Uniform Sales Use Tax Exemption Resale 2019-2026

What is the Uniform Sales Use Tax Exemption Resale?

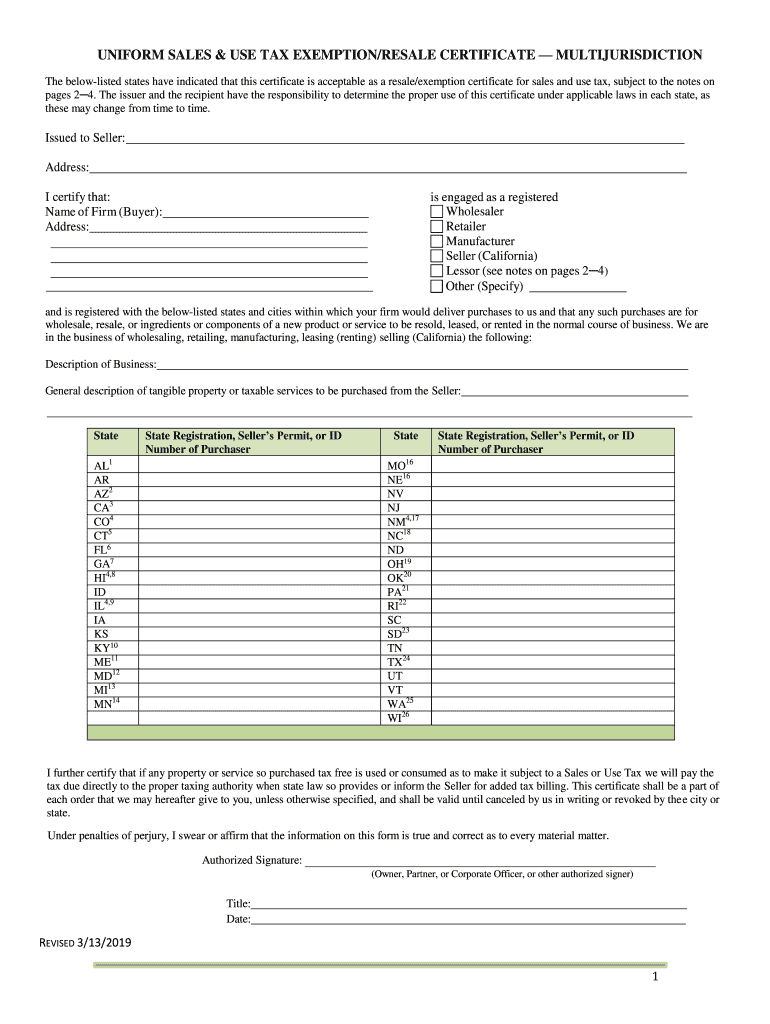

The Uniform Sales Use Tax Exemption Resale is a crucial document used by businesses in the United States to claim exemption from sales tax on purchases intended for resale. This certificate allows retailers to buy goods without paying sales tax, provided those goods are intended for sale to consumers. The exemption is based on the principle that sales tax is ultimately paid by the final consumer, not by the retailer. Understanding this document is essential for businesses looking to manage their tax obligations effectively.

How to Use the Uniform Sales Use Tax Exemption Resale

To utilize the Uniform Sales Use Tax Exemption Resale, businesses must present the certificate to suppliers at the time of purchase. This certificate serves as proof that the buyer is purchasing items for resale, thus exempting them from sales tax. It is important to ensure that the certificate is filled out completely and accurately to avoid any issues with suppliers or tax authorities. Each state may have specific requirements regarding the format and information required on the certificate.

Steps to Complete the Uniform Sales Use Tax Exemption Resale

Completing the Uniform Sales Use Tax Exemption Resale involves several key steps:

- Obtain the appropriate form from your state’s tax authority or website.

- Fill in your business information, including name, address, and tax identification number.

- Specify the type of property being purchased and its intended use for resale.

- Include the seller’s information to whom the certificate will be presented.

- Sign and date the certificate to validate it.

It is advisable to keep a copy of the completed certificate for your records, as it may be needed for future reference or audits.

Legal Use of the Uniform Sales Use Tax Exemption Resale

The legal use of the Uniform Sales Use Tax Exemption Resale is governed by state tax laws, which outline the conditions under which the certificate can be used. Businesses must ensure they are compliant with these regulations to avoid penalties. Misuse of the exemption certificate, such as using it for personal purchases or for items not intended for resale, can lead to significant legal repercussions, including fines and back taxes owed.

State-Specific Rules for the Uniform Sales Use Tax Exemption Resale

Each state in the U.S. has its own rules and regulations regarding the Uniform Sales Use Tax Exemption Resale. These can include variations in the form, specific information required, and the process for submission. It is essential for businesses to familiarize themselves with their state’s requirements to ensure compliance. Some states may also have additional exemptions or specific conditions that apply, making it vital to consult the state tax authority for detailed guidance.

Required Documents

When completing the Uniform Sales Use Tax Exemption Resale, certain documents may be required to support the application. These typically include:

- A valid business license or registration.

- Your federal Employer Identification Number (EIN).

- Any state-specific registration numbers or permits.

Having these documents ready can streamline the process and help ensure that the exemption is granted without delays.

Quick guide on how to complete uniform sales amp use tax exemptionresale certificate

Complete Uniform Sales Use Tax Exemption Resale effortlessly on any gadget

Digital document handling has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents promptly without delays. Manage Uniform Sales Use Tax Exemption Resale on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Uniform Sales Use Tax Exemption Resale seamlessly

- Find Uniform Sales Use Tax Exemption Resale and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your edits.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Alter and eSign Uniform Sales Use Tax Exemption Resale while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uniform sales amp use tax exemptionresale certificate

How to generate an eSignature for your Uniform Sales Amp Use Tax Exemptionresale Certificate in the online mode

How to generate an electronic signature for the Uniform Sales Amp Use Tax Exemptionresale Certificate in Google Chrome

How to create an eSignature for putting it on the Uniform Sales Amp Use Tax Exemptionresale Certificate in Gmail

How to create an electronic signature for the Uniform Sales Amp Use Tax Exemptionresale Certificate right from your smart phone

How to generate an eSignature for the Uniform Sales Amp Use Tax Exemptionresale Certificate on iOS devices

How to create an electronic signature for the Uniform Sales Amp Use Tax Exemptionresale Certificate on Android devices

People also ask

-

What is a sales tax certificate and why do I need one?

A sales tax certificate is a document issued by a state or local government that allows businesses to purchase goods without paying sales tax. This certificate is essential for businesses that want to avoid tax liabilities on their purchases and is a requirement for compliance with tax regulations.

-

How can airSlate SignNow help me obtain a sales tax certificate?

With airSlate SignNow, you can easily create, send, and eSign your sales tax certificate quickly and efficiently. Our platform streamlines the paperwork process so you can focus on your business without worrying about the complexities of tax documentation.

-

Are there any fees associated with obtaining a sales tax certificate through airSlate SignNow?

While airSlate SignNow offers a cost-effective solution for managing documents, obtaining a sales tax certificate may involve state-specific fees that vary. You can rely on our platform to simplify the processes associated with these requirements at a competitive price.

-

What features does airSlate SignNow offer for managing sales tax certificates?

airSlate SignNow provides features such as real-time eSigning, document tracking, and secure storage for your sales tax certificates. These functionalities ensure that your documents are accessible anytime you need them and are safely stored for compliance purposes.

-

Can airSlate SignNow integrate with other accounting software for sales tax purposes?

Yes, airSlate SignNow can seamlessly integrate with popular accounting software, enabling you to manage sales tax certificates and related documents effortlessly. This integration allows for better tracking of tax obligations and simplifies the workflow between your accounting and documentation processes.

-

What are the benefits of using airSlate SignNow for my sales tax documentation?

Using airSlate SignNow for your sales tax documentation offers several benefits, including time savings, reduced paperwork, and enhanced accuracy. Our user-friendly platform ensures that your sales tax certificates are completed and returned promptly, reducing the risk of delays.

-

How secure is my information when using airSlate SignNow for sales tax certificates?

Your information is secure with airSlate SignNow, as we implement advanced encryption and security measures to protect your data. We prioritize compliance with data protection regulations, ensuring that your sales tax certificates and other documents are safely stored and transmitted.

Get more for Uniform Sales Use Tax Exemption Resale

- Application for admission at the university of north florida form

- Marymount transcript request form

- Calworks program supply request form rio hondo college riohondo

- Scholarship tennessee promise form

- Purchase order request university of north florida unf form

- Nuvhs proctor approval form doc

- Paramedic program clinical and field reference manual form

- Teachers assessment form

Find out other Uniform Sales Use Tax Exemption Resale

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation