Agreement for Salary Reduction under Section 403b University of Form

What is the Agreement For Salary Reduction Under Section 403b University Of

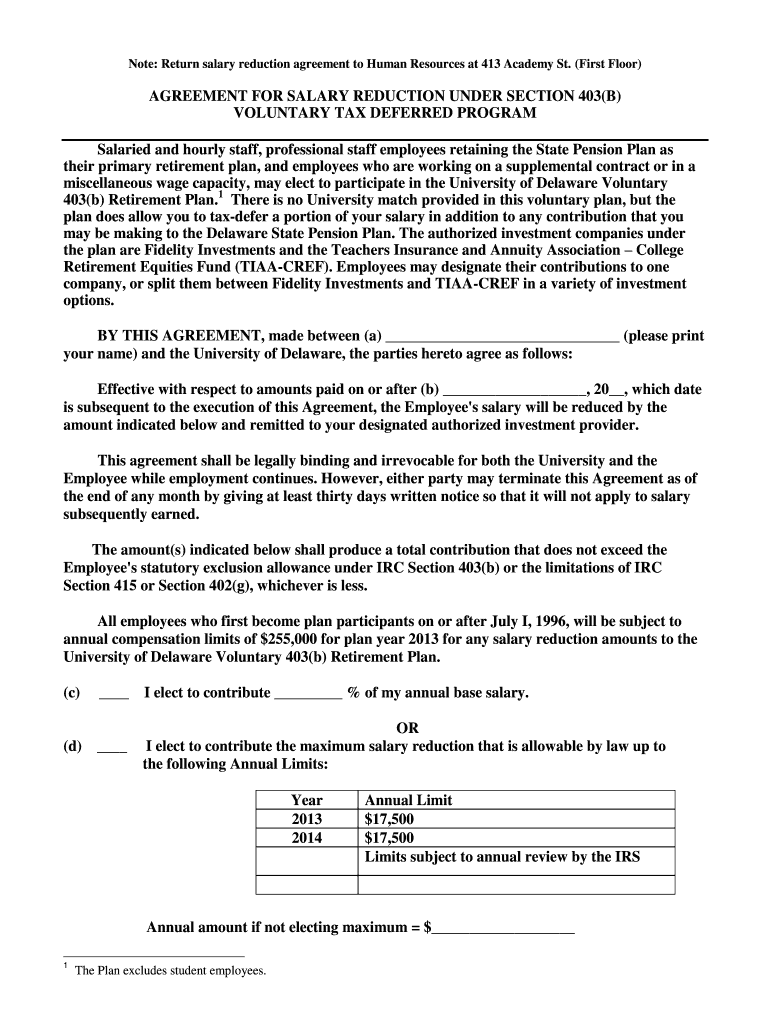

The Agreement For Salary Reduction Under Section 403b is a formal document that allows employees of eligible educational institutions to defer a portion of their salary into a retirement savings plan. This agreement is governed by Section 403(b) of the Internal Revenue Code, which provides tax advantages for retirement savings. By entering into this agreement, employees can reduce their taxable income while saving for retirement, as contributions are made pre-tax.

How to use the Agreement For Salary Reduction Under Section 403b University Of

To utilize the Agreement For Salary Reduction Under Section 403b, employees must first review their employer's specific plan details. This includes understanding the contribution limits, investment options, and any associated fees. Once familiar, employees can complete the agreement form, specifying the amount of salary to be deferred. After submission to the payroll department, the specified amount will be deducted from their paycheck and directed into their chosen retirement account.

Steps to complete the Agreement For Salary Reduction Under Section 403b University Of

Completing the Agreement For Salary Reduction Under Section 403b involves several key steps:

- Review the employer's 403(b) plan documentation to understand eligibility and contribution limits.

- Determine the amount of salary to defer, keeping in mind IRS limits on contributions.

- Fill out the agreement form accurately, ensuring all required information is provided.

- Submit the completed form to the appropriate department, typically human resources or payroll.

- Confirm with payroll that the deductions have been initiated as per the agreement.

Key elements of the Agreement For Salary Reduction Under Section 403b University Of

The key elements of the Agreement For Salary Reduction Under Section 403b include:

- Employee Information: Name, employee ID, and contact details.

- Salary Reduction Amount: The specific dollar amount or percentage of salary to be deferred.

- Effective Date: The date when the salary reduction will commence.

- Investment Options: Selection of investment vehicles available within the 403(b) plan.

- Signature: Employee's signature to validate the agreement.

IRS Guidelines

The IRS provides specific guidelines regarding contributions to 403(b) plans, including annual contribution limits and rules for catch-up contributions for employees aged fifty and older. It is important for employees to stay informed about these guidelines to ensure compliance and maximize their retirement savings. Additionally, employees should be aware of the tax implications of withdrawals from their 403(b) accounts, as early withdrawals may incur penalties.

Eligibility Criteria

Eligibility for the Agreement For Salary Reduction Under Section 403b typically includes employees of public schools, certain non-profit organizations, and other eligible institutions. Employees must also meet any specific criteria set forth by their employer's retirement plan. Generally, full-time employees are eligible, while part-time employees may have different requirements. It is advisable for employees to consult their HR department for detailed eligibility information.

Quick guide on how to complete agreement for salary reduction under section 403b university of

Accomplish [SKS] effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The simplest method to modify and eSign [SKS] without stress

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Put aside concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Agreement For Salary Reduction Under Section 403b University Of

Create this form in 5 minutes!

How to create an eSignature for the agreement for salary reduction under section 403b university of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Agreement For Salary Reduction Under Section 403b University Of?

The Agreement For Salary Reduction Under Section 403b University Of is a legal document that allows employees of educational institutions to reduce their salary in exchange for contributions to a 403(b) retirement plan. This agreement helps employees save for retirement while benefiting from tax advantages. Understanding this agreement is crucial for maximizing your retirement savings.

-

How can airSlate SignNow help with the Agreement For Salary Reduction Under Section 403b University Of?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning the Agreement For Salary Reduction Under Section 403b University Of. Our user-friendly interface ensures that you can easily manage your documents and track their status. This efficiency saves time and reduces the hassle of paperwork.

-

What are the pricing options for using airSlate SignNow for the Agreement For Salary Reduction Under Section 403b University Of?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different users, including those managing the Agreement For Salary Reduction Under Section 403b University Of. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for managing the Agreement For Salary Reduction Under Section 403b University Of?

With airSlate SignNow, you can easily create templates for the Agreement For Salary Reduction Under Section 403b University Of, automate workflows, and track document progress. Our platform also includes secure eSigning capabilities, ensuring that your agreements are legally binding and compliant. These features enhance efficiency and accuracy in document management.

-

What are the benefits of using airSlate SignNow for the Agreement For Salary Reduction Under Section 403b University Of?

Using airSlate SignNow for the Agreement For Salary Reduction Under Section 403b University Of offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick turnaround times on document signing, which is essential for timely retirement planning. Additionally, you can access your documents from anywhere, making it convenient for busy professionals.

-

Can airSlate SignNow integrate with other tools for the Agreement For Salary Reduction Under Section 403b University Of?

Yes, airSlate SignNow seamlessly integrates with various tools and applications, enhancing your workflow for the Agreement For Salary Reduction Under Section 403b University Of. Whether you use CRM systems, cloud storage, or other productivity tools, our integrations ensure that you can manage your documents efficiently. This connectivity helps streamline your processes and improve collaboration.

-

Is airSlate SignNow secure for handling the Agreement For Salary Reduction Under Section 403b University Of?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the Agreement For Salary Reduction Under Section 403b University Of. We ensure that your sensitive information remains confidential and secure throughout the signing process. Trust is essential, and we are committed to safeguarding your data.

Get more for Agreement For Salary Reduction Under Section 403b University Of

- Evaluating components of international migration legal migrants census form

- Historical census statistics on population totals by census gov census form

- Jnonarrscoordinationevaluation for releaseaa 6 b wpd census form

- Easy access on cd rom census form

- Census and you census and you census form

- Form 8889 and its instructions such as legislation enacted

- Instructions for form 1041 and schedules a b g j and k 1

- Commercial cleaning agreement template form

Find out other Agreement For Salary Reduction Under Section 403b University Of

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement