TR 579 CT New York State E File Authorization for Certain Corporation Tax Returns and Estimated Tax Payments for Corporations Ta 2024-2026

Understanding the TR 579 CT for New York State

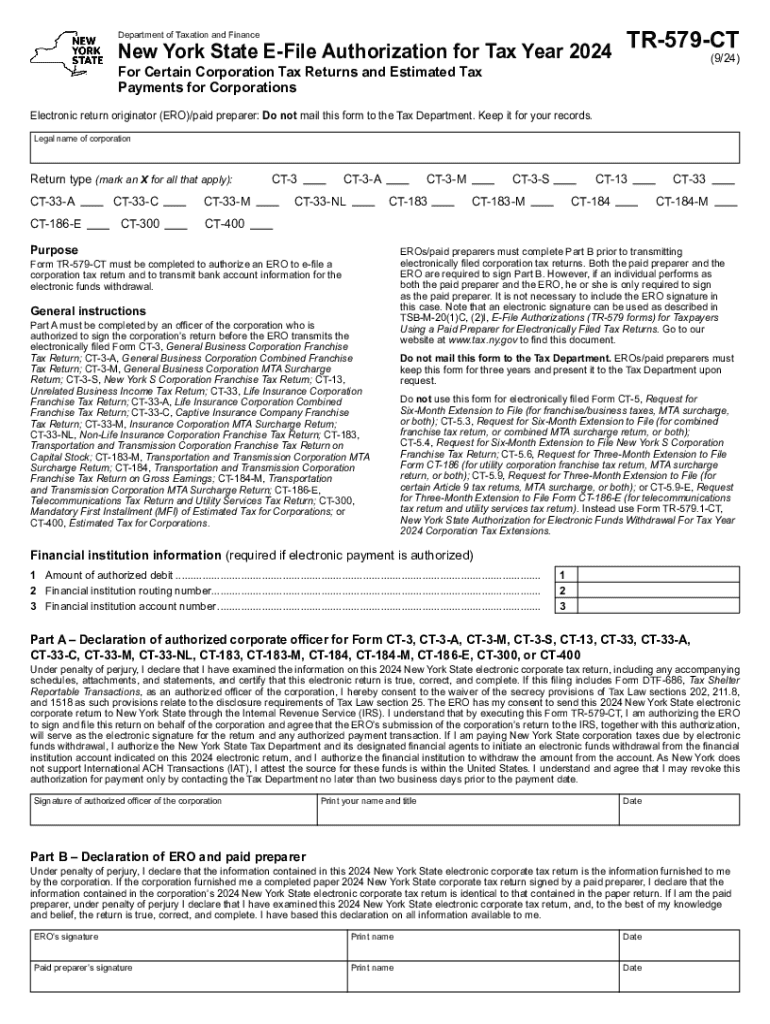

The TR 579 CT is a crucial form used in New York State for e-filing certain corporation tax returns and making estimated tax payments. This form serves as an authorization that allows corporations to submit their tax documents electronically, streamlining the filing process. It is specifically designed for corporate entities that meet the eligibility criteria set forth by the New York State Department of Taxation and Finance.

Steps to Complete the TR 579 CT

Completing the TR 579 CT involves several key steps:

- Gather necessary information, including your corporation's tax identification number and details about your tax returns.

- Access the form through the New York State Department of Taxation and Finance website or authorized e-filing software.

- Fill out the form accurately, ensuring all required fields are completed.

- Review your entries for any errors or omissions.

- Submit the form electronically through your chosen e-filing method.

Eligibility Criteria for the TR 579 CT

To use the TR 579 CT, corporations must meet specific eligibility criteria. Generally, this includes:

- Being registered as a corporation in New York State.

- Having a valid tax identification number.

- Filing certain types of corporation tax returns, as defined by the New York State Department of Taxation and Finance.

Corporations should verify their eligibility before attempting to complete the form to avoid potential filing issues.

Required Documents for TR 579 CT Submission

When preparing to submit the TR 579 CT, corporations should have the following documents ready:

- Previous year’s tax return for reference.

- Any supporting documents related to income and deductions.

- Tax identification number and business registration details.

Having these documents on hand can facilitate a smoother completion and submission process.

Filing Deadlines for the TR 579 CT

Corporations must adhere to specific filing deadlines to ensure compliance with New York State tax regulations. Generally, the TR 579 CT should be submitted by the due date of the corporation’s tax return. It is advisable to check the New York State Department of Taxation and Finance website for the most current deadlines, as they may vary based on the corporation's fiscal year and other factors.

Legal Use of the TR 579 CT

The TR 579 CT is legally binding once submitted and serves as an authorization for electronic filing. Corporations should ensure that all information provided is accurate and complete to avoid legal repercussions. Misrepresentation or errors can lead to penalties or issues with tax compliance. It is essential for corporations to maintain proper records of their submissions and any correspondence related to the TR 579 CT.

Create this form in 5 minutes or less

Find and fill out the correct tr 579 ct new york state e file authorization for certain corporation tax returns and estimated tax payments for corporations

Create this form in 5 minutes!

How to create an eSignature for the tr 579 ct new york state e file authorization for certain corporation tax returns and estimated tax payments for corporations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new york tr 579 ct and how does it relate to airSlate SignNow?

The new york tr 579 ct is a specific tax regulation that businesses in New York must comply with. airSlate SignNow provides an efficient way to manage and eSign documents related to this regulation, ensuring that your business stays compliant while saving time.

-

How much does airSlate SignNow cost for businesses dealing with new york tr 579 ct?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. For those specifically dealing with new york tr 579 ct, our plans are designed to be cost-effective, allowing you to manage your document signing needs without breaking the bank.

-

What features does airSlate SignNow offer for managing new york tr 579 ct documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing new york tr 579 ct documents. These features streamline the signing process and enhance compliance with tax regulations.

-

Can airSlate SignNow integrate with other tools for new york tr 579 ct compliance?

Yes, airSlate SignNow seamlessly integrates with various business tools and software, making it easier to manage new york tr 579 ct compliance. This integration allows for a smoother workflow and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for new york tr 579 ct documentation?

Using airSlate SignNow for new york tr 579 ct documentation offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, allowing you to focus on your business rather than administrative tasks.

-

Is airSlate SignNow user-friendly for those unfamiliar with new york tr 579 ct?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for everyone, even those unfamiliar with new york tr 579 ct. Our intuitive interface ensures that you can easily navigate the platform and manage your documents.

-

How does airSlate SignNow ensure the security of new york tr 579 ct documents?

airSlate SignNow prioritizes the security of your documents, including those related to new york tr 579 ct. We use advanced encryption and secure storage solutions to protect your sensitive information from unauthorized access.

Get more for TR 579 CT New York State E File Authorization For Certain Corporation Tax Returns And Estimated Tax Payments For Corporations Ta

Find out other TR 579 CT New York State E File Authorization For Certain Corporation Tax Returns And Estimated Tax Payments For Corporations Ta

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile