Nevada Tire Tax Form 2004

What is the Nevada Tire Tax Form

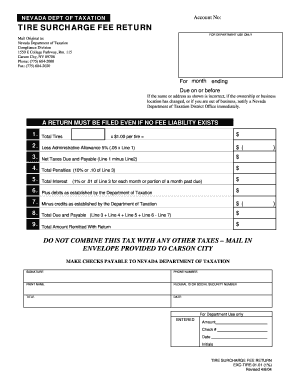

The Nevada Tire Tax Form is a document used for reporting and remitting the tire surcharge fee imposed on the sale of new tires in the state of Nevada. This fee is collected to support environmental initiatives and tire recycling programs. Businesses that sell new tires must complete this form to ensure compliance with state regulations. The form captures essential details such as the number of tires sold, the applicable surcharge rate, and the total amount due.

How to use the Nevada Tire Tax Form

Using the Nevada Tire Tax Form involves several key steps. First, businesses must gather sales data related to new tire transactions. Next, they should accurately fill out the form, detailing the number of tires sold and calculating the total surcharge fee. Once completed, the form must be submitted to the appropriate state agency, along with any payment due. It's important to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the Nevada Tire Tax Form

Completing the Nevada Tire Tax Form requires careful attention to detail. Follow these steps:

- Collect sales records for new tires sold during the reporting period.

- Fill in the required fields on the form, including business information and tire sales data.

- Calculate the total tire surcharge by multiplying the number of tires sold by the surcharge rate.

- Review the form for accuracy and completeness.

- Submit the form along with the payment to the designated state agency.

Legal use of the Nevada Tire Tax Form

The Nevada Tire Tax Form must be used in accordance with state laws and regulations. It serves as a legal document for reporting tire sales and remitting the associated surcharge fee. To ensure the form's legal validity, it is essential to complete it accurately and submit it by the specified deadlines. Failing to comply with these requirements can result in penalties and legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Nevada Tire Tax Form are critical for compliance. Businesses must be aware of the specific dates for submitting their forms and payments. Typically, the form is due quarterly, with deadlines falling at the end of each quarter. It's advisable to check for any updates or changes to these deadlines to avoid late fees or penalties.

Form Submission Methods

The Nevada Tire Tax Form can be submitted through various methods, ensuring convenience for businesses. Options include:

- Online submission via the state’s designated portal.

- Mailing a physical copy of the completed form to the appropriate agency.

- In-person submission at designated state offices.

Choosing the right submission method can help streamline the process and ensure timely compliance.

Quick guide on how to complete nevada tire tax form

Effortlessly prepare Nevada Tire Tax Form on any device

Managing documents online has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Nevada Tire Tax Form on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-based operation today.

How to edit and electronically sign Nevada Tire Tax Form with ease

- Locate Nevada Tire Tax Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and electronically sign Nevada Tire Tax Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nevada tire tax form

Create this form in 5 minutes!

How to create an eSignature for the nevada tire tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nevada tire surcharge fee return?

The Nevada tire surcharge fee return refers to the process businesses must follow to claim a refund on tire surcharges paid. Understanding this process is crucial for ensuring you receive the appropriate refunds promptly and efficiently.

-

How can airSlate SignNow help with the Nevada tire surcharge fee return?

airSlate SignNow streamlines the eSigning process for the Nevada tire surcharge fee return, allowing users to quickly send and sign necessary documents. Its intuitive platform saves time, ensuring you maximize your refund potential without the stress of paperwork delays.

-

Are there any fees associated with using airSlate SignNow for tire surcharge returns?

While airSlate SignNow is a cost-effective solution, you may encounter subscription fees based on the plan you choose. However, the efficiency gained from using airSlate SignNow for your Nevada tire surcharge fee return can outweigh these costs signNowly.

-

Can I integrate airSlate SignNow with other software for processing returns?

Yes, airSlate SignNow offers robust integrations with many business tools, which can enhance your workflow for handling the Nevada tire surcharge fee return. This capability enables seamless document management and ensures all aspects of your returns are synchronized.

-

What features does airSlate SignNow offer for managing tire surcharge fee returns?

airSlate SignNow provides features such as document templates, automated workflows, and secure eSigning, all of which facilitate the quick processing of your Nevada tire surcharge fee return. These features ensure that your documentation is always accurate and easily accessible.

-

Is airSlate SignNow secure for sensitive documents related to tire surcharge returns?

Absolutely! airSlate SignNow prioritizes security, employing encryption and compliance protocols to protect sensitive information related to your Nevada tire surcharge fee return. This enables users to send and sign documents with peace of mind.

-

How quickly can I process my Nevada tire surcharge fee return using airSlate SignNow?

With airSlate SignNow, you can process your Nevada tire surcharge fee return quickly, often in just a few clicks. The platform's efficiency and ease of use mean you spend less time on paperwork and more time focusing on your business.

Get more for Nevada Tire Tax Form

- Shenandoah oncology pc new patient history form please

- Health insurance marketplace in texas ambetter from superior form

- Deadline to submit data sheet january 15 form

- Diagnosis o k50 form

- Formulary exceptionprior authorization request form

- Ipfweborg form

- Pediatric clinic patient visit documentation school work evans amedd army form

- Infertility services precertification request form accessible infertility services precertification request form

Find out other Nevada Tire Tax Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation