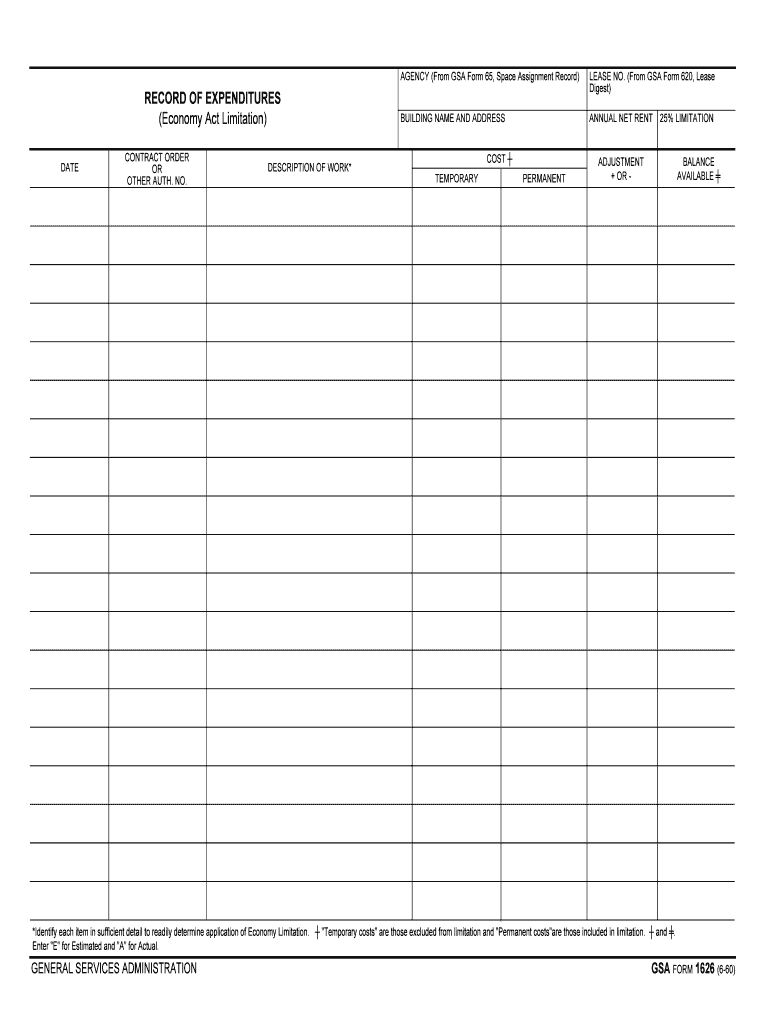

RECORD of EXPENDITURES Form

What is the record of expenditures?

The record of expenditures is a formal document used to detail all expenses incurred by an individual or organization over a specified period. This form is essential for maintaining accurate financial records, ensuring transparency, and facilitating budget management. It typically includes information such as the date of each expense, the amount spent, the purpose of the expenditure, and any relevant receipts or documentation. This record is often required for tax purposes, grant applications, or internal audits.

How to use the record of expenditures

Using the record of expenditures involves several key steps. First, gather all receipts and documentation related to your expenses. Next, categorize each expense based on its purpose, such as travel, supplies, or services. Then, enter the details into the form, ensuring accuracy in amounts and dates. After completing the form, review it for any discrepancies, and keep a copy for your records. This process not only aids in financial tracking but also supports compliance with any applicable regulations.

Steps to complete the record of expenditures

Completing the record of expenditures requires careful attention to detail. Follow these steps:

- Collect all relevant receipts and invoices.

- Organize expenses by category (e.g., travel, office supplies).

- Fill in the date, amount, and purpose of each expense on the form.

- Attach any necessary documentation, such as receipts.

- Review the completed form for accuracy.

- Store the form securely for future reference or submission.

Legal use of the record of expenditures

The record of expenditures serves a critical legal function, particularly in business and tax contexts. It provides a transparent account of spending, which can be essential during audits or legal reviews. For the document to be legally binding, it must be completed accurately and retained in accordance with relevant laws. Compliance with regulations such as the IRS guidelines ensures that the record can be used effectively in legal situations, protecting both individuals and organizations from potential liabilities.

Key elements of the record of expenditures

Understanding the key elements of the record of expenditures is crucial for effective documentation. Important components include:

- Date: The date when the expenditure occurred.

- Amount: The total cost of the expense.

- Purpose: A brief description of what the expenditure was for.

- Category: Classification of the expense, such as travel or supplies.

- Documentation: Attached receipts or invoices that support the recorded expenses.

Examples of using the record of expenditures

There are various scenarios in which the record of expenditures is utilized. For instance, a small business may use it to track monthly operating costs, ensuring they stay within budget. Non-profit organizations often require this form for grant reporting, demonstrating how funds were spent. Additionally, freelancers may maintain a record of expenditures to simplify tax preparation, ensuring they can deduct eligible business expenses. Each example highlights the importance of accurate record-keeping for financial accountability.

Quick guide on how to complete record of expenditures

Easily prepare RECORD OF EXPENDITURES on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Handle RECORD OF EXPENDITURES on any device with the airSlate SignNow apps for Android or iOS, and enhance any document-related procedure today.

How to modify and electronically sign RECORD OF EXPENDITURES effortlessly

- Find RECORD OF EXPENDITURES and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes only a few seconds and holds the same legal validity as a traditional ink signature.

- Review the information and then select the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you select. Edit and eSign RECORD OF EXPENDITURES while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the record of expenditures

How to create an eSignature for your Record Of Expenditures in the online mode

How to generate an eSignature for the Record Of Expenditures in Google Chrome

How to create an eSignature for putting it on the Record Of Expenditures in Gmail

How to generate an electronic signature for the Record Of Expenditures from your smart phone

How to generate an eSignature for the Record Of Expenditures on iOS devices

How to make an eSignature for the Record Of Expenditures on Android

People also ask

-

What is a RECORD OF EXPENDITURES in the context of airSlate SignNow?

A RECORD OF EXPENDITURES refers to a document that details the costs incurred during a specific project or time period. With airSlate SignNow, you can create and manage these records efficiently, ensuring all expenses are accurately tracked and signed off.

-

How can airSlate SignNow help in managing RECORD OF EXPENDITURES?

airSlate SignNow provides an easy-to-use interface to create and eSign your RECORD OF EXPENDITURES. This streamlines the documentation process, allowing for quicker submissions and approvals while maintaining compliance and accuracy.

-

What features does airSlate SignNow offer for handling RECORD OF EXPENDITURES?

Key features for managing RECORD OF EXPENDITURES in airSlate SignNow include customizable templates, advanced eSigning options, and secure cloud storage. These tools help you automate the process and ensure that all expenditure records are easily accessible and shareable.

-

Is there a mobile application for accessing RECORD OF EXPENDITURES in airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to access, create, and manage your RECORD OF EXPENDITURES on-the-go. This flexibility ensures that you can handle all documentation requirements anytime and anywhere.

-

How does airSlate SignNow ensure the security of RECORD OF EXPENDITURES?

airSlate SignNow prioritizes security with features such as encryption, two-factor authentication, and secure access controls. These measures ensure that your RECORD OF EXPENDITURES remain confidential and protected from unauthorized access.

-

Can I integrate airSlate SignNow with other applications for RECORD OF EXPENDITURES?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and project management tools, making it easy to sync your RECORD OF EXPENDITURES with platforms you already use. This integration enhances workflow efficiency and reduces manual data entry.

-

What are the pricing options for using airSlate SignNow for RECORD OF EXPENDITURES?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including features specifically designed for creating and managing RECORD OF EXPENDITURES. Pricing varies based on the number of users and features selected, ensuring cost-effectiveness.

Get more for RECORD OF EXPENDITURES

- Ui findings example form cli109l

- Michael j curry summer internship application illinois gov form

- Insurance and illinois election rejection forms

- Luba wc 1007 injury form

- Timesheet faith and hope independent living form

- Notice to leave premises ohioevictionnet form

- Affidavit for home owners permitcity of cleveland form

- West palm beach housing waiting list form

Find out other RECORD OF EXPENDITURES

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document