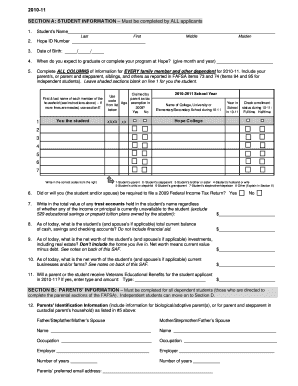

HOPE COLLEGE Form

What is the HOPE COLLEGE

The HOPE College is a financial aid program designed to assist students in covering the costs of higher education in the United States. It provides tax credits to eligible students and their families, making college more affordable. The program aims to encourage students to pursue their educational goals by alleviating some of the financial burdens associated with tuition and related expenses.

How to use the HOPE COLLEGE

To utilize the HOPE College program, students or their parents must first determine eligibility based on income and enrollment status. Once eligibility is confirmed, the next step involves completing the necessary tax forms during the annual tax filing process. This includes reporting qualified education expenses, which may include tuition, fees, and course materials. Proper documentation is essential to ensure that the credits are accurately applied.

Steps to complete the HOPE COLLEGE

Completing the HOPE College process involves several key steps:

- Determine eligibility based on income and enrollment criteria.

- Gather documentation of qualified education expenses.

- Complete the relevant tax forms, including Form 8863, to claim the credit.

- Submit the tax return by the designated filing deadline.

Legal use of the HOPE COLLEGE

The HOPE College program is governed by specific legal guidelines set forth by the Internal Revenue Service (IRS). It is important for applicants to understand these regulations to ensure compliance. This includes adhering to income limits and ensuring that the educational institution is eligible under IRS rules. Misuse of the program can lead to penalties, including the disallowance of the credit and potential fines.

Eligibility Criteria

To qualify for the HOPE College program, students must meet certain criteria:

- Be enrolled at least half-time in a degree or certificate program.

- Have a valid Social Security number.

- Meet income requirements as specified by the IRS.

- Not have previously claimed the credit for more than two tax years.

Required Documents

When applying for the HOPE College program, it is essential to gather the following documents:

- Form 1098-T from the educational institution, which details tuition payments.

- Receipts or statements for qualified expenses such as textbooks and supplies.

- Tax return from the previous year for income verification.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the HOPE College program is crucial for applicants. Generally, the tax return must be submitted by April 15 of the following year. However, if additional time is needed, taxpayers can file for an extension, but they must still pay any owed taxes by the original deadline to avoid penalties.

Quick guide on how to complete hope college

Complete [SKS] effortlessly on any gadget

Online document management has gained signNow traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can find the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to alter and electronically sign [SKS] effortlessly

- Acquire [SKS] and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select how you would like to share your form, either via email, SMS, invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to HOPE COLLEGE

Create this form in 5 minutes!

How to create an eSignature for the hope college

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it benefit HOPE COLLEGE?

airSlate SignNow is a powerful eSignature solution that allows institutions like HOPE COLLEGE to streamline their document management processes. By using airSlate SignNow, HOPE COLLEGE can easily send, sign, and manage documents electronically, saving time and reducing paperwork. This solution enhances efficiency and ensures compliance with legal standards.

-

How much does airSlate SignNow cost for HOPE COLLEGE?

The pricing for airSlate SignNow varies based on the features and number of users needed. For HOPE COLLEGE, we offer flexible pricing plans that can accommodate different budgets and requirements. It's best to contact our sales team for a customized quote tailored to HOPE COLLEGE's specific needs.

-

What features does airSlate SignNow offer that are beneficial for HOPE COLLEGE?

airSlate SignNow provides a range of features that are particularly beneficial for HOPE COLLEGE, including customizable templates, automated workflows, and secure cloud storage. These features help streamline administrative tasks and improve collaboration among staff and students. Additionally, the platform is user-friendly, making it easy for everyone at HOPE COLLEGE to adopt.

-

Can airSlate SignNow integrate with other tools used by HOPE COLLEGE?

Yes, airSlate SignNow offers seamless integrations with various applications that HOPE COLLEGE may already be using, such as Google Workspace, Microsoft Office, and CRM systems. These integrations enhance productivity by allowing users to manage documents directly within their preferred tools. This flexibility makes airSlate SignNow a great fit for HOPE COLLEGE's existing workflows.

-

Is airSlate SignNow secure for use at HOPE COLLEGE?

Absolutely! airSlate SignNow prioritizes security and compliance, making it a safe choice for HOPE COLLEGE. The platform employs advanced encryption methods and complies with industry standards to protect sensitive information. This ensures that all documents signed through airSlate SignNow are secure and confidential.

-

How can HOPE COLLEGE improve its document workflow with airSlate SignNow?

By implementing airSlate SignNow, HOPE COLLEGE can signNowly improve its document workflow through automation and digital signatures. This reduces the time spent on manual processes and minimizes errors associated with paper documents. As a result, HOPE COLLEGE can focus more on its core educational mission while enhancing operational efficiency.

-

What support options are available for HOPE COLLEGE using airSlate SignNow?

airSlate SignNow offers comprehensive support options for HOPE COLLEGE, including live chat, email support, and an extensive knowledge base. Our dedicated support team is available to assist with any questions or issues that may arise. This ensures that HOPE COLLEGE can maximize the benefits of using airSlate SignNow without any disruptions.

Get more for HOPE COLLEGE

- Exercise option purchase form

- Sample letter announcement 497332344 form

- Notice of dissolution partnership template form

- Change ownership property form

- Application medical questionnaire release waiver of liability and indemnity agreement with fitness instructor to study yoga form

- Motion dismiss court 497332348 form

- Employer declaration for ignition interlock license form

- Motion date court form

Find out other HOPE COLLEGE

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word