Form ST 101 Filing Annual Sales Tax in New York State 2024

What is the Form ST 101 Filing Annual Sales Tax In New York State

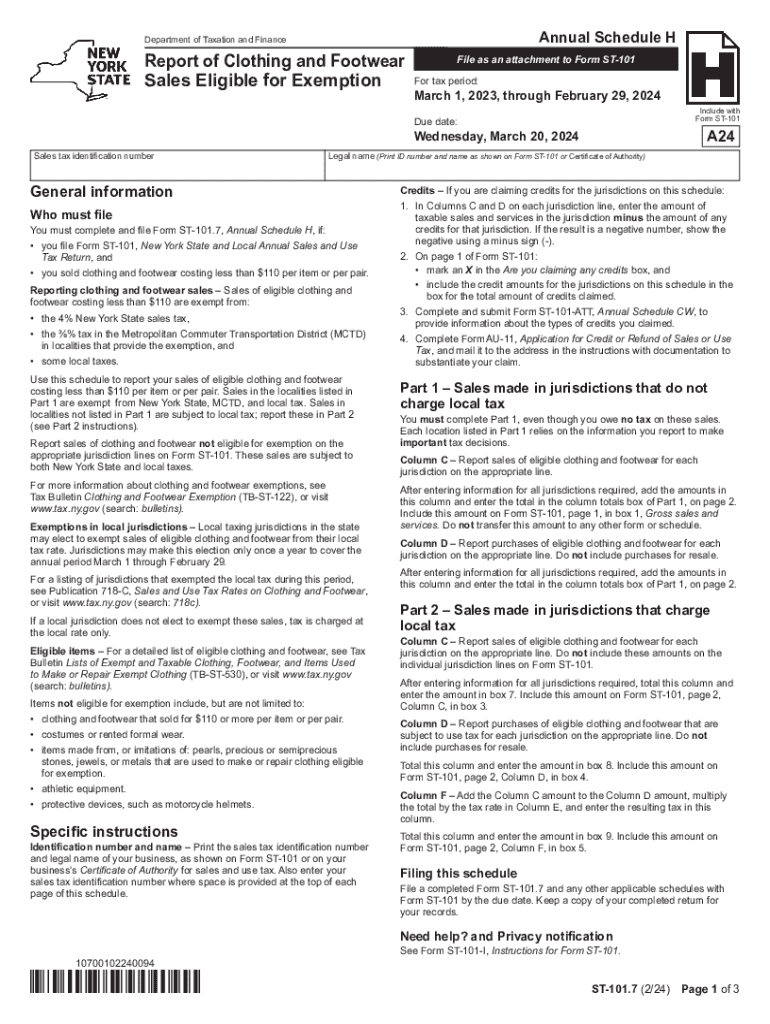

The Form ST 101 is an essential document for businesses in New York State that need to report and pay their annual sales tax. This form is specifically designed for those who qualify to file sales tax on an annual basis rather than quarterly or monthly. It allows businesses to declare their total sales and calculate the sales tax owed to the state. Understanding the purpose and requirements of Form ST 101 is crucial for compliance with New York tax regulations.

How to use the Form ST 101 Filing Annual Sales Tax In New York State

Using Form ST 101 involves several steps to ensure accurate reporting of sales tax. First, gather all necessary financial records, including sales receipts and previous tax filings. Next, fill out the form with the required information, such as total sales, exempt sales, and the applicable tax rate. After completing the form, review it for any errors before submission. It is important to keep a copy of the filed form for your records, as it may be needed for future reference or audits.

Steps to complete the Form ST 101 Filing Annual Sales Tax In New York State

Completing the Form ST 101 requires careful attention to detail. Follow these steps:

- Collect all relevant sales data for the year.

- Enter your total sales figures in the appropriate sections of the form.

- Calculate any exempt sales and document them accurately.

- Apply the correct sales tax rate to your taxable sales.

- Sum the total tax owed and ensure all calculations are correct.

- Sign and date the form before submitting it to the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for Form ST 101 to avoid penalties. The annual sales tax return is typically due on March 20 of the year following the tax year. Businesses should mark this date on their calendars and ensure that all necessary documentation is prepared in advance. Late submissions can result in fines and interest on unpaid taxes, making timely filing essential for compliance.

Required Documents

To complete Form ST 101, businesses must have certain documents on hand. These include:

- Sales records, including invoices and receipts.

- Previous sales tax returns for reference.

- Documentation of any exempt sales.

- Records of any tax credits or adjustments from prior periods.

Having these documents readily available will streamline the filing process and help ensure accuracy.

Penalties for Non-Compliance

Failing to file Form ST 101 on time or inaccurately reporting sales tax can lead to significant penalties. The New York State Department of Taxation and Finance may impose fines based on the amount of tax owed and the length of the delay. Additionally, interest may accrue on unpaid taxes, increasing the overall liability. It is advisable for businesses to remain compliant and seek assistance if they encounter difficulties in the filing process.

Quick guide on how to complete form st 101 filing annual sales tax in new york state

Complete Form ST 101 Filing Annual Sales Tax In New York State effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Form ST 101 Filing Annual Sales Tax In New York State on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to alter and eSign Form ST 101 Filing Annual Sales Tax In New York State effortlessly

- Obtain Form ST 101 Filing Annual Sales Tax In New York State and then click Get Form to begin.

- Utilize the resources we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal authority as a conventional handwritten signature.

- Verify all the information and then click the Done button to preserve your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your needs in document management with just a few clicks from any device of your choice. Edit and eSign Form ST 101 Filing Annual Sales Tax In New York State to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 101 filing annual sales tax in new york state

Create this form in 5 minutes!

How to create an eSignature for the form st 101 filing annual sales tax in new york state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form ST 101 Filing Annual Sales Tax In New York State?

Form ST 101 is a document used by businesses in New York State to report and pay their annual sales tax. This form is essential for compliance with state tax regulations and helps ensure that businesses fulfill their tax obligations accurately and on time.

-

How can airSlate SignNow assist with Form ST 101 Filing Annual Sales Tax In New York State?

airSlate SignNow provides a streamlined platform for businesses to prepare, sign, and submit Form ST 101 Filing Annual Sales Tax In New York State. With its user-friendly interface, you can easily manage your documents and ensure timely filing, reducing the risk of errors.

-

What are the pricing options for using airSlate SignNow for Form ST 101 Filing Annual Sales Tax In New York State?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you have the necessary tools for Form ST 101 Filing Annual Sales Tax In New York State.

-

Are there any features specifically designed for Form ST 101 Filing Annual Sales Tax In New York State?

Yes, airSlate SignNow includes features such as document templates, eSignature capabilities, and automated reminders that are specifically beneficial for Form ST 101 Filing Annual Sales Tax In New York State. These features help streamline the filing process and enhance compliance.

-

What benefits does airSlate SignNow offer for businesses filing Form ST 101?

Using airSlate SignNow for Form ST 101 Filing Annual Sales Tax In New York State offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Businesses can save time and resources while ensuring their filings are accurate and secure.

-

Can airSlate SignNow integrate with other accounting software for Form ST 101 Filing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your financial documents and streamline the Form ST 101 Filing Annual Sales Tax In New York State process. This integration helps maintain accurate records and simplifies tax preparation.

-

Is airSlate SignNow user-friendly for those unfamiliar with Form ST 101 Filing?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with Form ST 101 Filing Annual Sales Tax In New York State. The intuitive interface and helpful resources guide users through the filing process with ease.

Get more for Form ST 101 Filing Annual Sales Tax In New York State

- The unit circle with radians add tangent homeworkdocx mathlore form

- Cell unit review worksheet part 2 form

- Application for financial camc health system camc form

- Key language functions form

- Potluck sign up sheet form

- North kiteboarding evo 17 manual form

- Paphos pub leagues rules form

- Lifeforming leadership coaching

Find out other Form ST 101 Filing Annual Sales Tax In New York State

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation