TAX FILER INFORMATION Student 1213 Concordia University

What is the TAX FILER INFORMATION Student 1213 Concordia University

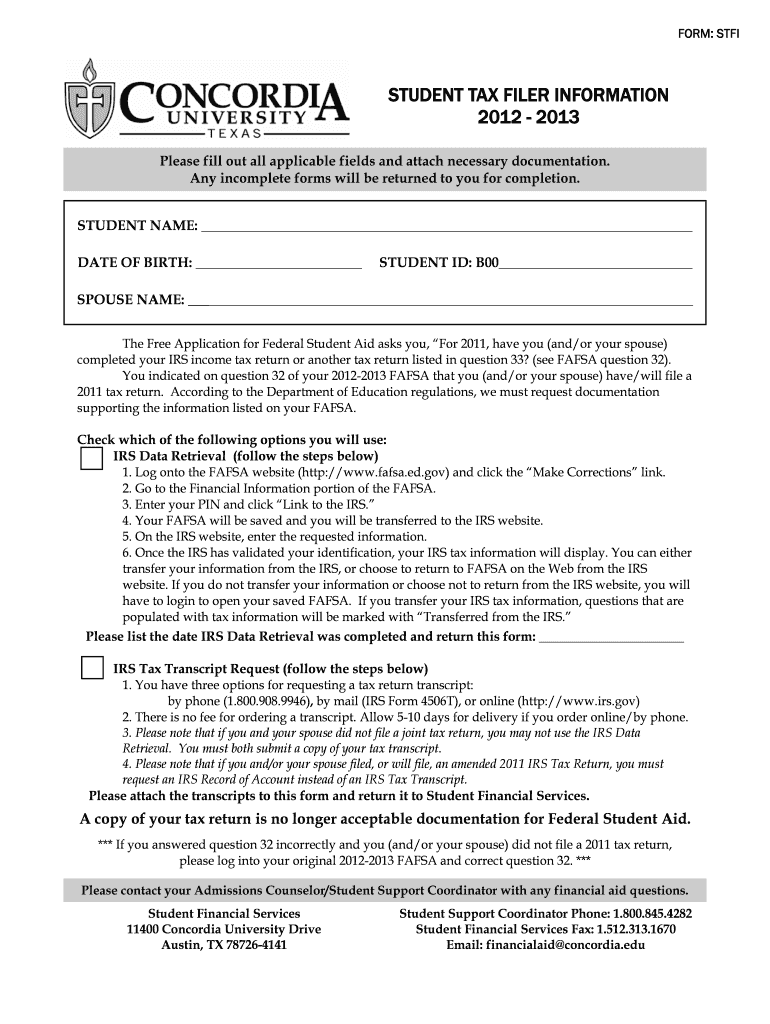

The TAX FILER INFORMATION Student 1213 Concordia University is a specific form used by students to report their tax information to the university. This form is essential for students who are applying for financial aid, scholarships, or other forms of assistance that require verification of income and tax status. It helps the university assess the financial needs of students and determine eligibility for various programs.

How to use the TAX FILER INFORMATION Student 1213 Concordia University

To use the TAX FILER INFORMATION Student 1213 Concordia University, students must first complete the form accurately. This involves providing personal details, including name, student ID, and tax information. Once the form is filled out, it should be submitted to the appropriate department at Concordia University, typically the financial aid office. It is crucial to ensure that all information is correct to avoid delays in processing.

Steps to complete the TAX FILER INFORMATION Student 1213 Concordia University

Completing the TAX FILER INFORMATION Student 1213 Concordia University involves several key steps:

- Gather necessary documents, such as tax returns and W-2 forms.

- Fill out the form with accurate personal and financial information.

- Review the form for any errors or omissions.

- Submit the form to the designated office at Concordia University.

Required Documents

When filling out the TAX FILER INFORMATION Student 1213 Concordia University, students must provide specific documents to support their claims. These typically include:

- Most recent tax return (Form 1040 or equivalent).

- W-2 forms from employers.

- Any additional income statements, if applicable.

Eligibility Criteria

Eligibility for using the TAX FILER INFORMATION Student 1213 Concordia University generally includes being a registered student at Concordia University and having a valid tax return. Students must also meet any specific financial aid requirements set by the university, which may vary based on their program of study or financial situation.

IRS Guidelines

Students must adhere to IRS guidelines when completing the TAX FILER INFORMATION Student 1213 Concordia University. This includes accurately reporting income, understanding tax filing requirements, and ensuring compliance with federal regulations. Familiarity with IRS rules can help students avoid issues with their tax filings and financial aid applications.

Quick guide on how to complete tax filer information student 1213 concordia university

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to easily access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage [SKS] across any platform using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The Easiest Way to Edit and eSign [SKS] Effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require new document prints. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to TAX FILER INFORMATION Student 1213 Concordia University

Create this form in 5 minutes!

How to create an eSignature for the tax filer information student 1213 concordia university

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of TAX FILER INFORMATION Student 1213 Concordia University?

TAX FILER INFORMATION Student 1213 Concordia University is crucial for students to accurately report their income and expenses for tax purposes. It helps ensure compliance with tax regulations and can maximize potential refunds. Understanding this information is essential for financial planning and scholarship applications.

-

How can airSlate SignNow assist with managing TAX FILER INFORMATION Student 1213 Concordia University?

airSlate SignNow provides a seamless platform for students to securely sign and manage their TAX FILER INFORMATION Student 1213 Concordia University documents. With its user-friendly interface, students can easily upload, sign, and share their tax documents, ensuring they are organized and accessible. This simplifies the tax filing process signNowly.

-

What features does airSlate SignNow offer for handling TAX FILER INFORMATION Student 1213 Concordia University?

airSlate SignNow offers features such as electronic signatures, document templates, and secure cloud storage specifically designed for managing TAX FILER INFORMATION Student 1213 Concordia University. These features enhance efficiency and reduce the time spent on paperwork. Additionally, users can track document status in real-time.

-

Is airSlate SignNow cost-effective for students needing TAX FILER INFORMATION Student 1213 Concordia University?

Yes, airSlate SignNow is a cost-effective solution for students managing TAX FILER INFORMATION Student 1213 Concordia University. With flexible pricing plans tailored for students, it ensures that essential document management tools are accessible without breaking the bank. This affordability makes it an ideal choice for budget-conscious students.

-

Can airSlate SignNow integrate with other tools for managing TAX FILER INFORMATION Student 1213 Concordia University?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing students to manage their TAX FILER INFORMATION Student 1213 Concordia University alongside other essential tools. This integration enhances workflow efficiency, enabling users to connect their tax documents with accounting software and educational platforms.

-

What are the benefits of using airSlate SignNow for TAX FILER INFORMATION Student 1213 Concordia University?

Using airSlate SignNow for TAX FILER INFORMATION Student 1213 Concordia University offers numerous benefits, including enhanced security, ease of use, and time savings. Students can confidently manage their tax documents knowing they are protected and easily accessible. This leads to a more organized approach to tax filing and financial management.

-

How secure is airSlate SignNow for handling TAX FILER INFORMATION Student 1213 Concordia University?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect TAX FILER INFORMATION Student 1213 Concordia University. Users can trust that their sensitive tax documents are safe from unauthorized access. This commitment to security ensures peace of mind for students during the tax filing process.

Get more for TAX FILER INFORMATION Student 1213 Concordia University

Find out other TAX FILER INFORMATION Student 1213 Concordia University

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now