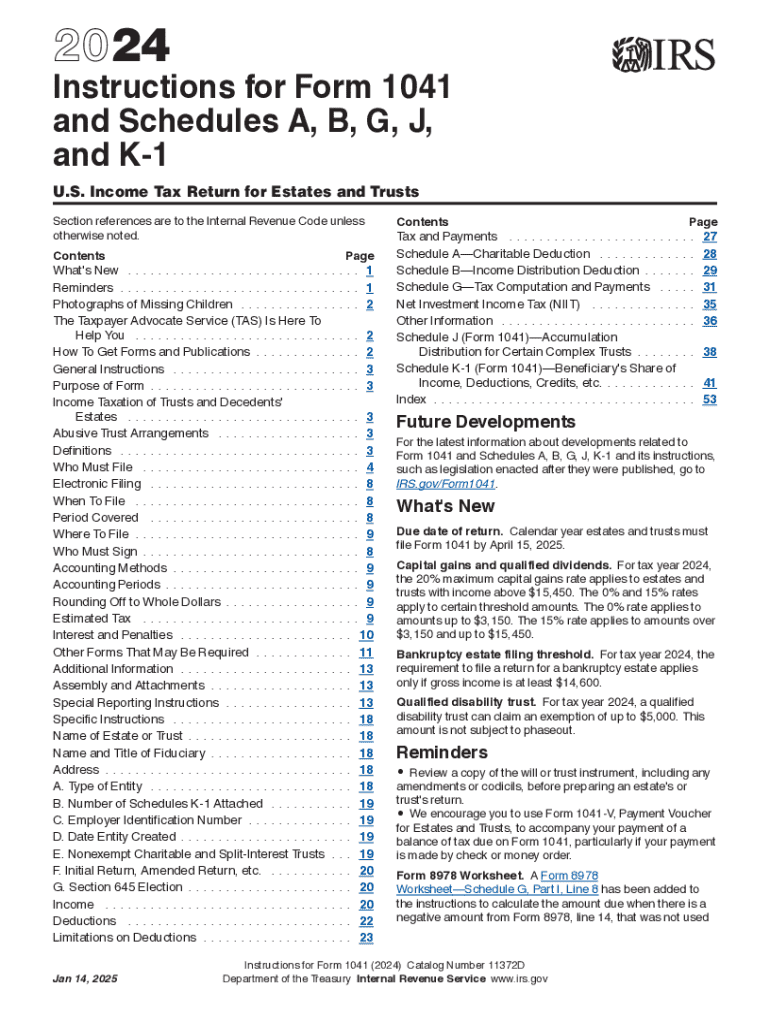

Instructions for Form 1041 and Schedules A, B, G, J, and K 1

Understanding IRS Form 1041 and Its Schedules

IRS Form 1041 is the U.S. Income Tax Return for Estates and Trusts. This form is essential for reporting income, deductions, gains, and losses of estates and trusts. Along with the main form, there are several schedules that provide detailed information regarding specific aspects of the estate or trust's financial activities. The most commonly used schedules include:

- Schedule A: Itemized deductions for estates and trusts.

- Schedule B: Interest and dividend income.

- Schedule G: Allocation of income, deductions, and credits.

- Schedule J: Election to treat a trust as a qualified revocable trust.

- Schedule K-1: Beneficiary's share of income, deductions, and credits.

Each schedule serves a specific purpose and must be completed accurately to ensure compliance with IRS regulations.

Steps to Complete IRS Form 1041 and Its Schedules

Completing IRS Form 1041 requires careful attention to detail. Here are the general steps to follow:

- Gather all necessary financial documents, including income statements and any previous tax returns related to the estate or trust.

- Fill out the main form, ensuring that all income and deductions are reported accurately.

- Complete the relevant schedules based on the financial activities of the estate or trust.

- Review the completed form and schedules for accuracy, ensuring all calculations are correct.

- Sign and date the form, and ensure it is filed by the due date.

It is advisable to consult with a tax professional if there are any uncertainties regarding the completion of the form or its schedules.

Filing Deadlines for IRS Form 1041

The due date for filing IRS Form 1041 is typically the fifteenth day of the fourth month following the end of the estate's or trust's tax year. For estates and trusts that operate on a calendar year, this means the form is due by April 15. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Extensions can be requested, but it is crucial to file the request before the original due date.

Legal Use of IRS Form 1041 and Its Schedules

IRS Form 1041 is legally required for estates and trusts that have gross income of $600 or more for the tax year or have any taxable income. It is essential for ensuring that the estate or trust meets its tax obligations. Failure to file can result in penalties, so understanding the legal requirements surrounding this form is critical for fiduciaries and beneficiaries alike.

Obtaining IRS Form 1041 and Its Instructions

The IRS Form 1041 and its instructions can be obtained directly from the IRS website. They are also available at various tax preparation offices and libraries. It is important to use the most current version of the form and instructions, particularly for the tax year being filed. For the 2024 tax year, ensure that you are using the 2024 Form 1041 instructions to comply with any updates or changes in tax law.

Examples of Using IRS Form 1041 and Its Schedules

IRS Form 1041 is commonly used in various scenarios, such as:

- When an estate is created following the death of an individual, and the estate generates income.

- When a trust is established to manage assets for beneficiaries, and it earns income during the tax year.

- For charitable trusts that must report their income and deductions to the IRS.

Each of these examples illustrates the importance of accurately completing and filing Form 1041 and its associated schedules to ensure compliance with tax regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1041 and schedules a b g j and k 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the IRS Form 1041 instructions?

The IRS Form 1041 instructions provide detailed guidance on how to complete the form for reporting income, deductions, and credits for estates and trusts. Understanding these instructions is crucial for accurate tax filing and compliance. airSlate SignNow can help streamline the process of signing and submitting these forms electronically.

-

How can airSlate SignNow assist with IRS Form 1041 instructions?

airSlate SignNow simplifies the process of managing IRS Form 1041 instructions by allowing users to eSign documents securely and efficiently. With our platform, you can easily upload, edit, and send your forms for signature, ensuring that you follow the IRS guidelines correctly. This saves time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for IRS Form 1041 instructions?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage your IRS Form 1041 instructions without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing IRS Form 1041 instructions?

airSlate SignNow provides features such as document templates, customizable workflows, and secure eSigning, all of which are beneficial for handling IRS Form 1041 instructions. These tools enhance efficiency and ensure compliance with IRS regulations. Additionally, our platform is user-friendly, making it accessible for everyone.

-

Can I integrate airSlate SignNow with other software for IRS Form 1041 instructions?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage IRS Form 1041 instructions alongside your existing tools. This integration enhances productivity and ensures that all your documents are in one place, making it easier to track and manage your tax filings.

-

What benefits does airSlate SignNow provide for IRS Form 1041 instructions?

Using airSlate SignNow for IRS Form 1041 instructions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of loss or unauthorized access. This allows you to focus on your business while we handle the documentation.

-

How does airSlate SignNow ensure compliance with IRS Form 1041 instructions?

airSlate SignNow is designed to help users comply with IRS Form 1041 instructions by providing templates and guidance throughout the signing process. Our platform is regularly updated to reflect the latest IRS requirements, ensuring that your submissions are accurate and compliant. This reduces the likelihood of errors and potential penalties.

Get more for Instructions For Form 1041 And Schedules A, B, G, J, And K 1

- Forms and documentsdivision of motor vehiclesnh

- Organized pursuant to the laws of the state of new hampshire hereinafter quotcorporationquot form

- A new hampshire corporation form

- Instructions for completing form 11pc rsa 293 a2

- Free new hampshire articles of incorporation templatesnh form

- Control number nh 00llc form

- An new hampshire limited liability company form

- New hampshire llcnew hampshire limited liability company form

Find out other Instructions For Form 1041 And Schedules A, B, G, J, And K 1

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later