Dependent Care Reimbursement Account DCRA Bates College Bates Form

What is the Dependent Care Reimbursement Account DCRA Bates College Bates

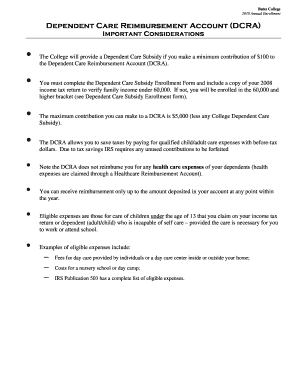

The Dependent Care Reimbursement Account (DCRA) at Bates College is a flexible spending account designed to help employees cover eligible dependent care expenses. This account allows participants to set aside pre-tax dollars to pay for care services for children under the age of thirteen or for dependents who are physically or mentally incapable of self-care. By utilizing the DCRA, employees can reduce their taxable income while managing the costs associated with dependent care, making it a valuable benefit for working families.

How to use the Dependent Care Reimbursement Account DCRA Bates College Bates

Using the DCRA involves several straightforward steps. First, employees must enroll in the program during the open enrollment period. After enrollment, participants can contribute a portion of their salary to the account. To access funds, employees must submit claims for eligible expenses, which may include daycare, after-school programs, or summer camps. It is essential to keep receipts and documentation for all expenses claimed, as these may be required for reimbursement processing.

Eligibility Criteria

To participate in the DCRA at Bates College, employees must meet specific eligibility requirements. Generally, full-time employees are eligible to enroll, while part-time employees may have different criteria. Dependents must be under the age of thirteen or unable to care for themselves due to physical or mental limitations. Additionally, the care must be necessary for the employee to work or look for work, ensuring that the program supports working families effectively.

Required Documents

When submitting claims for reimbursement from the DCRA, participants must provide certain documentation. Required documents typically include receipts that detail the services provided, the dates of service, and the names of the dependents receiving care. In some cases, a signed statement from the care provider may also be necessary. Ensuring that all documentation is complete and accurate can help streamline the reimbursement process.

Steps to complete the Dependent Care Reimbursement Account DCRA Bates College Bates

Completing the DCRA process involves a series of clear steps. First, employees should enroll in the plan during the designated enrollment period. Next, they need to contribute funds to the account through payroll deductions. After incurring eligible dependent care expenses, employees must gather the necessary documentation and complete a claim form. Finally, submit the claim form along with the required receipts to the appropriate office for processing. Reimbursements are typically issued within a specified timeframe, allowing employees to manage their finances effectively.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines that govern the use of dependent care reimbursement accounts. According to IRS regulations, the maximum amount that can be contributed to a DCRA is subject to annual limits, which may change each tax year. Furthermore, the IRS specifies which expenses qualify for reimbursement and outlines the eligibility criteria for dependents. Familiarizing oneself with these guidelines is crucial for maximizing the benefits of the DCRA and ensuring compliance with tax regulations.

Filing Deadlines / Important Dates

Employees participating in the DCRA should be aware of important filing deadlines to ensure timely reimbursement. Typically, claims must be submitted within a specific timeframe after the expense is incurred, often within a few months. Additionally, there may be a deadline for using funds contributed to the account, which is usually at the end of the plan year. Staying informed about these deadlines helps participants avoid losing out on eligible reimbursements.

Quick guide on how to complete dependent care reimbursement account dcra bates college bates

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign [SKS] without hassle

- Find [SKS] and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional signed document.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign [SKS] and guarantee outstanding communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Dependent Care Reimbursement Account DCRA Bates College Bates

Create this form in 5 minutes!

How to create an eSignature for the dependent care reimbursement account dcra bates college bates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Dependent Care Reimbursement Account DCRA Bates College Bates?

A Dependent Care Reimbursement Account DCRA Bates College Bates is a flexible spending account that allows employees to set aside pre-tax dollars to pay for eligible dependent care expenses. This account helps reduce taxable income while providing financial support for childcare or care for dependents. It's an excellent way for employees to manage their dependent care costs effectively.

-

How can I enroll in the Dependent Care Reimbursement Account DCRA Bates College Bates?

To enroll in the Dependent Care Reimbursement Account DCRA Bates College Bates, employees typically need to complete an enrollment form during the open enrollment period. It's important to review the specific guidelines provided by Bates College to ensure eligibility and compliance. Once enrolled, you can start contributing to the account and submitting claims for reimbursement.

-

What are the benefits of using the Dependent Care Reimbursement Account DCRA Bates College Bates?

The primary benefit of the Dependent Care Reimbursement Account DCRA Bates College Bates is the tax savings it offers. By using pre-tax dollars for dependent care expenses, employees can lower their taxable income, resulting in potential tax savings. Additionally, it provides a structured way to budget for childcare costs, making financial planning easier.

-

What types of expenses are eligible for reimbursement under the Dependent Care Reimbursement Account DCRA Bates College Bates?

Eligible expenses for the Dependent Care Reimbursement Account DCRA Bates College Bates typically include costs for daycare, preschool, and summer camps for children under 13, as well as care for dependents who are physically or mentally incapable of self-care. It's essential to keep receipts and documentation for all expenses submitted for reimbursement to ensure compliance with IRS regulations.

-

Is there a limit on how much I can contribute to the Dependent Care Reimbursement Account DCRA Bates College Bates?

Yes, there are annual contribution limits for the Dependent Care Reimbursement Account DCRA Bates College Bates. As of the latest guidelines, employees can contribute up to $5,000 per household or $2,500 if married and filing separately. It's advisable to check with Bates College for any updates or specific policies regarding contribution limits.

-

How do I submit claims for the Dependent Care Reimbursement Account DCRA Bates College Bates?

To submit claims for the Dependent Care Reimbursement Account DCRA Bates College Bates, employees usually need to fill out a claim form and provide supporting documentation, such as receipts or invoices. Claims can often be submitted online or via mail, depending on the process established by Bates College. Ensure that all submissions are made within the designated time frame to avoid losing reimbursement eligibility.

-

Can I use the Dependent Care Reimbursement Account DCRA Bates College Bates with other benefits?

Yes, the Dependent Care Reimbursement Account DCRA Bates College Bates can often be used in conjunction with other employee benefits, such as health savings accounts (HSAs) or flexible spending accounts (FSAs). However, it's important to understand the specific rules and limitations regarding overlapping benefits to maximize your savings. Consulting with the HR department at Bates College can provide clarity on this matter.

Get more for Dependent Care Reimbursement Account DCRA Bates College Bates

- Quotnf 57 03 01 3 15 diving incident reportquot noaa form 57 03 01

- Cd 224 form

- Inpatient referral assessment form

- Old english game bantam club of america form

- Anew health care services notice of privacy practices form

- How to fill out aia08 forms

- Usda 1890 national scholars program application form

- Usda rural development iowa performance report usda performance report

Find out other Dependent Care Reimbursement Account DCRA Bates College Bates

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors