MINISTRY of FINANCE of the REPUBLIC of INDONESIA FORM DGT 2021-2026

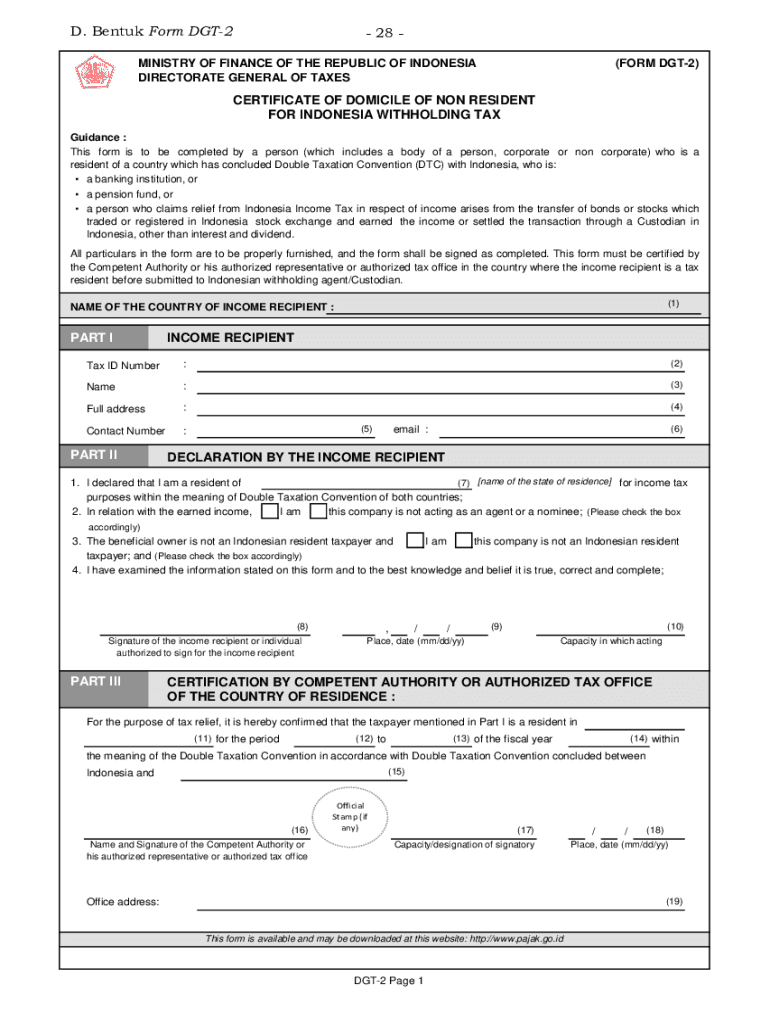

What is the Indonesia non-resident withholding tax form?

The Indonesia non-resident withholding tax form is a crucial document for individuals or entities that are not residents of Indonesia but earn income sourced from the country. This form is essential for ensuring compliance with Indonesian tax regulations. It typically includes details about the income, the non-resident's identity, and the applicable tax rate. Understanding this form is vital for avoiding potential penalties and ensuring that the correct amount of tax is withheld at the source.

Key elements of the Indonesia non-resident withholding tax form

Several key elements must be included when completing the Indonesia non-resident withholding tax form. These elements generally consist of:

- Taxpayer Identification Number (NPWP): This unique number is assigned to taxpayers in Indonesia and is necessary for processing the form.

- Income Type: Clearly specify the type of income being earned, such as dividends, royalties, or service fees.

- Withholding Tax Rate: Indicate the applicable tax rate, which may vary based on tax treaties between Indonesia and the non-resident's country.

- Signature: A valid signature is required to authenticate the form and confirm the information provided.

Steps to complete the Indonesia non-resident withholding tax form

Completing the Indonesia non-resident withholding tax form involves several steps to ensure accuracy and compliance:

- Gather necessary documentation, including the taxpayer identification number and details of the income.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Sign the form to validate the information provided.

- Submit the form to the relevant Indonesian tax authority, either electronically or via mail.

Legal use of the Indonesia non-resident withholding tax form

The legal use of the Indonesia non-resident withholding tax form is governed by Indonesian tax laws. It is essential to ensure that the form is filled out correctly and submitted in accordance with local regulations. Failure to comply with these requirements can lead to penalties, including fines or additional tax liabilities. Understanding the legal framework surrounding this form helps non-residents navigate their tax obligations effectively.

Required documents for the Indonesia non-resident withholding tax form

When preparing to complete the Indonesia non-resident withholding tax form, several documents are typically required:

- Taxpayer Identification Number (NPWP): This is essential for identifying the taxpayer.

- Proof of Income: Documentation that verifies the income earned in Indonesia, such as contracts or invoices.

- Tax Residency Certificate: This may be required to establish the non-resident's tax status in their home country.

Form submission methods for the Indonesia non-resident withholding tax form

The Indonesia non-resident withholding tax form can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the Indonesian tax authority. Common submission methods include:

- Online Submission: Many tax authorities allow for electronic submission of forms through their official portals.

- Mail: The form can be printed and sent via postal service to the relevant tax office.

- In-Person Submission: Taxpayers may also have the option to submit the form directly at designated tax offices.

Quick guide on how to complete ministry of finance of the republic of indonesia form dgt

Prepare MINISTRY OF FINANCE OF THE REPUBLIC OF INDONESIA FORM DGT seamlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage MINISTRY OF FINANCE OF THE REPUBLIC OF INDONESIA FORM DGT on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to change and eSign MINISTRY OF FINANCE OF THE REPUBLIC OF INDONESIA FORM DGT effortlessly

- Obtain MINISTRY OF FINANCE OF THE REPUBLIC OF INDONESIA FORM DGT and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about misplaced or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device of your choice. Edit and eSign MINISTRY OF FINANCE OF THE REPUBLIC OF INDONESIA FORM DGT and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ministry of finance of the republic of indonesia form dgt

Create this form in 5 minutes!

How to create an eSignature for the ministry of finance of the republic of indonesia form dgt

The way to create an eSignature for your PDF in the online mode

The way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is airSlate SignNow for Indonesia non residents?

airSlate SignNow is a digital solution that allows Indonesia non residents to send, receive, and electronically sign documents efficiently. It's designed to facilitate smooth transactions and document handling regardless of geographical barriers.

-

How does airSlate SignNow benefit Indonesia non residents?

For Indonesia non residents, airSlate SignNow offers a convenient way to manage document signing without the need for physical presence. This not only saves time but also ensures compliance with various legal requirements associated with remote signing.

-

What pricing options are available for Indonesia non residents?

airSlate SignNow provides flexible pricing plans tailored for Indonesia non residents to choose from, ensuring affordability. These plans cater to different business sizes and needs, making it an economical choice for remote document management.

-

Can Indonesia non residents integrate airSlate SignNow with other applications?

Yes, airSlate SignNow allows Indonesia non residents to integrate the platform seamlessly with various applications such as Google Drive, Dropbox, and Salesforce. This enhances workflow and ensures that documents can be managed effectively across different platforms.

-

What features does airSlate SignNow offer for Indonesia non residents?

airSlate SignNow includes features like customizable templates, automated workflows, and secure cloud storage, specifically designed to meet the needs of Indonesia non residents. These tools help streamline the document signing process while ensuring security and compliance.

-

Is it secure for Indonesia non residents to use airSlate SignNow?

Absolutely, airSlate SignNow prioritizes security for Indonesia non residents with robust encryption and compliance with international security standards. This means that your documents are safe during storage and transmission, giving you peace of mind.

-

How does the eSigning process work for Indonesia non residents?

For Indonesia non residents, the eSigning process with airSlate SignNow is simple and intuitive. Users can upload documents, add necessary signers, and send them for signature instantly, all while tracking the signing status in real-time.

Get more for MINISTRY OF FINANCE OF THE REPUBLIC OF INDONESIA FORM DGT

- Ing discharge authority form

- Dl 965 form

- China bank downloadable forms

- Fillable online 477 23rd street ogden ut 84401 fax email form

- Imperial county ca marriage certificate application form

- Petition for probate of will and for letters of form

- Wa sos form

- Referenceprivacy act requests united states department of justiceprivacy release form congressman david scottprivacy release

Find out other MINISTRY OF FINANCE OF THE REPUBLIC OF INDONESIA FORM DGT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation