IC 002 Form 4T Wisconsin Exempt Organization Business Franchise or Income Tax Return 2022

Understanding the IC 002 Form 4T for Wisconsin Exempt Organizations

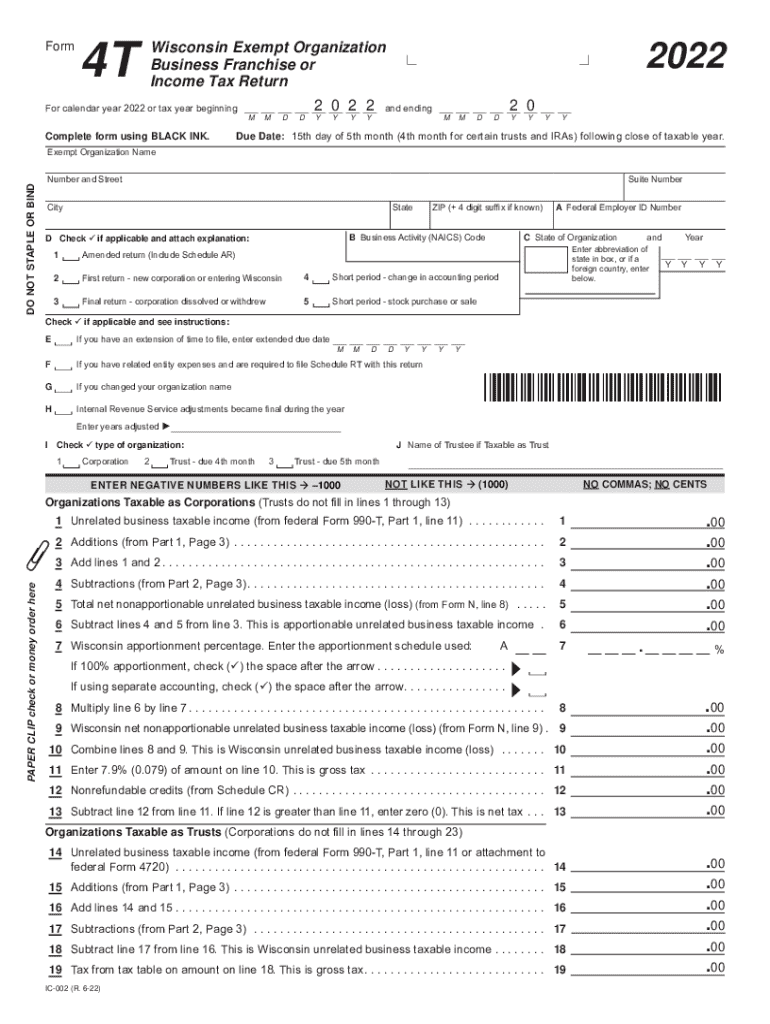

The IC 002 Form 4T is specifically designed for exempt organizations in Wisconsin to report their business franchise or income tax. This form is essential for organizations that qualify under state laws and need to comply with tax regulations. Understanding the purpose and requirements of this form is crucial for maintaining compliance and avoiding penalties.

Steps to Complete the IC 002 Form 4T

Completing the IC 002 Form 4T involves several key steps:

- Gather necessary information about your organization, including its legal name, address, and tax identification number.

- Determine your organization's eligibility for exemption under Wisconsin law.

- Complete the form accurately, ensuring all required fields are filled out, including financial details and any applicable deductions.

- Review the completed form for accuracy and completeness to avoid delays in processing.

- Submit the form by the designated filing deadline, either online or via mail.

Legal Use of the IC 002 Form 4T

The IC 002 Form 4T serves a legal purpose in the context of Wisconsin tax law. It is used by exempt organizations to report income and ensure compliance with state tax obligations. Proper use of this form helps organizations maintain their exempt status and avoid potential legal issues related to tax non-compliance.

Filing Deadlines for the IC 002 Form 4T

Filing deadlines for the IC 002 Form 4T are critical to ensure compliance. Typically, the form must be submitted by the 15th day of the fifth month following the end of the organization’s fiscal year. It is important to keep track of these dates to avoid late fees and penalties.

Required Documents for the IC 002 Form 4T

When preparing to file the IC 002 Form 4T, organizations should gather the following documents:

- Financial statements for the reporting period.

- Previous tax returns, if applicable.

- Documentation supporting any claimed exemptions or deductions.

- Organizational bylaws or articles of incorporation.

Key Elements of the IC 002 Form 4T

The IC 002 Form 4T includes several key elements that organizations must complete:

- Identification section, including the organization's name and address.

- Financial information, detailing income, expenses, and any applicable deductions.

- Signature section, requiring an authorized representative to certify the accuracy of the information provided.

Quick guide on how to complete ic 002 form 4t wisconsin exempt organization business franchise or income tax return

Complete IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your documents quickly without delays. Manage IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to alter and electronically sign IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return with ease

- Locate IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for those purposes.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ic 002 form 4t wisconsin exempt organization business franchise or income tax return

Create this form in 5 minutes!

How to create an eSignature for the ic 002 form 4t wisconsin exempt organization business franchise or income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 4t form and how is it used?

A 4t form is a specific type of document used for various administrative purposes. With airSlate SignNow, you can easily create, send, and eSign 4t forms, streamlining your workflow and ensuring compliance. This digital solution simplifies the process, making it accessible for businesses of all sizes.

-

How can airSlate SignNow help with 4t form management?

airSlate SignNow offers a user-friendly platform for managing 4t forms efficiently. You can customize templates, track document status, and automate reminders, ensuring that your 4t forms are processed quickly and accurately. This enhances productivity and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for 4t forms?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs. Each plan includes features for managing 4t forms, such as eSigning and document tracking. You can choose a plan that fits your budget while still benefiting from our comprehensive solutions.

-

What features does airSlate SignNow offer for 4t forms?

airSlate SignNow includes features like customizable templates, secure eSigning, and real-time tracking for 4t forms. Additionally, you can integrate with other applications to enhance your document management process. These features make it easier to handle 4t forms efficiently.

-

Can I integrate airSlate SignNow with other tools for 4t forms?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to streamline your workflow for 4t forms. Whether you use CRM systems, cloud storage, or project management tools, our platform can connect seamlessly to enhance your document processes.

-

What are the benefits of using airSlate SignNow for 4t forms?

Using airSlate SignNow for 4t forms offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and easy document sharing, which can signNowly speed up your business processes. This ultimately leads to better customer satisfaction.

-

How secure is the signing process for 4t forms with airSlate SignNow?

The signing process for 4t forms with airSlate SignNow is highly secure. We utilize advanced encryption and authentication methods to protect your documents and ensure that only authorized users can access them. This commitment to security helps maintain the integrity of your 4t forms.

Get more for IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return

Find out other IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document