Issue No 169 Nevada Department of Taxation State of Nevada Tax State Nv 2007-2026

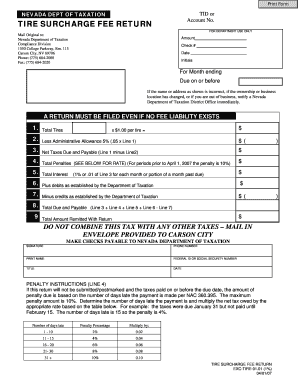

Understanding the Nevada Tire Tax Form

The Nevada tire tax form, also known as the Nevada tire surcharge fee return, is a crucial document for individuals and businesses involved in the sale of tires in Nevada. This form is used to report and remit the tire tax imposed by the state, which aims to fund environmental initiatives related to tire disposal and recycling. Understanding the purpose and requirements of this form is essential for compliance with state regulations.

Steps to Complete the Nevada Tire Tax Form

Completing the Nevada tire tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including sales records and tire inventory. Next, accurately calculate the total number of tires sold during the reporting period, as well as the corresponding tax amount. Fill out the form by entering the required details, including your business information and the total tire tax due. Finally, review the completed form for any errors before submission.

Required Documents for Filing

When filing the Nevada tire tax form, you will need to provide certain documents to support your submission. These typically include:

- Sales records for the reporting period

- Inventory records showing the number of tires sold

- Any previous tire tax returns filed

Having these documents ready will facilitate a smoother filing process and help avoid potential discrepancies.

Filing Methods for the Nevada Tire Tax Form

The Nevada tire tax form can be submitted through various methods, providing flexibility for businesses. You can file the form online through the Nevada Department of Taxation's website, which offers a convenient and efficient way to submit your information. Alternatively, you can mail a physical copy of the completed form to the appropriate tax office or deliver it in person. Ensure that you choose the method that best suits your needs and complies with any deadlines.

Penalties for Non-Compliance

Failure to file the Nevada tire tax form on time or inaccuracies in reporting can lead to penalties and interest charges. The state takes compliance seriously, and businesses may face fines for late submissions or underreporting tire sales. It is important to adhere to filing deadlines and ensure that all information is accurate to avoid these potential consequences.

Eligibility Criteria for Filing

Eligibility to file the Nevada tire tax form typically includes businesses that sell tires within the state. This includes retailers, wholesalers, and any entities involved in the distribution of tires. It is essential to verify that your business meets the necessary criteria to ensure compliance with state regulations.

Quick guide on how to complete issue no 169 nevada department of taxation state of nevada tax state nv

Effortlessly prepare Issue No 169 Nevada Department Of Taxation State Of Nevada Tax State Nv on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly solution to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Issue No 169 Nevada Department Of Taxation State Of Nevada Tax State Nv on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Issue No 169 Nevada Department Of Taxation State Of Nevada Tax State Nv with ease

- Obtain Issue No 169 Nevada Department Of Taxation State Of Nevada Tax State Nv and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant portions of your documents or obscure sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Issue No 169 Nevada Department Of Taxation State Of Nevada Tax State Nv to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct issue no 169 nevada department of taxation state of nevada tax state nv

Create this form in 5 minutes!

How to create an eSignature for the issue no 169 nevada department of taxation state of nevada tax state nv

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nevada tire tax form?

The Nevada tire tax form is a document required for the reporting and payment of tire taxes in the state of Nevada. This form helps businesses comply with state regulations regarding tire disposal and recycling. Understanding this form is essential for businesses involved in tire sales or services.

-

How can airSlate SignNow help with the Nevada tire tax form?

airSlate SignNow provides an easy-to-use platform for businesses to electronically sign and send the Nevada tire tax form. Our solution streamlines the process, ensuring that your documents are securely signed and submitted on time. This can save you valuable time and reduce the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Nevada tire tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution allows you to manage the Nevada tire tax form and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Nevada tire tax form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the Nevada tire tax form. These tools enhance your workflow and ensure that all necessary steps are completed efficiently. Additionally, our platform is user-friendly, making it accessible for all team members.

-

Can I integrate airSlate SignNow with other software for the Nevada tire tax form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your processes related to the Nevada tire tax form. Whether you use accounting software or CRM systems, our platform can connect seamlessly to enhance your document management.

-

What are the benefits of using airSlate SignNow for the Nevada tire tax form?

Using airSlate SignNow for the Nevada tire tax form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of loss or unauthorized access. This allows you to focus on your core business activities.

-

How do I get started with airSlate SignNow for the Nevada tire tax form?

Getting started with airSlate SignNow for the Nevada tire tax form is simple. You can sign up for a free trial on our website, explore the features, and start creating your documents. Our user-friendly interface will guide you through the process, making it easy to manage your tire tax forms.

Get more for Issue No 169 Nevada Department Of Taxation State Of Nevada Tax State Nv

Find out other Issue No 169 Nevada Department Of Taxation State Of Nevada Tax State Nv

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim