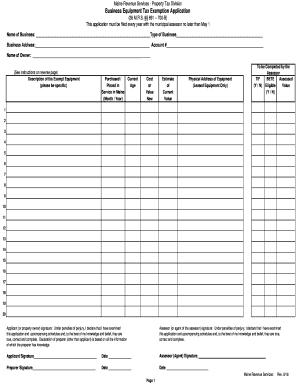

Maine Revenue Services Property Tax Division Form

Understanding the Maine Revenue Services Property Tax Division

The Maine Revenue Services Property Tax Division is responsible for overseeing property tax administration in the state of Maine. This division ensures that property taxes are assessed fairly and consistently across municipalities. It provides guidance to local assessors, administers property tax laws, and oversees various property tax programs, including exemptions and abatements. The division plays a crucial role in ensuring compliance with state laws and regulations related to property taxation.

How to Navigate the Maine Revenue Services Property Tax Division

Utilizing the Maine Revenue Services Property Tax Division involves understanding its resources and services. Property owners can access forms, guidelines, and information regarding property tax assessments and appeals. The division also offers educational resources to help taxpayers understand their rights and responsibilities. Engaging with the division can help clarify any questions regarding property tax obligations and available exemptions.

Steps to Complete Property Tax Forms

Completing forms related to the Maine Revenue Services Property Tax Division requires careful attention to detail. Begin by identifying the specific form needed, such as those for property tax exemptions or appeals. Gather all necessary documentation, including proof of ownership and any relevant financial information. Follow the instructions provided with the form, ensuring that all fields are filled out accurately. Once completed, submit the form through the designated method, whether online, by mail, or in person.

Required Documents for Property Tax Transactions

When dealing with the Maine Revenue Services Property Tax Division, specific documents may be required depending on the nature of the request. Commonly required documents include proof of property ownership, previous tax bills, and any documentation supporting claims for exemptions or abatements. It is essential to check the specific requirements for each form to ensure that all necessary paperwork is included, which can prevent delays in processing.

Filing Deadlines and Important Dates

Awareness of filing deadlines is crucial when working with the Maine Revenue Services Property Tax Division. Key dates include deadlines for submitting property tax exemption applications and appeals, which typically align with local tax assessment schedules. Missing these deadlines can result in the loss of eligibility for certain benefits or the inability to contest property tax assessments. It is advisable to stay informed about these dates to ensure compliance and maximize potential benefits.

Eligibility Criteria for Property Tax Programs

Eligibility for various property tax programs administered by the Maine Revenue Services Property Tax Division varies based on specific criteria. Programs may include exemptions for veterans, the elderly, or low-income homeowners. Each program has distinct requirements that must be met to qualify. Property owners should review the eligibility criteria carefully to determine their potential qualifications for tax relief or other benefits.

Quick guide on how to complete maine revenue services property tax division

Complete Maine Revenue Services Property Tax Division effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it in the cloud. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Handle Maine Revenue Services Property Tax Division on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Maine Revenue Services Property Tax Division effortlessly

- Obtain Maine Revenue Services Property Tax Division and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes just moments and carries the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or incomplete files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Maine Revenue Services Property Tax Division and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maine revenue services property tax division

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the Maine Revenue Services Property Tax Division provide?

The Maine Revenue Services Property Tax Division offers a range of services including property tax assessments, exemptions, and appeals. They ensure compliance with state laws and provide guidance to municipalities on property tax administration. Understanding these services can help property owners navigate their tax obligations effectively.

-

How can airSlate SignNow assist with documents related to the Maine Revenue Services Property Tax Division?

airSlate SignNow simplifies the process of sending and eSigning documents required by the Maine Revenue Services Property Tax Division. With its user-friendly interface, you can quickly prepare and sign tax-related documents, ensuring timely submissions. This efficiency can help you stay compliant with property tax regulations.

-

What are the pricing options for using airSlate SignNow for property tax documents?

airSlate SignNow offers flexible pricing plans that cater to various business needs, making it a cost-effective solution for managing documents related to the Maine Revenue Services Property Tax Division. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features required. This allows you to find a plan that fits your budget.

-

Are there any integrations available with airSlate SignNow for property tax management?

Yes, airSlate SignNow integrates seamlessly with various applications that can enhance your property tax management processes. These integrations allow you to connect with accounting software, CRM systems, and other tools that facilitate communication with the Maine Revenue Services Property Tax Division. This connectivity streamlines your workflow and improves efficiency.

-

What benefits does airSlate SignNow provide for businesses dealing with the Maine Revenue Services Property Tax Division?

Using airSlate SignNow offers numerous benefits for businesses interacting with the Maine Revenue Services Property Tax Division. It enhances document security, reduces processing time, and minimizes errors associated with manual signatures. This leads to a more efficient and reliable way to handle property tax documentation.

-

How does airSlate SignNow ensure the security of documents related to the Maine Revenue Services Property Tax Division?

airSlate SignNow prioritizes document security by employing advanced encryption and secure cloud storage. This ensures that all documents related to the Maine Revenue Services Property Tax Division are protected from unauthorized access. Additionally, the platform complies with industry standards to safeguard sensitive information.

-

Can I track the status of my documents sent to the Maine Revenue Services Property Tax Division using airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all documents sent, including those related to the Maine Revenue Services Property Tax Division. You can easily monitor the status of your documents, ensuring that you are informed about when they are viewed and signed, which helps you stay on top of your tax obligations.

Get more for Maine Revenue Services Property Tax Division

Find out other Maine Revenue Services Property Tax Division

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple