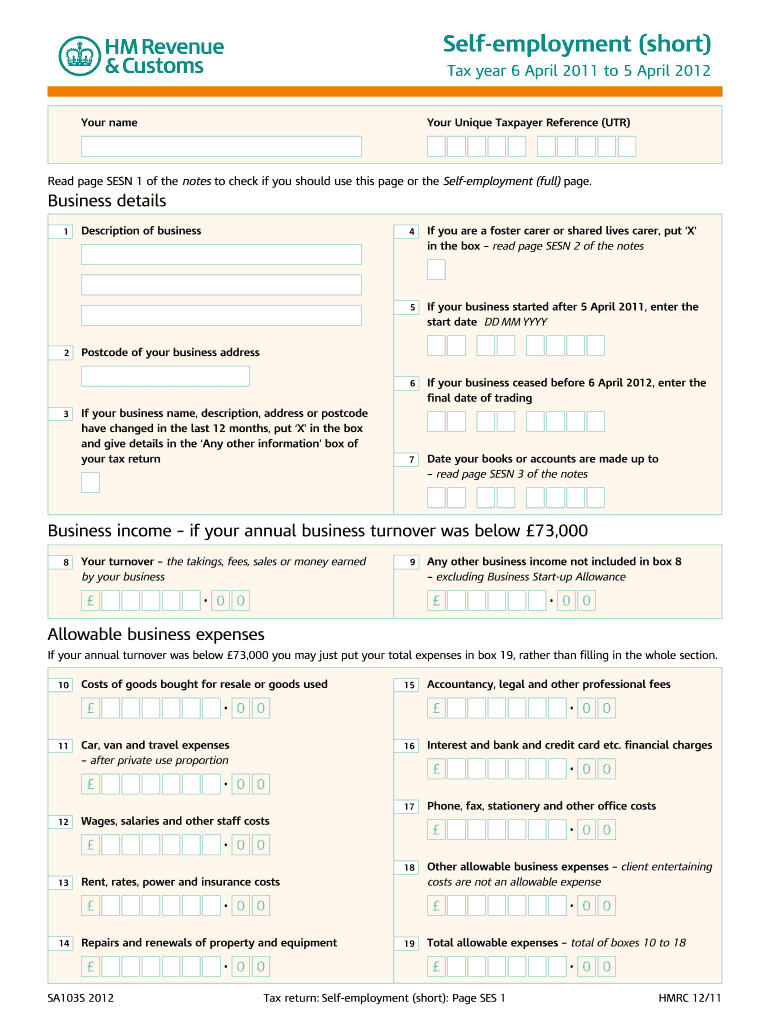

The SA103S form is a supplementary tax document used by self-employed individuals in the United Kingdom to report income from self-employment. Specifically, it is designed for those who have income from a business that is not incorporated. The SA103S PDF version allows taxpayers to fill out and submit their financial information electronically, streamlining the process of tax reporting. This form captures essential details such as trading income, expenses, and any allowable deductions, ensuring compliance with tax regulations.

Steps to Complete the SA103S PDF

Completing the SA103S PDF requires careful attention to detail to ensure accuracy and compliance with tax laws. Here are the key steps involved:

- Gather all relevant financial documents, including records of income and expenses.

- Download the SA103S PDF from a reliable source or access it through an electronic filing platform.

- Fill in your personal information at the top of the form, including your name, address, and National Insurance number.

- Detail your trading income and any other income sources in the designated sections.

- List all allowable business expenses, ensuring you have supporting documentation for each item.

- Review the completed form for accuracy, making sure all figures are correct and all required sections are filled.

- Submit the form electronically or print it for mailing, depending on your filing preference.

Legal Use of the SA103S PDF

The SA103S PDF is legally recognized as a valid document for reporting self-employed income to the tax authorities. To ensure its legal standing, it must be completed accurately and submitted by the relevant deadlines. Compliance with the guidelines set forth by the IRS or HMRC is crucial, as failure to do so may result in penalties or legal repercussions. Using a trusted electronic signature service can further enhance the legitimacy of the document by providing an audit trail and secure submission options.

How to Obtain the SA103S PDF

Obtaining the SA103S PDF is straightforward. Taxpayers can access the form through the official IRS or HMRC website, where it is available for download. Alternatively, many tax preparation software solutions offer the SA103S form as part of their service, allowing for easy completion and submission. Ensure that you are using the correct version of the form for the tax year you are filing, as there may be updates or changes in requirements from year to year.

Filing Deadlines / Important Dates

Filing deadlines for the SA103S form are critical to avoid penalties. Typically, the deadline for submitting your self-assessment tax return, including the SA103S, is January 31st following the end of the tax year. For example, for the tax year ending on April 5, the submission deadline would be January 31 of the following year. It is advisable to check for any updates or changes to deadlines each tax year to ensure timely compliance.

Examples of Using the SA103S PDF

The SA103S PDF is utilized by various self-employed individuals, including freelancers, consultants, and small business owners. For instance, a freelance graphic designer would use the form to report income earned from client projects, detailing expenses such as software subscriptions and office supplies. Similarly, a small business owner operating a local café would report income from sales and list expenses like rent, utilities, and employee wages. These examples illustrate the diverse applications of the SA103S form in accurately reporting self-employment income.

Quick guide on how to complete sa103s pdf

Accomplish Sa103s Pdf seamlessly on any gadget

Digital document administration has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate template and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your files promptly without delays. Handle Sa103s Pdf on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The simplest method to modify and electronically sign Sa103s Pdf effortlessly

- Obtain Sa103s Pdf and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize key sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that task.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sharing your form: via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors necessitating new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Sa103s Pdf to ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sa103s pdf

Create this form in 5 minutes!

How to create an eSignature for the sa103s pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sa103s form 2012 pdf, and why do I need it?

The sa103s form 2012 pdf is a self-assessment tax form used by sole traders in the UK to report their income and expenses. It's essential for ensuring compliance with HMRC regulations and helps you submit accurate tax returns, which can save you money in the long run.

-

How can airSlate SignNow assist with the sa103s form 2012 pdf?

airSlate SignNow simplifies the process of filling out and signing the sa103s form 2012 pdf. With our platform, you can easily upload, edit, eSign, and share the form securely, ensuring a hassle-free experience.

-

What are the pricing options for using airSlate SignNow for the sa103s form 2012 pdf?

airSlate SignNow offers flexible pricing plans to accommodate various needs, making it cost-effective for businesses of all sizes. Whether you require basic features or advanced capabilities for handling the sa103s form 2012 pdf, we've got a plan that fits your budget.

-

Does airSlate SignNow support integrations with accounting software for the sa103s form 2012 pdf?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, allowing you to easily incorporate your financial data when completing the sa103s form 2012 pdf. This integration enhances efficiency and reduces manual entry errors.

-

What features of airSlate SignNow make it ideal for managing the sa103s form 2012 pdf?

airSlate SignNow offers features like intuitive document editing, secure eSigning, and cloud storage that make managing the sa103s form 2012 pdf straightforward. Additionally, its user-friendly interface ensures that you can navigate the process smoothly.

-

Is it safe to use airSlate SignNow for sensitive documents like the sa103s form 2012 pdf?

Absolutely! airSlate SignNow employs industry-standard encryption and security measures to protect your sensitive documents, including the sa103s form 2012 pdf. You can trust us to keep your information safe while you focus on running your business.

-

Can I access the sa103s form 2012 pdf on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to complete and sign the sa103s form 2012 pdf on the go. Our mobile-friendly platform ensures you never miss a deadline, even while traveling.

Get more for Sa103s Pdf

- Request for disposal use permit san bernardino county sbcounty form

- Pe verification form 1st semester virginia beach

- Language handbook worksheets answer key pdf 232249730 form

- State of maine direct hire form

- Las cruces public schools transfer request form

- Keep a bladder diary form

- Comfort in social situations worksheet form

- Vendor non compete agreement template form

Find out other Sa103s Pdf

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease