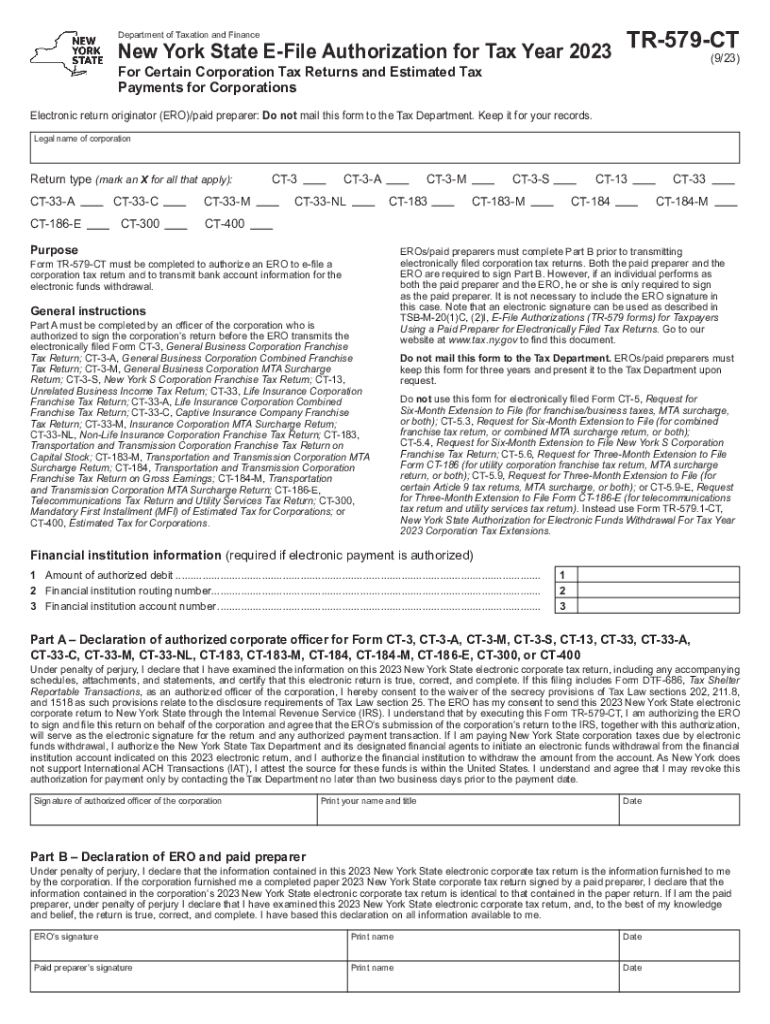

Form TR 579 CT, New York State E File Authorization for 2023

Understanding the New York E File Authorization Form

The New York E File Authorization Form, officially known as Form TR-579 CT, is a crucial document for taxpayers who wish to authorize an electronic filing of their tax returns. This form allows tax professionals to file returns on behalf of taxpayers, ensuring compliance with state regulations. It is particularly relevant for individuals and businesses who prefer the convenience of e-filing over traditional paper submissions.

Steps to Complete the New York E File Authorization Form

Completing the Form TR-579 CT involves a few straightforward steps:

- Begin by providing your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are granting authorization.

- Designate your tax preparer by including their name, address, and preparer identification number.

- Sign and date the form to validate your authorization.

Ensure all information is accurate to avoid delays in processing your e-filed tax return.

Obtaining the New York E File Authorization Form

The Form TR-579 CT can be easily obtained through the New York State Department of Taxation and Finance website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, many tax preparation software programs include this form as part of their e-filing services, allowing for seamless integration into the filing process.

Legal Use of the New York E File Authorization Form

The Form TR-579 CT serves a legal purpose by allowing taxpayers to authorize a third party to file their tax returns electronically. This authorization is essential for ensuring that tax preparers can submit returns on behalf of clients, adhering to New York State tax laws. It is important to retain a copy of the signed form for your records, as it may be required for verification purposes by tax authorities.

Filing Deadlines and Important Dates

Awareness of filing deadlines is critical when using the New York E File Authorization Form. Typically, the deadline for submitting e-filed tax returns aligns with the federal tax deadline, which is usually April 15. However, taxpayers should verify specific dates each tax year, as extensions or changes may occur. Filing on time helps avoid penalties and ensures compliance with state regulations.

Examples of Using the New York E File Authorization Form

There are various scenarios in which the Form TR-579 CT is utilized:

- A self-employed individual authorizing a tax professional to file their business taxes electronically.

- A retired taxpayer seeking assistance with their tax returns, allowing a preparer to submit on their behalf.

- Students who may not have the time or expertise to file their taxes independently can authorize a parent or tax preparer.

These examples illustrate the form's versatility in accommodating different taxpayer situations.

Quick guide on how to complete form tr 579 ct new york state e file authorization for

Prepare Form TR 579 CT, New York State E File Authorization For easily on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Form TR 579 CT, New York State E File Authorization For on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Form TR 579 CT, New York State E File Authorization For effortlessly

- Find Form TR 579 CT, New York State E File Authorization For and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your updates.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form TR 579 CT, New York State E File Authorization For and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form tr 579 ct new york state e file authorization for

Create this form in 5 minutes!

How to create an eSignature for the form tr 579 ct new york state e file authorization for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NY e file authorization form?

The NY e file authorization form is a document that allows taxpayers to authorize a tax professional to e-file their tax returns on their behalf. This form is essential for ensuring that your tax filings are submitted accurately and securely. With airSlate SignNow, you can easily complete and eSign this form online.

-

How can I obtain the NY e file authorization form?

You can obtain the NY e file authorization form directly from the New York State Department of Taxation and Finance website. Additionally, airSlate SignNow provides templates that allow you to create and customize this form quickly. Our platform simplifies the process of filling out and signing the form electronically.

-

Is there a cost associated with using airSlate SignNow for the NY e file authorization form?

airSlate SignNow offers a cost-effective solution for managing documents, including the NY e file authorization form. Pricing plans are available to suit different business needs, and you can choose a plan that fits your budget. The value provided by our platform often outweighs the costs, especially for frequent users.

-

What features does airSlate SignNow offer for the NY e file authorization form?

airSlate SignNow offers a range of features for the NY e file authorization form, including customizable templates, secure eSigning, and document tracking. These features enhance the efficiency of your document management process. You can also integrate with various applications to streamline your workflow.

-

How does airSlate SignNow ensure the security of the NY e file authorization form?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure servers to protect your data when completing the NY e file authorization form. Additionally, our platform complies with industry standards to ensure that your sensitive information remains confidential.

-

Can I integrate airSlate SignNow with other software for the NY e file authorization form?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the NY e file authorization form alongside your existing tools. Whether you use CRM systems, accounting software, or other platforms, our integrations enhance your workflow and productivity.

-

What are the benefits of using airSlate SignNow for the NY e file authorization form?

Using airSlate SignNow for the NY e file authorization form provides numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our platform allows you to complete and eSign documents from anywhere, making it convenient for busy professionals. Additionally, the electronic process minimizes errors associated with manual entries.

Get more for Form TR 579 CT, New York State E File Authorization For

- Louisiana marriage 497309130 form

- Louisiana partition property form

- Unanimous consent directors of form

- Consent members form

- Unanimous consent shareholders form

- Unanimous consent agreement by the shareholders and directors of corporation louisiana form

- Louisiana donation form 497309136

- Donation and declaration louisiana form

Find out other Form TR 579 CT, New York State E File Authorization For

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney