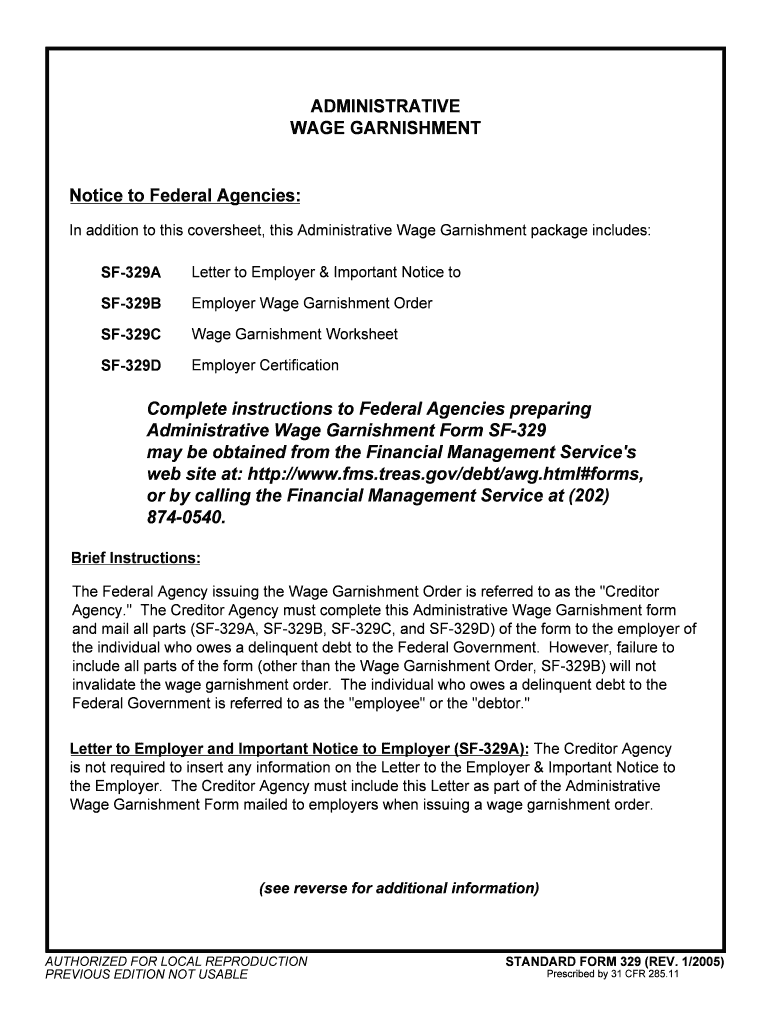

ADMINISTRATIVE WAGE GARNISHMENT Notice to GSA Form

Understanding the wage garnishment notice

A wage garnishment notice is a legal document that instructs an employer to withhold a portion of an employee's earnings to satisfy a debt. This notice typically arises from court orders or government agencies seeking to collect unpaid debts, such as taxes or child support. It is essential for both employers and employees to understand the implications of this notice, as it affects financial well-being and employment relationships.

Key elements of the wage garnishment notice

The wage garnishment notice contains several critical components that ensure its validity and enforceability. These elements include:

- Debtor Information: The name and address of the employee whose wages are being garnished.

- Creditor Information: The name and address of the entity or individual to whom the debt is owed.

- Amount to be Garnished: The specific dollar amount or percentage of wages that must be withheld.

- Legal Basis: The court order or statutory authority that justifies the garnishment.

- Employer Instructions: Clear directives for the employer on how to process the garnishment.

Steps to complete the wage garnishment notice

Filling out a wage garnishment notice involves several steps to ensure compliance with legal requirements. Follow these steps for accurate completion:

- Gather necessary information about the debtor and creditor.

- Determine the amount to be garnished based on applicable laws.

- Fill out the notice template, ensuring all required fields are completed.

- Attach any supporting documents, such as the court order.

- Send the completed notice to the employer and retain copies for records.

Legal use of the wage garnishment notice

The legal use of a wage garnishment notice is governed by federal and state laws. Employers must comply with these regulations to avoid legal repercussions. Key points include:

- Adherence to the Fair Debt Collection Practices Act (FDCPA).

- Understanding state-specific limits on garnishment amounts.

- Ensuring proper notification to the employee about the garnishment.

Penalties for non-compliance

Failure to comply with a wage garnishment notice can lead to significant penalties for employers. These may include:

- Legal action from the creditor.

- Fines imposed by state or federal agencies.

- Potential liability for the amount that should have been garnished.

Examples of using the wage garnishment notice

Examples of situations where a wage garnishment notice may be issued include:

- Unpaid child support obligations.

- Delinquent federal or state taxes.

- Defaulted student loans.

Quick guide on how to complete administrative wage garnishment notice to gsa

Easily prepare ADMINISTRATIVE WAGE GARNISHMENT Notice To GSA on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle ADMINISTRATIVE WAGE GARNISHMENT Notice To GSA seamlessly across any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to alter and electronically sign ADMINISTRATIVE WAGE GARNISHMENT Notice To GSA effortlessly

- Locate ADMINISTRATIVE WAGE GARNISHMENT Notice To GSA and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invite link, or download it directly to your computer.

Stop worrying about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign ADMINISTRATIVE WAGE GARNISHMENT Notice To GSA to guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the administrative wage garnishment notice to gsa

How to generate an eSignature for the Administrative Wage Garnishment Notice To Gsa online

How to generate an electronic signature for your Administrative Wage Garnishment Notice To Gsa in Chrome

How to generate an electronic signature for signing the Administrative Wage Garnishment Notice To Gsa in Gmail

How to create an electronic signature for the Administrative Wage Garnishment Notice To Gsa from your smart phone

How to create an electronic signature for the Administrative Wage Garnishment Notice To Gsa on iOS

How to create an eSignature for the Administrative Wage Garnishment Notice To Gsa on Android

People also ask

-

What is a wage garnishment notice to employee template?

A wage garnishment notice to employee template is a pre-formatted document that informs an employee that their wages will be garnished. This template typically outlines the reasons for the garnishment, the amount being withheld, and any necessary steps the employee should take. Using our template ensures compliance with legal requirements and simplifies the process for employers.

-

How does airSlate SignNow simplify the creation of a wage garnishment notice to employee template?

airSlate SignNow allows users to quickly create a customized wage garnishment notice to employee template with an intuitive drag-and-drop interface. You can easily fill in relevant details, add your company branding, and personalize the message for each employee. This streamlines the process, saving time and reducing errors.

-

Is there a cost associated with using the wage garnishment notice to employee template in airSlate SignNow?

Yes, using the wage garnishment notice to employee template is part of our subscription plans available at airSlate SignNow. We offer various pricing options tailored to different business sizes and needs, ensuring you get a cost-effective solution for document management. You can choose a plan that best fits your organization's requirements.

-

Can I integrate the wage garnishment notice to employee template with other software?

Absolutely! airSlate SignNow integrates seamlessly with various applications, such as HR systems and payment platforms. This allows you to automate the process of sending out wage garnishment notices to employees, ensuring efficiency and accuracy. You can connect your existing tools and enhance your document workflow effortlessly.

-

What are the benefits of using a wage garnishment notice to employee template?

Using a wage garnishment notice to employee template provides numerous benefits, including compliance with legal standards, time savings, and the ability to maintain clear communication with employees. It helps ensure that all necessary information is included, reducing the risk of potential disputes. Additionally, having a standardized template enhances professionalism.

-

Is the wage garnishment notice to employee template customizable?

Yes, the wage garnishment notice to employee template offered by airSlate SignNow is fully customizable. You can modify the content to suit your company's policies, include specific details relevant to the garnishment, and incorporate your organization's branding. This flexibility ensures that the template meets your unique needs.

-

How secure is the process of sending a wage garnishment notice to employee template?

The security of sending a wage garnishment notice to employee template through airSlate SignNow is a top priority. Our platform uses advanced encryption and robust security measures to protect sensitive information. You can trust that the documents are secure and that employee data remains confidential throughout the eSigning process.

Get more for ADMINISTRATIVE WAGE GARNISHMENT Notice To GSA

Find out other ADMINISTRATIVE WAGE GARNISHMENT Notice To GSA

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document