Certification of Lostmissing Receipts Commercial Card Transactions Marietta Form

What is the Certification Of Lostmissing Receipts Commercial Card Transactions Marietta

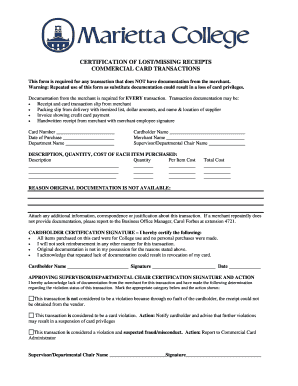

The Certification Of Lostmissing Receipts Commercial Card Transactions in Marietta is a formal document used by businesses to attest to the loss or unavailability of receipts for transactions made using a commercial card. This certification serves as a verification tool for accounting and auditing purposes, ensuring that all financial records are accurate and compliant with relevant regulations. It is particularly important for maintaining transparency in financial reporting and for tax purposes.

How to use the Certification Of Lostmissing Receipts Commercial Card Transactions Marietta

This certification is utilized when a business cannot produce original receipts for commercial card transactions. To use the certification, a designated company representative must fill out the form with details of the transactions in question, including the date, amount, and purpose of each transaction. Once completed, the representative must sign the document, affirming the accuracy of the information provided. This certification can then be submitted to the relevant financial department or auditor as needed.

Steps to complete the Certification Of Lostmissing Receipts Commercial Card Transactions Marietta

Completing the Certification Of Lostmissing Receipts involves several key steps:

- Gather information regarding the transactions for which receipts are missing.

- Fill out the certification form, ensuring all required fields are completed accurately.

- Include details such as transaction dates, amounts, and descriptions.

- Sign the certification to validate the information.

- Submit the completed certification to the appropriate department or authority.

Legal use of the Certification Of Lostmissing Receipts Commercial Card Transactions Marietta

The legal use of this certification is crucial for businesses to comply with financial regulations and tax laws. It acts as a safeguard against potential audits by providing a formal declaration of missing receipts. Businesses must ensure that the information provided is truthful and accurate, as any discrepancies could lead to legal repercussions, including fines or penalties.

Key elements of the Certification Of Lostmissing Receipts Commercial Card Transactions Marietta

Key elements of the certification include:

- Transaction Details: Date, amount, and purpose of each transaction.

- Company Information: Name and address of the business.

- Authorized Signatory: Name and title of the person completing the certification.

- Signature: A signature affirming the accuracy of the information provided.

Examples of using the Certification Of Lostmissing Receipts Commercial Card Transactions Marietta

Examples of situations where this certification may be used include:

- When a business employee loses a receipt while traveling for work.

- In cases where receipts are damaged or illegible.

- For transactions made through online platforms where digital receipts are not available.

Quick guide on how to complete certification of lostmissing receipts commercial card transactions marietta

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Method to Modify and Electronically Sign [SKS] Effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize our tools to complete your form.

- Mark important sections of the documents or obscure sensitive information using the tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Certification Of Lostmissing Receipts Commercial Card Transactions Marietta

Create this form in 5 minutes!

How to create an eSignature for the certification of lostmissing receipts commercial card transactions marietta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Certification Of Lostmissing Receipts Commercial Card Transactions Marietta?

The Certification Of Lostmissing Receipts Commercial Card Transactions Marietta is a formal document that verifies the absence of receipts for commercial card transactions. This certification is essential for businesses to maintain accurate financial records and ensure compliance with accounting standards.

-

How can airSlate SignNow help with the Certification Of Lostmissing Receipts Commercial Card Transactions Marietta?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign the Certification Of Lostmissing Receipts Commercial Card Transactions Marietta. Our user-friendly interface simplifies the process, making it easy to manage documentation efficiently.

-

What are the pricing options for using airSlate SignNow for Certification Of Lostmissing Receipts Commercial Card Transactions Marietta?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, ensuring you get the best value for managing your Certification Of Lostmissing Receipts Commercial Card Transactions Marietta.

-

Are there any features specifically designed for the Certification Of Lostmissing Receipts Commercial Card Transactions Marietta?

Yes, airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning that are particularly beneficial for the Certification Of Lostmissing Receipts Commercial Card Transactions Marietta. These features enhance efficiency and ensure compliance with legal requirements.

-

What benefits does airSlate SignNow offer for managing Certification Of Lostmissing Receipts Commercial Card Transactions Marietta?

Using airSlate SignNow for the Certification Of Lostmissing Receipts Commercial Card Transactions Marietta provides numerous benefits, including reduced processing time, improved accuracy, and enhanced security. This allows businesses to focus on their core operations while ensuring their documentation is handled efficiently.

-

Can airSlate SignNow integrate with other software for Certification Of Lostmissing Receipts Commercial Card Transactions Marietta?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and financial software, making it easier to manage the Certification Of Lostmissing Receipts Commercial Card Transactions Marietta. This integration helps streamline workflows and ensures that all financial data is synchronized.

-

Is it easy to track the status of the Certification Of Lostmissing Receipts Commercial Card Transactions Marietta with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for the Certification Of Lostmissing Receipts Commercial Card Transactions Marietta. Users can easily monitor the status of their documents, ensuring that all necessary approvals and signatures are obtained promptly.

Get more for Certification Of Lostmissing Receipts Commercial Card Transactions Marietta

Find out other Certification Of Lostmissing Receipts Commercial Card Transactions Marietta

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney