Alaska Employer Tax Information 2022-2026

What is the Alaska Employer Tax Information

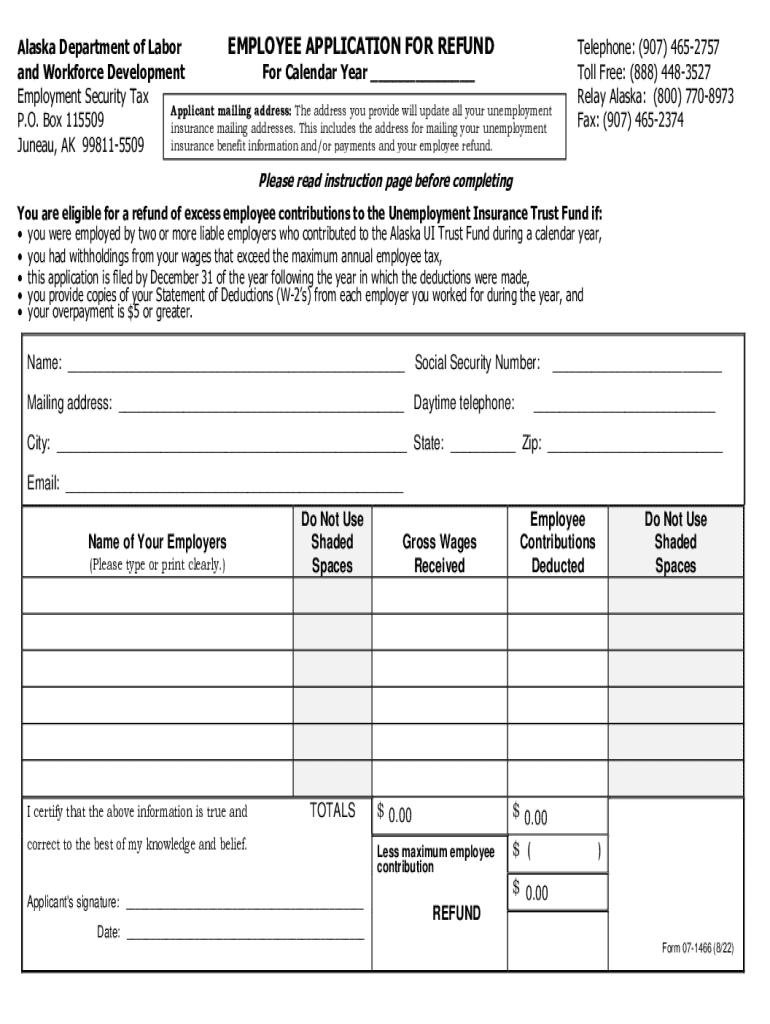

The Alaska Employer Tax Information is a crucial document that outlines the tax obligations for employers operating within Alaska. This information includes details on various taxes that employers must pay, such as unemployment insurance tax, which is essential for funding unemployment benefits for workers. Understanding this information helps employers comply with state regulations and avoid potential penalties.

How to use the Alaska Employer Tax Information

Employers can utilize the Alaska Employer Tax Information by reviewing the guidelines provided to ensure they are meeting their tax obligations. This information serves as a resource for understanding the types of taxes applicable to their business, the rates, and the reporting requirements. By following these guidelines, employers can accurately calculate their tax liabilities and maintain compliance with state laws.

Steps to complete the Alaska Employer Tax Information

Completing the Alaska Employer Tax Information involves several key steps:

- Gather necessary business information, including your Employer Identification Number (EIN).

- Review the tax rates and obligations applicable to your business type.

- Calculate the total taxes owed based on your payroll and employee count.

- Complete the necessary forms as outlined in the guidelines.

- Submit the completed forms by the specified deadlines to avoid penalties.

Required Documents

To accurately complete the Alaska Employer Tax Information, employers need to prepare several documents, including:

- Employer Identification Number (EIN)

- Payroll records for the reporting period

- Previous tax filings for reference

- Any relevant correspondence from the Alaska Department of Labor and Workforce Development

Filing Deadlines / Important Dates

Employers must be aware of specific filing deadlines to ensure compliance with Alaska tax regulations. Key dates include:

- Quarterly tax filings, typically due on the last day of the month following the end of each quarter.

- Annual reconciliation forms, which are usually due by January 31 of the following year.

- Any changes in tax rates or obligations that may be announced by the state.

Penalties for Non-Compliance

Failure to comply with the Alaska Employer Tax Information requirements can result in significant penalties. Employers may face:

- Fines for late submissions or underpayment of taxes.

- Interest charges on unpaid taxes.

- Potential legal action for continued non-compliance.

Quick guide on how to complete alaska employer tax information

Effortlessly Prepare Alaska Employer Tax Information on Any Device

Managing documents online has become increasingly popular with both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Alaska Employer Tax Information on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to edit and electronically sign Alaska Employer Tax Information with ease

- Search for Alaska Employer Tax Information and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight necessary sections of the documents or redact sensitive information with tools specifically available from airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form: via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Alaska Employer Tax Information and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska employer tax information

Create this form in 5 minutes!

How to create an eSignature for the alaska employer tax information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Alaska Employer Tax Information?

Alaska Employer Tax Information refers to the guidelines and requirements that employers in Alaska must follow regarding state taxes. This includes information on unemployment insurance, payroll taxes, and other employer obligations. Understanding this information is crucial for compliance and effective payroll management.

-

How can airSlate SignNow help with Alaska Employer Tax Information?

airSlate SignNow provides a streamlined solution for managing documents related to Alaska Employer Tax Information. With our eSigning capabilities, businesses can easily send, sign, and store tax-related documents securely. This simplifies the process of maintaining compliance with Alaska's tax regulations.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage for managing Alaska Employer Tax Information. These tools help businesses efficiently handle tax documents and ensure they are always up-to-date. Additionally, our platform allows for easy collaboration among team members.

-

Is airSlate SignNow cost-effective for small businesses in Alaska?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses in Alaska. Our pricing plans are flexible and cater to various business sizes, ensuring that you only pay for what you need. This affordability makes it easier for small businesses to manage their Alaska Employer Tax Information without breaking the bank.

-

Can airSlate SignNow integrate with other software for payroll management?

Absolutely! airSlate SignNow integrates seamlessly with various payroll management software, allowing for efficient handling of Alaska Employer Tax Information. This integration ensures that all tax documents are synchronized with your payroll system, reducing the risk of errors and improving overall efficiency.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for managing Alaska Employer Tax Information offers numerous benefits, including enhanced security, improved compliance, and time savings. Our platform ensures that your documents are securely stored and easily accessible, while automated workflows help streamline the signing process. This allows you to focus more on your business and less on paperwork.

-

How does airSlate SignNow ensure the security of tax documents?

airSlate SignNow prioritizes the security of your Alaska Employer Tax Information by employing advanced encryption and secure cloud storage. Our platform complies with industry standards to protect sensitive data from unauthorized access. This commitment to security gives businesses peace of mind when handling important tax documents.

Get more for Alaska Employer Tax Information

- Quitclaim deed from husband and wife to husband and wife iowa form

- Iowa warranty deed form

- Iowa revocation form

- Iowa property 497304866 form

- Iowa postnuptial agreement 497304867 form

- Quitclaim deed from husband and wife to an individual iowa form

- Warranty deed from husband and wife to an individual iowa form

- Quitclaim deed from two individuals to one individual iowa form

Find out other Alaska Employer Tax Information

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document