Federal Form 13909 Tax Exempt Organization Complaint

What is the Federal Form 13909 Tax Exempt Organization Complaint

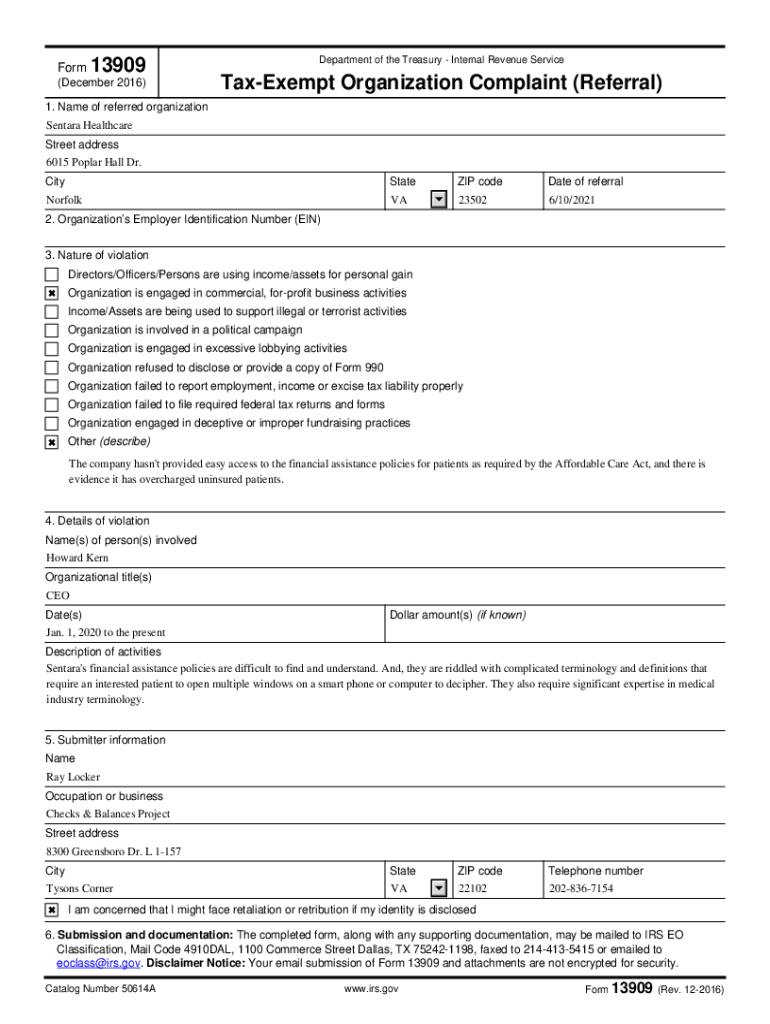

The Federal Form 13909 is a formal complaint form used by individuals or organizations to report concerns regarding the operations of tax-exempt organizations. This form is specifically designed for complaints related to the misuse of tax-exempt status, ensuring that organizations adhere to the rules and regulations set forth by the Internal Revenue Service (IRS). It serves as a tool for the public to voice concerns about potential violations, such as excessive lobbying, failure to operate for exempt purposes, or private benefit to individuals.

How to use the Federal Form 13909 Tax Exempt Organization Complaint

Using the Federal Form 13909 involves several steps to ensure your complaint is properly documented and submitted. First, gather all relevant information about the tax-exempt organization in question, including its name, address, and the specific issues you are reporting. Next, fill out the form with detailed descriptions of your concerns, providing any supporting documentation that may strengthen your case. Once completed, you can submit the form according to the instructions provided, either online or via mail, ensuring you keep a copy for your records.

Steps to complete the Federal Form 13909 Tax Exempt Organization Complaint

Completing the Federal Form 13909 requires careful attention to detail. Follow these steps:

- Identify the organization you are reporting and gather its contact information.

- Clearly articulate your complaint, focusing on specific actions or behaviors that violate tax-exempt regulations.

- Provide your contact information, as the IRS may need to reach you for further details.

- Attach any relevant documents that support your claims, such as correspondence or financial statements.

- Review the form for accuracy before submission.

Legal use of the Federal Form 13909 Tax Exempt Organization Complaint

The Federal Form 13909 is legally recognized as a means for the public to report potential violations of tax-exempt status. It is important to use this form responsibly and ensure that all claims are truthful and substantiated. Misuse of the form, such as filing frivolous complaints, could lead to legal repercussions. Understanding the legal framework surrounding tax-exempt organizations can help ensure that your complaint is valid and taken seriously by the IRS.

Filing Deadlines / Important Dates

While there are no specific deadlines for submitting the Federal Form 13909, it is advisable to file your complaint as soon as you identify a potential violation. Prompt reporting allows the IRS to investigate issues more effectively. Additionally, being aware of any relevant deadlines for related tax filings or compliance reviews can help ensure that your complaint is considered in a timely manner.

Form Submission Methods (Online / Mail / In-Person)

The Federal Form 13909 can be submitted through various methods to accommodate different preferences. You may submit the form online via the IRS website, which allows for a quicker processing time. Alternatively, you can print the completed form and mail it to the designated IRS address. In-person submissions are generally not accepted, so it is essential to choose one of the electronic or mail options for your submission.

Quick guide on how to complete federal form 13909 tax exempt organization complaint

Complete Federal Form 13909 Tax Exempt Organization Complaint effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, since you can easily find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Federal Form 13909 Tax Exempt Organization Complaint on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Federal Form 13909 Tax Exempt Organization Complaint without hassle

- Find Federal Form 13909 Tax Exempt Organization Complaint and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Federal Form 13909 Tax Exempt Organization Complaint and guarantee exceptional communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the federal form 13909 tax exempt organization complaint

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Federal Form 13909 Tax Exempt Organization Complaint?

The Federal Form 13909 Tax Exempt Organization Complaint is a form used to report concerns regarding the operations of tax-exempt organizations. It allows individuals to submit complaints to the IRS about potential violations of tax-exempt status. Understanding this form is crucial for ensuring compliance and addressing any issues effectively.

-

How can airSlate SignNow help with the Federal Form 13909 Tax Exempt Organization Complaint?

airSlate SignNow provides a streamlined platform for preparing and eSigning the Federal Form 13909 Tax Exempt Organization Complaint. Our user-friendly interface simplifies the process, ensuring that your complaint is submitted accurately and efficiently. This can save you time and reduce the stress associated with filing important documents.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for individuals and organizations. Each plan includes features that support the completion of forms like the Federal Form 13909 Tax Exempt Organization Complaint. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and secure cloud storage, all of which enhance document management. These features are particularly useful when dealing with forms like the Federal Form 13909 Tax Exempt Organization Complaint, ensuring that your documents are organized and easily accessible.

-

Is airSlate SignNow compliant with legal standards for eSigning?

Yes, airSlate SignNow is fully compliant with legal standards for eSigning, including the ESIGN Act and UETA. This compliance ensures that documents signed through our platform, such as the Federal Form 13909 Tax Exempt Organization Complaint, are legally binding and recognized by authorities.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. This means you can easily incorporate the Federal Form 13909 Tax Exempt Organization Complaint into your existing systems, making the process more efficient.

-

What are the benefits of using airSlate SignNow for tax-exempt organizations?

Using airSlate SignNow provides tax-exempt organizations with a cost-effective solution for managing important documents like the Federal Form 13909 Tax Exempt Organization Complaint. Benefits include increased efficiency, reduced paperwork, and enhanced compliance, allowing organizations to focus on their mission rather than administrative tasks.

Get more for Federal Form 13909 Tax Exempt Organization Complaint

- Form 50 141 2018 2019

- Form 50 141 general real property rendition of taxable property general real property rendition of taxable property

- Texas w 9 2018 2019 form

- Texas w 9 2017 form

- Texas application exemption 2017 2019 form

- Property appraisal notice of protest texas comptroller texasgov form

- Texas battery sales fee 2018 2019 form

- Texas battery sales fee 2017 form

Find out other Federal Form 13909 Tax Exempt Organization Complaint

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive