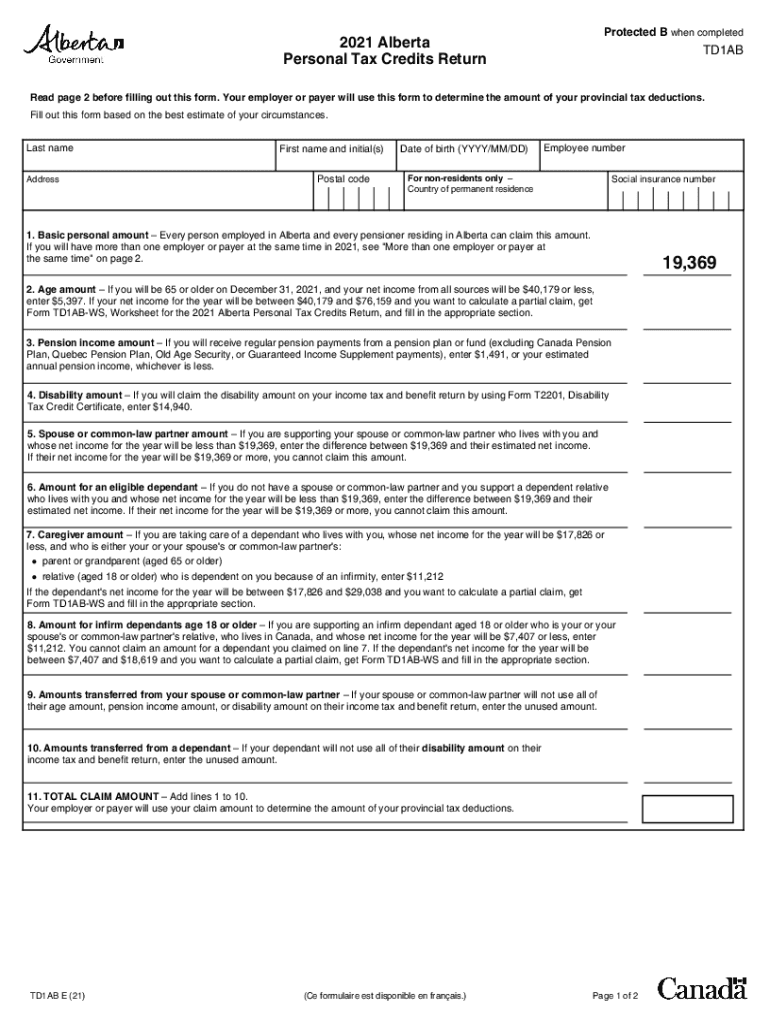

Alberta Tax Forms 2021

What is the 2021 Personal Tax Return?

The 2021 personal tax return is a crucial document that individuals in the United States must complete to report their income, claim deductions, and determine their tax liability for the fiscal year. This form is essential for ensuring compliance with federal tax laws and can include various schedules and forms depending on individual circumstances. Understanding the components of the personal tax return is vital for accurate filing.

Steps to Complete the 2021 Personal Tax Return

Completing the 2021 personal tax return involves several steps to ensure accuracy and compliance. Here are the key steps:

- Gather all necessary documents, including W-2s, 1099s, and any relevant receipts for deductions.

- Choose the appropriate tax form, such as Form 1040, based on your filing status and income sources.

- Fill out the form by entering your personal information, income details, and any deductions or credits you qualify for.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Sign and date the return before submitting it to the IRS.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 2021 personal tax return is essential to avoid penalties. Generally, the deadline for submitting your personal tax return is April 15, 2022. If you need additional time, you can file for an extension, which typically grants an extra six months to file, although any taxes owed must still be paid by the original deadline.

Required Documents

To complete the 2021 personal tax return, you will need several key documents, including:

- W-2 forms from employers to report wages.

- 1099 forms for any freelance or contract income.

- Records of any other income, such as interest or dividends.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

Form Submission Methods

There are multiple methods for submitting your 2021 personal tax return. You can file electronically using tax software, which often simplifies the process and ensures accuracy. Alternatively, you can print your completed return and mail it to the appropriate IRS address. Some individuals may also choose to file in person at designated tax assistance locations.

IRS Guidelines

Adhering to IRS guidelines is crucial when completing your 2021 personal tax return. The IRS provides detailed instructions for each form, outlining eligibility criteria, required information, and common pitfalls to avoid. Familiarizing yourself with these guidelines can help ensure a smooth filing process and minimize the risk of errors.

Quick guide on how to complete alberta tax forms

Complete Alberta Tax Forms seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and without delays. Manage Alberta Tax Forms on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Alberta Tax Forms effortlessly

- Find Alberta Tax Forms and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Alberta Tax Forms and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alberta tax forms

Create this form in 5 minutes!

How to create an eSignature for the alberta tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for submitting a 2021 personal tax return using airSlate SignNow?

To submit your 2021 personal tax return using airSlate SignNow, simply upload your completed tax documents to the platform. You can then easily add electronic signatures and send them securely to the necessary tax authorities or recipients. The process is designed to be straightforward and user-friendly, ensuring that your 2021 personal tax return is handled efficiently.

-

How does airSlate SignNow ensure the security of my 2021 personal tax return?

airSlate SignNow prioritizes security by utilizing advanced encryption methods to protect your documents. When you submit your 2021 personal tax return, all data is safeguarded against unauthorized access. Additionally, each signed document is stored securely, allowing you to manage your sensitive information with peace of mind.

-

What are the costs associated with using airSlate SignNow for my 2021 personal tax return?

airSlate SignNow offers a range of pricing plans to accommodate various needs, allowing you to choose an option that fits your budget while processing your 2021 personal tax return. With cost-effective solutions, you can access all the necessary features without overspending. Transparent pricing also means no hidden fees to worry about.

-

Can I integrate airSlate SignNow with my existing tax software for my 2021 personal tax return?

Yes, airSlate SignNow can be easily integrated with popular tax software programs, allowing you to streamline your workflow for your 2021 personal tax return. These integrations help you save time by enabling seamless data transfers and document management. This compatibility ensures you can manage your tax filings efficiently.

-

What features does airSlate SignNow offer to assist with my 2021 personal tax return?

airSlate SignNow provides an array of features to assist you with your 2021 personal tax return, including easy document uploads, electronic signatures, and secure sharing options. Additionally, you can track the status of your documents in real-time, ensuring you stay updated on the progress of your return. These tools are designed to make the tax filing process more efficient.

-

Is it easy to e-sign my 2021 personal tax return with airSlate SignNow?

Absolutely! eSigning your 2021 personal tax return with airSlate SignNow is a simple and intuitive process. Users can easily add their signatures and initials as needed, without the hassle of printing or scanning. This functionality allows for faster processing and submission of your tax documents.

-

Are there any limitations on the number of documents I can submit for my 2021 personal tax return?

airSlate SignNow doesn't impose strict limitations on the number of documents you can submit for your 2021 personal tax return. Depending on your chosen plan, you may enjoy increased document storage and submission capabilities. This flexibility is designed to accommodate your needs without compromising on usability.

Get more for Alberta Tax Forms

- Tulsa model systems personal development plan and follow up tulsaschools form

- City of tupelo contractors application tupeloms form

- Imm 1294b application for a study permit made outside of canada form

- Strategy lifecycle form

- Indiana laborers fringe benefit funds form

- Answer sheet to nova video questions hunting the elements form

- The jean keating transcript freedom school form

- Crescent lodge scholarship application form

Find out other Alberta Tax Forms

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation