the Self Employment Assistance Program Individual Services Verification Form ES 161 4 2021-2026

What is the Self Employment Assistance Program Individual Services Verification Form ES 161 4

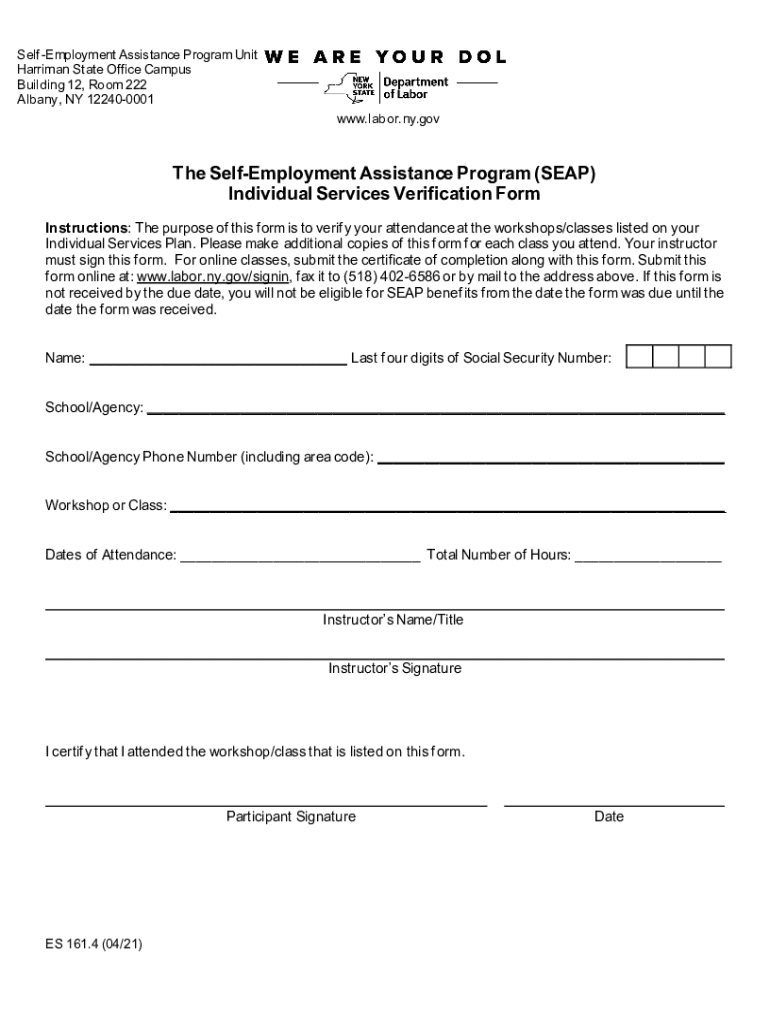

The Self Employment Assistance Program Individual Services Verification Form ES 161 4 is a document used by individuals participating in the Self Employment Assistance (SEA) Program. This program is designed to assist unemployed individuals in starting their own businesses while receiving unemployment benefits. The form collects essential information to verify eligibility for the program and the services provided to participants. It is crucial for ensuring that applicants meet the necessary criteria to receive support and resources for their entrepreneurial endeavors.

How to use the Self Employment Assistance Program Individual Services Verification Form ES 161 4

Using the Self Employment Assistance Program Individual Services Verification Form ES 161 4 involves several steps. First, individuals must obtain the form from their state’s employment office or relevant agency. After acquiring the form, participants should carefully read the instructions provided. The form requires personal information, details about the business venture, and information regarding any services received under the program. Once completed, the form must be submitted to the appropriate state agency for review and approval.

Steps to complete the Self Employment Assistance Program Individual Services Verification Form ES 161 4

Completing the Self Employment Assistance Program Individual Services Verification Form ES 161 4 involves the following steps:

- Gather necessary personal information, including your name, address, and Social Security number.

- Provide details about your business idea or current business operations.

- List any services or assistance received through the program, such as training or coaching.

- Review the form for accuracy and completeness before submission.

- Submit the form to the designated state agency either online, by mail, or in person, as per state guidelines.

Legal use of the Self Employment Assistance Program Individual Services Verification Form ES 161 4

The Self Employment Assistance Program Individual Services Verification Form ES 161 4 is legally binding and must be used in accordance with state regulations. This form serves as an official document to verify eligibility for the SEA Program and the services provided. Misrepresentation or failure to provide accurate information on this form can lead to penalties, including the loss of benefits or legal repercussions. It is essential for applicants to ensure that all information is truthful and complete to maintain compliance with the law.

Eligibility Criteria

To qualify for the Self Employment Assistance Program, applicants must meet specific eligibility criteria. Generally, individuals must be unemployed and receiving unemployment benefits. They should demonstrate a viable business idea and a commitment to pursuing self-employment. Additionally, applicants may need to participate in training or workshops related to business development as part of the program requirements. Each state may have its own specific criteria, so it is important to review local guidelines carefully.

Form Submission Methods

The Self Employment Assistance Program Individual Services Verification Form ES 161 4 can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state’s employment agency website.

- Mailing the completed form to the designated agency address.

- In-person submission at local employment offices or designated locations.

It is advisable to check with the local agency for the preferred submission method to ensure timely processing.

Quick guide on how to complete the self employment assistance program individual services verification form es 161 4

Prepare The Self Employment Assistance Program Individual Services Verification Form ES 161 4 effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage The Self Employment Assistance Program Individual Services Verification Form ES 161 4 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign The Self Employment Assistance Program Individual Services Verification Form ES 161 4 with ease

- Obtain The Self Employment Assistance Program Individual Services Verification Form ES 161 4 and click on Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Mark relevant portions of the documents or redact sensitive details using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your needs in document management in just a few clicks from any device of your choice. Alter and eSign The Self Employment Assistance Program Individual Services Verification Form ES 161 4 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct the self employment assistance program individual services verification form es 161 4

Create this form in 5 minutes!

How to create an eSignature for the the self employment assistance program individual services verification form es 161 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is The Self Employment Assistance Program Individual Services Verification Form ES 161 4?

The Self Employment Assistance Program Individual Services Verification Form ES 161 4 is a document required for individuals participating in the Self Employment Assistance Program. This form verifies the services provided to support self-employment initiatives. Completing this form accurately is essential for receiving the necessary assistance.

-

How can airSlate SignNow help with The Self Employment Assistance Program Individual Services Verification Form ES 161 4?

airSlate SignNow simplifies the process of completing and submitting The Self Employment Assistance Program Individual Services Verification Form ES 161 4. With our platform, you can easily fill out, eSign, and send the form securely. This streamlines your workflow and ensures that your documents are processed efficiently.

-

Is there a cost associated with using airSlate SignNow for The Self Employment Assistance Program Individual Services Verification Form ES 161 4?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage The Self Employment Assistance Program Individual Services Verification Form ES 161 4 and other documents efficiently. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing The Self Employment Assistance Program Individual Services Verification Form ES 161 4?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and document tracking for The Self Employment Assistance Program Individual Services Verification Form ES 161 4. These features enhance your document management experience, making it easier to handle forms and ensure compliance with program requirements.

-

Can I integrate airSlate SignNow with other applications for The Self Employment Assistance Program Individual Services Verification Form ES 161 4?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling The Self Employment Assistance Program Individual Services Verification Form ES 161 4. This means you can connect with tools you already use, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for The Self Employment Assistance Program Individual Services Verification Form ES 161 4?

Using airSlate SignNow for The Self Employment Assistance Program Individual Services Verification Form ES 161 4 provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform ensures that your documents are handled with care, reducing the risk of errors and ensuring timely submissions.

-

How secure is airSlate SignNow when handling The Self Employment Assistance Program Individual Services Verification Form ES 161 4?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your data when managing The Self Employment Assistance Program Individual Services Verification Form ES 161 4. You can trust that your information is safe and secure throughout the entire process.

Get more for The Self Employment Assistance Program Individual Services Verification Form ES 161 4

- Nebraska drainage 497318379 form

- Tax free exchange package nebraska form

- Landlord tenant sublease package nebraska form

- Buy sell agreement package nebraska form

- Option to purchase package nebraska form

- Amendment of lease package nebraska form

- Annual financial checkup package nebraska form

- Ne bill sale 497318386 form

Find out other The Self Employment Assistance Program Individual Services Verification Form ES 161 4

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF