EQUI VEST Annuity FormsEquitable 2021-2026

What is the AXA EQUI VEST Variable Annuity?

The AXA EQUI VEST Variable Annuity is a financial product designed to provide individuals with a combination of investment growth potential and income during retirement. This type of annuity allows policyholders to allocate their premiums into various investment options, which can include stocks, bonds, and mutual funds. The value of the annuity can fluctuate based on the performance of these investments, offering both opportunities for growth and risks associated with market volatility.

Key Elements of the AXA EQUI VEST Variable Annuity

Understanding the key elements of the AXA EQUI VEST Variable Annuity is essential for making informed decisions. Some important aspects include:

- Investment Options: Policyholders can choose from a range of investment portfolios to suit their risk tolerance and financial goals.

- Fees: Various fees may apply, including management fees and mortality and expense risk charges, which can impact overall returns.

- Tax Benefits: Earnings grow tax-deferred until withdrawal, providing potential tax advantages during the accumulation phase.

- Withdrawal Options: Policyholders can access their funds through withdrawals or annuitization, providing flexibility in how they receive income.

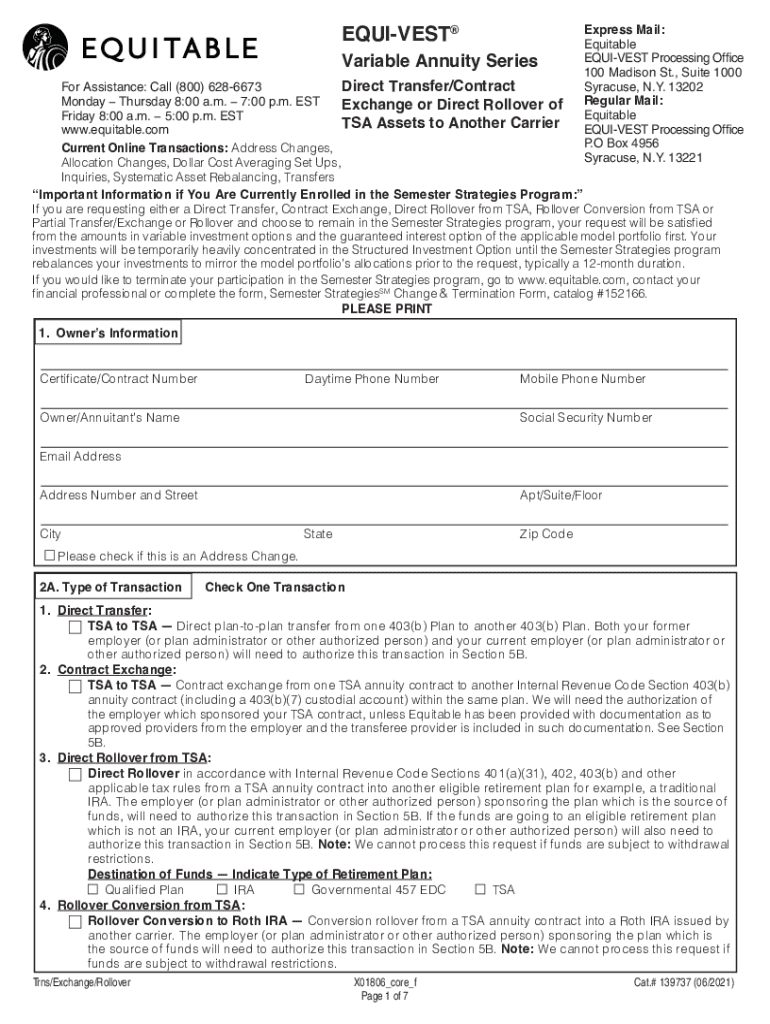

Steps to Complete the AXA EQUI VEST Variable Annuity Forms

Completing the necessary forms for the AXA EQUI VEST Variable Annuity involves several steps to ensure accuracy and compliance. Here are the key steps:

- Gather Required Information: Collect personal information, including Social Security number, employment details, and financial information.

- Choose Investment Options: Review available investment portfolios and select those that align with your financial objectives.

- Fill Out the Application: Complete the application form accurately, ensuring all sections are filled out to avoid delays.

- Review and Sign: Carefully review the application for any errors before signing to confirm your understanding of the terms.

- Submit the Application: Send the completed forms to AXA via the designated submission method, either online or by mail.

How to Obtain the AXA EQUI VEST Variable Annuity Forms

Obtaining the necessary forms for the AXA EQUI VEST Variable Annuity is straightforward. Individuals can access these forms through the following methods:

- Online Access: Visit the AXA website to download the forms directly from their resources section.

- Customer Service: Contact AXA customer service for assistance in obtaining the forms, including any specific requirements.

- Financial Advisors: Consult with a financial advisor who can provide the necessary forms and guidance throughout the application process.

Legal Use of the AXA EQUI VEST Variable Annuity Forms

The AXA EQUI VEST Variable Annuity forms are legally binding documents that require accurate completion to ensure compliance with financial regulations. It is important to understand the legal implications of the information provided, as any discrepancies may lead to issues with the annuity contract. Policyholders should retain copies of all submitted forms for their records and consult with legal or financial advisors if they have questions regarding the terms and conditions.

Form Submission Methods

Submitting the AXA EQUI VEST Variable Annuity forms can be done through various methods, ensuring convenience for policyholders. The available submission methods include:

- Online Submission: Many forms can be completed and submitted electronically through the AXA website, streamlining the process.

- Mail Submission: Completed forms can be sent via traditional mail to the designated AXA address, ensuring they are properly received.

- In-Person Submission: Individuals may also choose to submit forms in person at an AXA office, allowing for direct interaction with representatives.

Quick guide on how to complete equi vest annuity formsequitable

Effortlessly prepare EQUI VEST Annuity FormsEquitable on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without setbacks. Manage EQUI VEST Annuity FormsEquitable on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign EQUI VEST Annuity FormsEquitable with ease

- Locate EQUI VEST Annuity FormsEquitable and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from any chosen device. Edit and electronically sign EQUI VEST Annuity FormsEquitable while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct equi vest annuity formsequitable

Create this form in 5 minutes!

How to create an eSignature for the equi vest annuity formsequitable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the axa equi vest variable annuity?

The axa equi vest variable annuity is a financial product that combines investment options with insurance benefits. It allows policyholders to invest in various portfolios while providing a death benefit and potential income during retirement. This product is designed to help individuals grow their savings over time.

-

What are the key features of the axa equi vest variable annuity?

Key features of the axa equi vest variable annuity include flexible investment options, tax-deferred growth, and customizable income riders. Additionally, it offers a death benefit that ensures your beneficiaries receive a payout. These features make it a versatile choice for retirement planning.

-

How does pricing work for the axa equi vest variable annuity?

Pricing for the axa equi vest variable annuity typically includes a mortality and expense risk charge, investment management fees, and any optional riders you choose. It's important to review the specific fee structure with your financial advisor to understand the total costs involved. This transparency helps you make informed decisions about your investment.

-

What are the benefits of investing in the axa equi vest variable annuity?

Investing in the axa equi vest variable annuity offers several benefits, including potential for higher returns through market investments and the security of a guaranteed income stream. Additionally, it provides tax advantages, as earnings grow tax-deferred until withdrawal. This combination of growth potential and security makes it an attractive option for retirement savings.

-

Can I customize my axa equi vest variable annuity?

Yes, the axa equi vest variable annuity is highly customizable. You can choose from a variety of investment options, add income riders, and select the death benefit that best fits your needs. This flexibility allows you to tailor the annuity to align with your financial goals and risk tolerance.

-

How does the axa equi vest variable annuity integrate with other financial products?

The axa equi vest variable annuity can integrate seamlessly with other financial products, such as IRAs and 401(k) plans. This integration allows for a comprehensive retirement strategy that maximizes your savings and investment potential. Consulting with a financial advisor can help you understand how to best combine these products.

-

What should I consider before purchasing an axa equi vest variable annuity?

Before purchasing an axa equi vest variable annuity, consider your long-term financial goals, risk tolerance, and the fees associated with the product. It's also essential to evaluate the investment options available and how they align with your investment strategy. Taking the time to assess these factors can lead to a more informed decision.

Get more for EQUI VEST Annuity FormsEquitable

- 04 damages personal injury reasonable value of services form

- Find the lowest car insurance quotes here online definition form

- Directory of games game newsastro empires 3rd anniversary form

- Auto insurance from companies you trust auto insurance form

- Children tort claims docsharetips form

- 10 damages personal injury susceptible plaintiff form

- Consumer products mass tort defense form

- Monsanto co new form s 1a received 08302000 093920

Find out other EQUI VEST Annuity FormsEquitable

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement