Alaska Employee Application for Refund Form 2011

What is the Alaska Employee Application For Refund Form

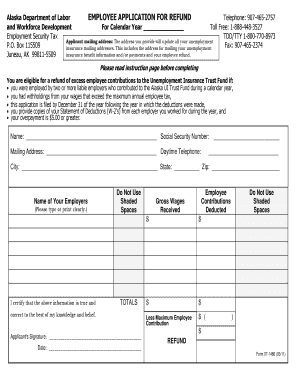

The Alaska Employee Application For Refund Form is a crucial document that allows employees in Alaska to request a refund for overpaid taxes or other eligible deductions. This form serves as a formal request to the appropriate state authorities, ensuring that employees can reclaim funds that are rightfully theirs. It is important for employees to understand the specific circumstances under which they can file this application, as well as the types of refunds they may be eligible to receive.

Steps to complete the Alaska Employee Application For Refund Form

Completing the Alaska Employee Application For Refund Form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your name, address, and social security number. Next, clearly indicate the reason for your refund request, providing any relevant details that support your claim. It is essential to review the form for completeness and accuracy before submission. Finally, submit the form via the designated method, whether online, by mail, or in person, depending on the guidelines provided by the state.

Legal use of the Alaska Employee Application For Refund Form

The legal use of the Alaska Employee Application For Refund Form is governed by state tax laws and regulations. To be considered valid, the form must be filled out completely and accurately, adhering to any specific requirements outlined by the Alaska Department of Revenue. This includes providing necessary documentation that supports your refund claim. Understanding these legal parameters is essential to ensure that your application is processed without delays or complications.

Eligibility Criteria

To qualify for a refund using the Alaska Employee Application For Refund Form, employees must meet certain eligibility criteria. Typically, this includes having paid excess taxes or having deductions that warrant a refund. Employees should also ensure they are filing within the appropriate time frame, as there are deadlines that must be adhered to for the application to be considered. Additionally, specific circumstances, such as changes in employment status or tax law changes, may affect eligibility.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Alaska Employee Application For Refund Form can be done through various methods, depending on the preferences of the employee and the guidelines set by the state. Employees may have the option to submit the form online through the state’s official tax portal, which often provides a faster processing time. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. It is important to choose the method that best suits your needs while ensuring compliance with submission deadlines.

Key elements of the Alaska Employee Application For Refund Form

The Alaska Employee Application For Refund Form contains several key elements that are essential for a successful submission. These include personal identification information, details of the refund request, and any supporting documentation required by the state. Additionally, the form may require signatures to validate the request. Understanding these elements helps ensure that all necessary information is provided, which can expedite the processing of the application.

Filing Deadlines / Important Dates

Filing deadlines for the Alaska Employee Application For Refund Form are critical to ensure that requests are processed in a timely manner. Employees should be aware of specific dates that may apply to their situation, such as the end of the tax year or other relevant deadlines set by the state. Missing these deadlines can result in delays or denial of the refund request, making it essential to stay informed about important dates throughout the filing process.

Quick guide on how to complete alaska employee application for refund form

Complete Alaska Employee Application For Refund Form effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Handle Alaska Employee Application For Refund Form on any system with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to alter and eSign Alaska Employee Application For Refund Form without hassle

- Locate Alaska Employee Application For Refund Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that function.

- Generate your signature using the Sign tool, which takes moments and carries the same legal weight as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting form searches, or mistakes necessitating new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and eSign Alaska Employee Application For Refund Form and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska employee application for refund form

Create this form in 5 minutes!

How to create an eSignature for the alaska employee application for refund form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alaska Employee Application For Refund Form?

The Alaska Employee Application For Refund Form is a document designed for employees in Alaska to request a refund for overpaid taxes or other applicable deductions. By using this form, employees can streamline the process of obtaining their entitled refunds efficiently and effectively.

-

How can I access the Alaska Employee Application For Refund Form?

You can easily access the Alaska Employee Application For Refund Form through our user-friendly platform at airSlate SignNow. Simply navigate to the forms section, where you can find the application ready for completion and e-signing.

-

Is there a cost associated with using the Alaska Employee Application For Refund Form?

Using the Alaska Employee Application For Refund Form on airSlate SignNow is part of our affordable plan options. Sign up for our service to access a wide range of features, including document templates and e-signature capabilities without hidden fees.

-

What are the benefits of using the Alaska Employee Application For Refund Form on airSlate SignNow?

The Alaska Employee Application For Refund Form on airSlate SignNow offers multiple benefits, including ease of use, time efficiency, and secure electronic signing. Our platform ensures that your personal information is protected while you handle your refund requests swiftly.

-

Can I integrate the Alaska Employee Application For Refund Form with other tools?

Yes, airSlate SignNow allows you to integrate the Alaska Employee Application For Refund Form with various third-party applications. This feature enhances your workflow by letting you manage documents across platforms such as CRM systems or project management tools.

-

How does the e-signature process work for the Alaska Employee Application For Refund Form?

The e-signature process for the Alaska Employee Application For Refund Form is straightforward. After filling out the form, you can electronically sign it using our secure tool, ensuring that your signature is legally binding and recognized under law.

-

What types of documents can I manage alongside the Alaska Employee Application For Refund Form?

With airSlate SignNow, you can manage various documents alongside the Alaska Employee Application For Refund Form, including contracts, service agreements, and consent forms. Our solution is versatile and designed to meet your document management needs.

Get more for Alaska Employee Application For Refund Form

Find out other Alaska Employee Application For Refund Form

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer