IC 002 Form 4T Wisconsin Exempt Organization Business Franchise or Income Tax Return Fillable 2023-2026

What is the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable

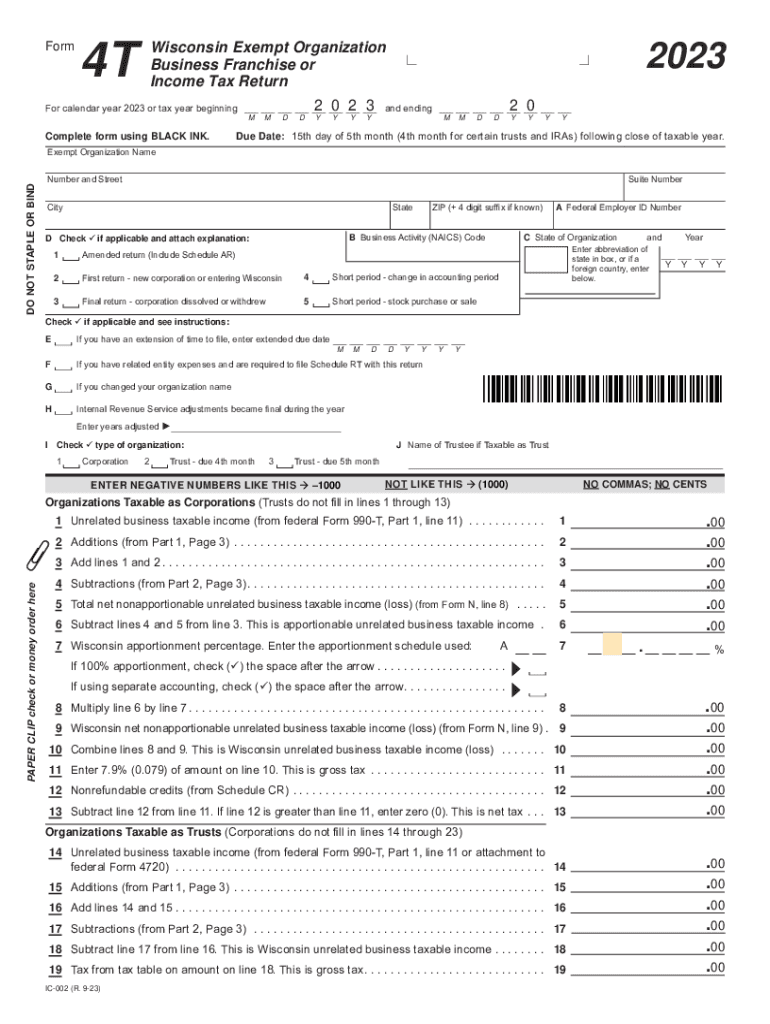

The IC 002 Form 4T is a specific tax return form used by exempt organizations in Wisconsin. This form is designed for entities that are exempt from federal income tax but may still have obligations regarding state business franchise or income tax. The fillable version of this form allows organizations to complete it electronically, ensuring accuracy and efficiency in the filing process. It is essential for organizations to understand their tax responsibilities under state law, even if they are exempt from federal taxation.

How to use the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable

Using the IC 002 Form 4T involves several steps. First, organizations need to download the fillable form from the appropriate state website. Once obtained, users can fill out the form electronically, entering required information such as the organization’s name, address, and tax identification number. After completing the form, it is crucial to review all entries for accuracy. The final step is to submit the form according to state guidelines, which may include online submission or mailing a printed copy.

Steps to complete the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable

Completing the IC 002 Form 4T requires attention to detail. Start by gathering all necessary documentation, including financial statements and previous tax returns. Fill in the organization’s identifying information accurately. Next, provide details regarding income, deductions, and any applicable credits. Ensure that all calculations are correct, as errors can lead to delays or penalties. After filling out the form, double-check all entries and save a copy for your records before submission.

Key elements of the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable

The IC 002 Form 4T includes several key elements that organizations must complete. These elements typically include the organization’s name, address, and federal employer identification number (EIN). Additionally, the form requires a breakdown of income sources, allowable deductions, and any credits that may apply. Understanding each section is vital for accurate reporting and compliance with state tax laws.

Legal use of the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable

The legal use of the IC 002 Form 4T is essential for exempt organizations to maintain compliance with Wisconsin tax regulations. Organizations must file this form if they meet specific criteria set by the state. Filing the form accurately helps to avoid penalties and ensures that the organization remains in good standing. It is important for organizations to stay informed about any changes in tax law that may affect their filing requirements.

Filing Deadlines / Important Dates

Filing deadlines for the IC 002 Form 4T are crucial for exempt organizations to note. Typically, the form must be submitted by the 15th day of the fifth month following the end of the organization’s fiscal year. Organizations should keep track of these dates to ensure timely submission and avoid late fees. It is advisable to check for any updates or changes to deadlines each tax year to ensure compliance.

Create this form in 5 minutes or less

Find and fill out the correct ic 002 form 4t wisconsin exempt organization business franchise or income tax return fillable 731615438

Create this form in 5 minutes!

How to create an eSignature for the ic 002 form 4t wisconsin exempt organization business franchise or income tax return fillable 731615438

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable?

The IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable is a tax form specifically designed for exempt organizations in Wisconsin. It allows these organizations to report their business franchise or income tax obligations efficiently. Using a fillable format simplifies the process, making it easier to complete and submit.

-

How can I access the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable?

You can access the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable directly through the airSlate SignNow platform. Our user-friendly interface allows you to find and fill out the form quickly. Simply navigate to the forms section and search for the IC 002 Form 4T.

-

Is there a cost associated with using the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable?

Yes, there is a cost associated with using the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable on airSlate SignNow. However, our pricing is competitive and designed to provide value for businesses looking for an efficient eSigning solution. You can choose from various subscription plans that suit your needs.

-

What features does the airSlate SignNow platform offer for the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable?

The airSlate SignNow platform offers several features for the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable, including eSigning, document sharing, and secure storage. Additionally, you can track the status of your forms and receive notifications when they are signed. These features streamline the filing process for your organization.

-

Can I integrate the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications, enhancing your workflow. You can integrate the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable with CRM systems, cloud storage, and other productivity tools. This integration helps you manage your documents more effectively.

-

What are the benefits of using the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable on airSlate SignNow?

Using the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable on airSlate SignNow offers numerous benefits, including time savings and increased accuracy. The fillable format reduces the chances of errors, while the eSigning feature speeds up the approval process. Overall, it enhances your organization's efficiency in handling tax-related documents.

-

Is the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable compliant with Wisconsin tax regulations?

Yes, the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable is designed to comply with Wisconsin tax regulations. airSlate SignNow ensures that all forms are up-to-date with the latest requirements, helping your organization stay compliant. You can trust that your submissions will meet state standards.

Get more for IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable

- Customer set up form

- Thedigitalhippies com billofsale form

- Dnr form new mexico

- Law of conservation of mass worksheet fill in the blank with the correct number form

- Equal housing opportunity rental application form 100083213

- Coa paracetamol form

- Www pdffiller com360542463 medicaladminrecordcamp medication administration form fill online printable

- Clinician ordersprogress notes patient labelclini form

Find out other IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF