Form TA 1, Transient Accommodations Tax Return, Rev Form Fillable 2022-2026

What is the TA 1 Form, Transient Accommodations Tax Return?

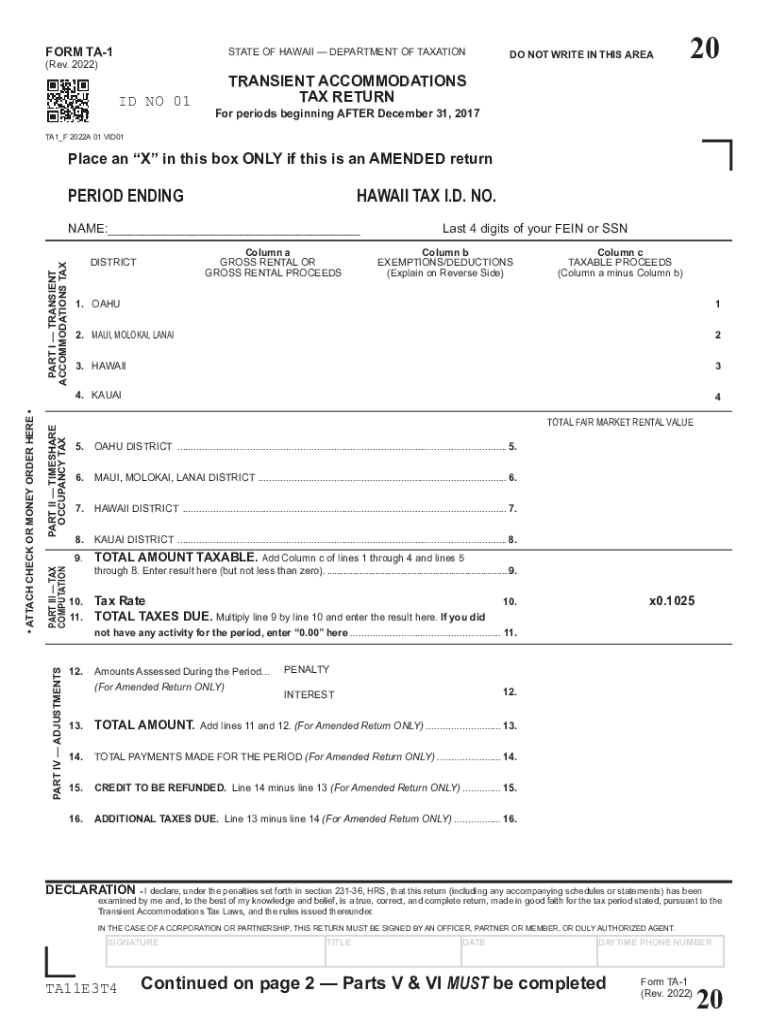

The TA 1 form, officially known as the Transient Accommodations Tax Return, is a tax document used in Hawaii. This form is primarily for individuals and businesses that rent out accommodations for short-term stays, such as vacation rentals, hotels, and bed-and-breakfasts. The tax collected through this form is designated for the state’s tourism and infrastructure development. Completing this form accurately is essential for compliance with state tax regulations.

How to Use the TA 1 Form, Transient Accommodations Tax Return

Using the TA 1 form involves several steps to ensure proper reporting of transient accommodations tax. First, gather all necessary financial records related to your rental income. This includes details about the number of rentals, rental rates, and any applicable deductions. Next, fill out the form by providing accurate information regarding your business and the income generated from accommodations. Once completed, submit the form to the appropriate state department, either online or via mail, as per the guidelines provided by the state of Hawaii.

Steps to Complete the TA 1 Form, Transient Accommodations Tax Return

Completing the TA 1 form requires attention to detail. Follow these steps:

- Gather your rental income records for the reporting period.

- Indicate your business name, address, and tax identification number on the form.

- Report the total gross income received from transient accommodations.

- Calculate the transient accommodations tax owed based on the income reported.

- Sign and date the form to certify the accuracy of the information provided.

- Submit the completed form to the appropriate state authority by the specified deadline.

Legal Use of the TA 1 Form, Transient Accommodations Tax Return

The TA 1 form is legally required for all operators of transient accommodations in Hawaii. It ensures compliance with state tax laws and helps fund essential services related to tourism. Failure to file this form can result in penalties, including fines and interest on unpaid taxes. It is crucial for businesses to understand their legal obligations regarding this form to avoid any potential legal issues.

Filing Deadlines and Important Dates for the TA 1 Form

Filing deadlines for the TA 1 form are critical for compliance. Typically, the form must be filed quarterly, with specific due dates set by the state of Hawaii. It is important to stay informed about these dates to ensure timely submission and avoid late fees. Mark your calendar with the filing deadlines to maintain compliance with state regulations.

Key Elements of the TA 1 Form, Transient Accommodations Tax Return

The TA 1 form includes several key elements that must be completed accurately. These elements typically include:

- Business information, including name and address.

- Tax identification number.

- Gross rental income for the reporting period.

- Calculation of the transient accommodations tax owed.

- Signature of the taxpayer or authorized representative.

Quick guide on how to complete form ta 1 transient accommodations tax return rev form fillable

Effortlessly Prepare Form TA 1, Transient Accommodations Tax Return, Rev Form Fillable on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Handle Form TA 1, Transient Accommodations Tax Return, Rev Form Fillable on any platform with airSlate SignNow's Android or iOS applications and streamline any document-based process today.

How to Modify and Electronically Sign Form TA 1, Transient Accommodations Tax Return, Rev Form Fillable with Ease

- Obtain Form TA 1, Transient Accommodations Tax Return, Rev Form Fillable and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form TA 1, Transient Accommodations Tax Return, Rev Form Fillable and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ta 1 transient accommodations tax return rev form fillable

Create this form in 5 minutes!

How to create an eSignature for the form ta 1 transient accommodations tax return rev form fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a ta 1 form and how can airSlate SignNow help with it?

The ta 1 form is a crucial document used in various business processes. airSlate SignNow simplifies the management of the ta 1 form by allowing users to easily send, sign, and store it electronically, ensuring a streamlined workflow.

-

How much does it cost to use airSlate SignNow for managing ta 1 forms?

airSlate SignNow offers competitive pricing plans tailored to different business needs. You can choose a plan that fits your budget while efficiently managing your ta 1 forms and other documents.

-

What features does airSlate SignNow provide for ta 1 form management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSigning for ta 1 forms. These tools enhance productivity and ensure that your documents are handled efficiently.

-

Can I integrate airSlate SignNow with other applications for ta 1 forms?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easy to manage your ta 1 forms alongside other business tools. This integration capability enhances your overall workflow.

-

What are the benefits of using airSlate SignNow for ta 1 forms?

Using airSlate SignNow for your ta 1 forms provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. These advantages help businesses save time and resources.

-

Is airSlate SignNow user-friendly for managing ta 1 forms?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage ta 1 forms without extensive training. Its intuitive interface allows for quick adoption.

-

How secure is airSlate SignNow when handling ta 1 forms?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your ta 1 forms. You can trust that your sensitive documents are safe and secure.

Get more for Form TA 1, Transient Accommodations Tax Return, Rev Form Fillable

- Instructions for nontaxable transaction certificates form

- Entry form american kennel club

- Enter the individuals role on the project e form

- Travailleurs demandeurs au canada form

- Attachment e cdrh final guidance cover sheet fda form

- Untitled california department of justice cagov form

- Illinois court of claims form

- Lost warrant form illinois secretary of state

Find out other Form TA 1, Transient Accommodations Tax Return, Rev Form Fillable

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe