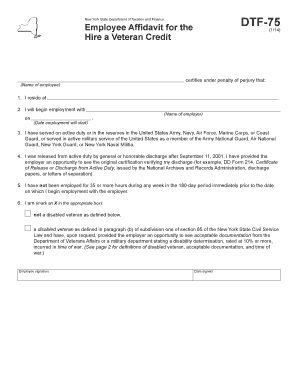

Form DTF 75 Department of Taxation and Finance New York State Tax Ny 2014

Understanding Form DTF 75

The Form DTF 75 is a critical document issued by the Department of Taxation and Finance in New York State. This form is primarily used for tax purposes, specifically for claiming a refund of New York State income tax withheld from wages. It serves as a means for taxpayers to report their income and calculate any potential refunds they may be eligible for. Understanding the purpose and requirements of this form is essential for ensuring compliance with state tax regulations.

Steps to Complete Form DTF 75

Completing Form DTF 75 involves several key steps. First, gather all necessary documentation, including your W-2 forms and any other income statements. Next, accurately fill out the personal information section, ensuring that your name, address, and Social Security number are correct. Then, report your total income and any taxes withheld as indicated on your W-2 forms. Finally, review the form for accuracy before submission to avoid delays in processing your refund.

How to Obtain Form DTF 75

Form DTF 75 can be easily obtained from the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing taxpayers to print and fill it out at their convenience. Additionally, physical copies may be available at local tax offices or public libraries. Ensure you have the most current version of the form to comply with any recent updates or changes in tax regulations.

Legal Use of Form DTF 75

The legal use of Form DTF 75 is to claim a refund for overpaid New York State income taxes. Taxpayers must ensure that they meet the eligibility criteria, which typically includes having had taxes withheld from their wages or making estimated tax payments. Using this form correctly helps avoid potential penalties and ensures compliance with state tax laws, safeguarding taxpayers' rights to refunds they are entitled to.

Filing Deadlines for Form DTF 75

It is crucial to be aware of the filing deadlines associated with Form DTF 75. Generally, the form must be submitted by April 15 of the year following the tax year for which the refund is being claimed. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Timely submission is essential to ensure that claims for refunds are processed without delays.

Form Submission Methods

Form DTF 75 can be submitted through various methods, including online, by mail, or in person. For online submissions, taxpayers can use the New York State Department of Taxation and Finance's secure portal. If submitting by mail, ensure that the form is sent to the correct address specified in the instructions. In-person submissions can be made at designated tax offices, allowing for immediate confirmation of receipt.

Key Elements of Form DTF 75

Form DTF 75 includes several key elements that are essential for accurate completion. These elements typically include personal identification information, income details, and tax withholding amounts. Additionally, the form may require signatures and dates to validate the claim. Understanding these components ensures that taxpayers provide all necessary information, facilitating a smoother processing experience for their refund claims.

Quick guide on how to complete form dtf 75 department of taxation and finance new york state tax ny

Prepare Form DTF 75 Department Of Taxation And Finance New York State Tax Ny effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a superb eco-friendly alternative to conventional printed and signed papers, as you can obtain the necessary format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without issues. Manage Form DTF 75 Department Of Taxation And Finance New York State Tax Ny on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form DTF 75 Department Of Taxation And Finance New York State Tax Ny without hassle

- Locate Form DTF 75 Department Of Taxation And Finance New York State Tax Ny and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Alter and eSign Form DTF 75 Department Of Taxation And Finance New York State Tax Ny and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form dtf 75 department of taxation and finance new york state tax ny

Create this form in 5 minutes!

How to create an eSignature for the form dtf 75 department of taxation and finance new york state tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form DTF 75 from the Department Of Taxation And Finance in New York State?

Form DTF 75 is a document issued by the Department Of Taxation And Finance in New York State that is used for various tax-related purposes. It is essential for businesses and individuals to understand its requirements to ensure compliance with New York State Tax regulations.

-

How can airSlate SignNow help with Form DTF 75?

airSlate SignNow provides an efficient platform for businesses to send and eSign Form DTF 75 electronically. This streamlines the process, reduces paperwork, and ensures that your submissions to the Department Of Taxation And Finance in New York State are timely and secure.

-

What are the pricing options for using airSlate SignNow for Form DTF 75?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it a cost-effective solution for managing Form DTF 75. You can choose from various subscription tiers based on the volume of documents you need to handle, ensuring you only pay for what you use.

-

What features does airSlate SignNow offer for managing Form DTF 75?

With airSlate SignNow, you can easily create, send, and eSign Form DTF 75 with features like templates, automated workflows, and real-time tracking. These tools enhance efficiency and ensure that all necessary steps are completed for compliance with New York State Tax requirements.

-

Are there any integrations available for airSlate SignNow when handling Form DTF 75?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, allowing you to manage Form DTF 75 alongside your existing tools. This integration capability enhances your workflow and ensures that all your tax documentation is organized and accessible.

-

What are the benefits of using airSlate SignNow for Form DTF 75?

Using airSlate SignNow for Form DTF 75 offers numerous benefits, including increased efficiency, reduced processing time, and enhanced security for your documents. This solution empowers businesses to focus on their core activities while ensuring compliance with the Department Of Taxation And Finance in New York State.

-

Is airSlate SignNow user-friendly for completing Form DTF 75?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete and eSign Form DTF 75. The intuitive interface ensures that even those with minimal technical skills can navigate the platform effortlessly.

Get more for Form DTF 75 Department Of Taxation And Finance New York State Tax Ny

- Release form michigan bpa

- Student accident incident report formxls

- Participants legal liability coverage form

- Credit application and personal guarantee missouri mulch form

- Cepa community trust grant application final draft2docx form

- Industrial hvac ampamp generator rentals in fl tx ampamp laportable air form

- This examination must be certified by a form

- Insulation certificate 76111625 form

Find out other Form DTF 75 Department Of Taxation And Finance New York State Tax Ny

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF