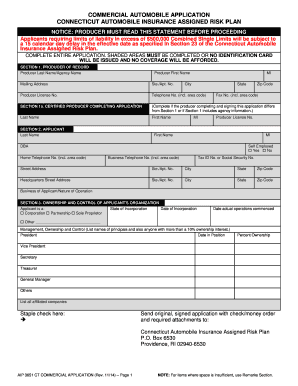

CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN Form

What is the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN

The CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN is a state-mandated program designed to provide automobile insurance coverage to drivers who are unable to obtain it through the standard market. This plan serves individuals who may have difficulty securing insurance due to various reasons, such as a poor driving record or lack of prior coverage. The assigned risk plan ensures that all drivers have access to necessary insurance, promoting road safety and financial responsibility.

Eligibility Criteria

To qualify for the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN, applicants must meet specific criteria. Generally, individuals must demonstrate that they have been denied coverage by at least two insurance companies in the voluntary market. Additionally, applicants should provide proof of their driving history and any relevant information that may impact their eligibility. This process ensures that the plan is reserved for those who genuinely require assistance in obtaining automobile insurance.

Steps to Complete the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN

Completing the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN involves several key steps:

- Gather necessary documentation, including proof of identity, driving history, and previous insurance denials.

- Contact the Connecticut Automobile Insurance Assigned Risk Plan administrator to obtain the required application forms.

- Fill out the application accurately, ensuring all information is complete and truthful.

- Submit the application along with any required documentation to the designated administrator.

- Await notification regarding the approval or denial of your application.

How to Obtain the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN

To obtain coverage through the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN, individuals must follow a structured process. First, they should contact the state’s assigned risk plan administrator or visit the official state website to access application forms. After filling out the required forms, applicants must submit them along with any necessary documentation. It is important to keep copies of all submitted materials for personal records. Once submitted, the application will be reviewed, and applicants will receive a decision regarding their coverage.

Key Elements of the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN

The CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN includes several important elements that applicants should be aware of:

- Coverage Types: The plan typically offers liability coverage, which is essential for meeting state requirements.

- Premium Rates: Premiums may be higher than standard market rates due to the higher risk associated with assigned risk drivers.

- Renewal Process: Policyholders must adhere to renewal procedures to maintain their coverage, which may include periodic reviews of their driving history.

Legal Use of the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN

The CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN operates under state law, ensuring that all drivers have access to necessary insurance coverage. It is crucial for individuals to understand that while the plan provides essential coverage, it does not replace the need for responsible driving practices. Adhering to traffic laws and maintaining a clean driving record can help individuals transition to standard insurance options in the future.

Quick guide on how to complete connecticut automobile insurance assigned risk plan

Complete CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN effortlessly on any gadget

Digital document handling has become widespread among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without holdups. Manage CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to alter and electronically sign CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN with ease

- Locate CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN and then click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to preserve your updates.

- Select how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choosing. Alter and electronically sign CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN ensuring excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the connecticut automobile insurance assigned risk plan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN?

The CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN is a program designed to provide automobile insurance coverage to drivers who are unable to obtain insurance through the standard market. This plan ensures that all drivers have access to necessary coverage, promoting road safety and compliance with state laws.

-

Who qualifies for the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN?

Individuals who have been denied automobile insurance coverage by multiple insurers may qualify for the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN. This includes drivers with poor driving records or those who have recently moved to Connecticut and lack a local insurance history.

-

How does the pricing work for the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN?

Pricing for the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN is determined based on various factors, including the driver's history and the type of vehicle. Rates may be higher than standard insurance due to the increased risk associated with assigned risk drivers.

-

What are the benefits of the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN?

The primary benefit of the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN is that it provides essential coverage for drivers who might otherwise be uninsured. Additionally, it helps drivers comply with state insurance requirements, reducing the risk of penalties.

-

Can I integrate the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN with other insurance products?

Yes, the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN can often be integrated with other insurance products to provide comprehensive coverage. This allows drivers to tailor their insurance portfolio to meet their specific needs and ensure they are fully protected.

-

How do I apply for the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN?

To apply for the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN, you need to contact a licensed insurance agent who can guide you through the application process. They will help you gather the necessary documentation and submit your application to the appropriate authorities.

-

What documents are required for the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN?

When applying for the CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN, you typically need to provide proof of identity, vehicle registration, and any previous insurance documentation. Your insurance agent will provide a complete list of required documents to ensure a smooth application process.

Get more for CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN

- Oes name request form

- Harvard syllabus form

- Zoningsign permit application city of camden ci camden nj form

- Medical and chest x ray form imm18

- Figurative language in because of winn dixie form

- Colorado form b 569

- Bravotroyohio comthe float troy experience pthe float troy experience form

- Individual employment agreement template form

Find out other CONNECTICUT AUTOMOBILE INSURANCE ASSIGNED RISK PLAN

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure