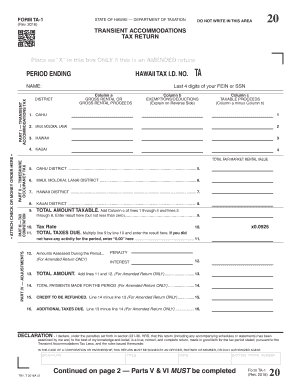

Form TA 1 Transient Accommodations Tax Return, Rev Form Software Vendor 2016

What is the Form TA 1 Transient Accommodations Tax Return?

The Form TA 1 Transient Accommodations Tax Return is a crucial document used by businesses and individuals in the United States to report and remit transient accommodations tax. This tax typically applies to short-term rentals, such as hotels, motels, and vacation rentals. The form is designed to ensure compliance with local tax regulations and to facilitate the accurate collection of taxes owed to state or local governments.

Steps to Complete the Form TA 1 Transient Accommodations Tax Return

Completing the Form TA 1 involves several key steps:

- Gather Required Information: Collect all necessary details, including your business name, address, tax identification number, and rental income.

- Calculate Tax Due: Determine the total amount of transient accommodations tax owed based on your rental income and applicable tax rates.

- Fill Out the Form: Accurately enter the gathered information into the form, ensuring all sections are completed as required.

- Review for Accuracy: Double-check all entries to avoid errors that could lead to penalties or delays in processing.

- Submit the Form: Choose your preferred submission method—online, by mail, or in person—and ensure it is sent by the deadline.

Legal Use of the Form TA 1 Transient Accommodations Tax Return

The Form TA 1 is legally mandated for businesses and individuals who engage in transient accommodations. Filing this form is essential for compliance with local tax laws. Failure to submit the form or inaccuracies in reporting can result in penalties, fines, or legal repercussions. It is important to understand the legal obligations surrounding this form to maintain good standing with tax authorities.

Filing Deadlines and Important Dates

Filing deadlines for the Form TA 1 can vary by jurisdiction, but it is generally required to be submitted on a monthly or quarterly basis. It is crucial to be aware of the specific deadlines set by your local tax authority to avoid late fees. Marking these dates on your calendar can help ensure timely compliance.

Required Documents for Filing

When preparing to file the Form TA 1, certain documents are typically required:

- Proof of rental income, such as invoices or receipts.

- Your business tax identification number.

- Any previous tax returns related to transient accommodations.

- Records of any exemptions or deductions applicable to your situation.

Form Submission Methods

The Form TA 1 can be submitted through various methods, depending on local regulations. Common submission options include:

- Online: Many jurisdictions offer an online portal for electronic submission.

- By Mail: You can print the completed form and send it to the designated tax office.

- In-Person: Some locations allow for direct submission at local tax offices.

Quick guide on how to complete form ta 1 transient accommodations tax return rev form software vendor

Complete Form TA 1 Transient Accommodations Tax Return, Rev Form Software Vendor effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form TA 1 Transient Accommodations Tax Return, Rev Form Software Vendor on any device using airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

Steps to adjust and electronically sign Form TA 1 Transient Accommodations Tax Return, Rev Form Software Vendor with ease

- Obtain Form TA 1 Transient Accommodations Tax Return, Rev Form Software Vendor and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Craft your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your adjustments.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your PC.

Forget about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Form TA 1 Transient Accommodations Tax Return, Rev Form Software Vendor while ensuring superb communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ta 1 transient accommodations tax return rev form software vendor

Create this form in 5 minutes!

How to create an eSignature for the form ta 1 transient accommodations tax return rev form software vendor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form TA 1 Transient Accommodations Tax Return, Rev Form Software Vendor?

The Form TA 1 Transient Accommodations Tax Return, Rev Form Software Vendor is a specialized software solution designed to help businesses efficiently manage and file their transient accommodations tax returns. This tool simplifies the process, ensuring compliance with local regulations while saving time and reducing errors.

-

How does airSlate SignNow facilitate the completion of the Form TA 1 Transient Accommodations Tax Return?

airSlate SignNow streamlines the completion of the Form TA 1 Transient Accommodations Tax Return by providing an intuitive interface for data entry and document management. Users can easily fill out the form, eSign it, and submit it directly from the platform, ensuring a hassle-free experience.

-

What are the pricing options for the Form TA 1 Transient Accommodations Tax Return, Rev Form Software Vendor?

Pricing for the Form TA 1 Transient Accommodations Tax Return, Rev Form Software Vendor varies based on the features and number of users. airSlate SignNow offers flexible subscription plans to accommodate businesses of all sizes, ensuring you only pay for what you need.

-

What features are included with the Form TA 1 Transient Accommodations Tax Return software?

The Form TA 1 Transient Accommodations Tax Return software includes features such as customizable templates, eSignature capabilities, automated reminders, and secure document storage. These features enhance efficiency and ensure that your tax returns are filed accurately and on time.

-

Can I integrate the Form TA 1 Transient Accommodations Tax Return software with other tools?

Yes, the Form TA 1 Transient Accommodations Tax Return, Rev Form Software Vendor can be integrated with various third-party applications. This allows for seamless data transfer and enhances your overall workflow, making it easier to manage your tax documentation alongside other business processes.

-

What are the benefits of using airSlate SignNow for the Form TA 1 Transient Accommodations Tax Return?

Using airSlate SignNow for the Form TA 1 Transient Accommodations Tax Return offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform's user-friendly design and robust features help businesses save time and minimize the risk of errors in their tax filings.

-

Is training available for using the Form TA 1 Transient Accommodations Tax Return software?

Yes, airSlate SignNow provides comprehensive training resources for users of the Form TA 1 Transient Accommodations Tax Return software. These resources include tutorials, webinars, and customer support to ensure you can effectively utilize the software and maximize its benefits.

Get more for Form TA 1 Transient Accommodations Tax Return, Rev Form Software Vendor

Find out other Form TA 1 Transient Accommodations Tax Return, Rev Form Software Vendor

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF