Form 673 2019-2026

What is the Form 673

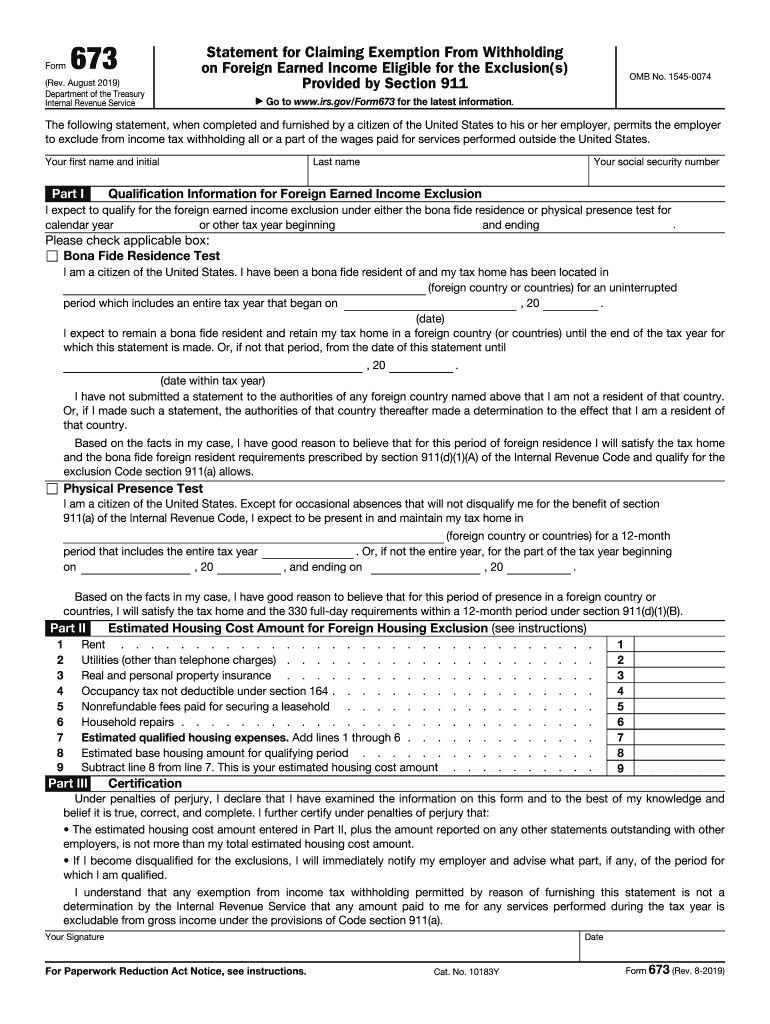

The Form 673, formally known as the IRS Form 673, is a tax document used by U.S. citizens and resident aliens to claim the foreign earned income exclusion. This form allows eligible taxpayers to exclude a certain amount of their foreign earned income from U.S. taxation, provided they meet specific criteria. The exclusion is beneficial for individuals working abroad, as it can significantly reduce their taxable income and overall tax liability.

Steps to complete the Form 673

Completing the Form 673 involves several key steps to ensure accuracy and compliance with IRS guidelines:

- Gather necessary information: Collect details about your foreign earned income, including the amount and the country where it was earned.

- Determine eligibility: Confirm that you meet the requirements for the foreign earned income exclusion, such as the physical presence test or the bona fide residence test.

- Fill out the form: Enter your personal information, including your name, address, and Social Security number. Provide the necessary income details as required by the form.

- Review for accuracy: Double-check all entries to ensure there are no mistakes that could lead to processing delays or penalties.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent before the tax deadline.

Legal use of the Form 673

The legal use of the Form 673 is governed by IRS regulations, which stipulate that the form must be completed accurately and submitted in a timely manner. When properly executed, the form serves as a declaration of your eligibility for the foreign earned income exclusion. It is crucial to maintain compliance with all IRS requirements to avoid penalties or issues with your tax filings. Using a reliable eSignature platform can enhance the legal validity of your submission, ensuring that it meets all necessary electronic signature laws.

How to obtain the Form 673

The Form 673 can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is available as a fillable PDF, making it easy to complete electronically. Additionally, tax professionals can provide the form as part of their services, ensuring that you receive guidance throughout the filing process. Always ensure you are using the most current version of the form to comply with IRS regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 673 align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must submit their forms by April 15 of the following tax year. However, if you are living abroad, you may qualify for an automatic extension, allowing you to file by June 15. It is essential to stay informed about any changes to deadlines or regulations that may affect your filing schedule.

Examples of using the Form 673

Examples of using the Form 673 include scenarios where individuals work overseas in various capacities, such as teachers, engineers, or business consultants. For instance, a U.S. citizen working as a teacher in an international school in Germany may use the form to exclude a portion of their income from U.S. taxes. Similarly, an American software developer working remotely for a U.S. company while residing in Canada can also benefit from the foreign earned income exclusion by submitting the Form 673.

Quick guide on how to complete form 673 rev august 2019 statement for claiming exemption from withtholding on foreign earned income eligible for the

Finish Form 673 easily on any gadget

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal sustainable alternative to conventional printed and signed papers, allowing you to find the correct form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without any delays. Manage Form 673 on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest way to alter and eSign Form 673 without hassle

- Obtain Form 673 and then click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize signNow parts of the documents or redact sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, burdensome form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 673 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 673 rev august 2019 statement for claiming exemption from withtholding on foreign earned income eligible for the

How to make an electronic signature for the Form 673 Rev August 2019 Statement For Claiming Exemption From Withtholding On Foreign Earned Income Eligible For The online

How to make an electronic signature for the Form 673 Rev August 2019 Statement For Claiming Exemption From Withtholding On Foreign Earned Income Eligible For The in Chrome

How to generate an eSignature for signing the Form 673 Rev August 2019 Statement For Claiming Exemption From Withtholding On Foreign Earned Income Eligible For The in Gmail

How to create an electronic signature for the Form 673 Rev August 2019 Statement For Claiming Exemption From Withtholding On Foreign Earned Income Eligible For The right from your smart phone

How to generate an eSignature for the Form 673 Rev August 2019 Statement For Claiming Exemption From Withtholding On Foreign Earned Income Eligible For The on iOS devices

How to make an eSignature for the Form 673 Rev August 2019 Statement For Claiming Exemption From Withtholding On Foreign Earned Income Eligible For The on Android devices

People also ask

-

What is form 673 and how can it benefit my business?

Form 673 is a document that can help streamline various approval processes within your organization. By utilizing airSlate SignNow, you can eSign and send form 673 easily, ensuring that you're saving time and enhancing productivity across your business operations.

-

How can I electronically sign form 673 using airSlate SignNow?

To electronically sign form 673 with airSlate SignNow, simply upload the document to our platform, invite the necessary parties to sign, and track the status in real-time. Our user-friendly interface makes it quick and straightforward to ensure all signatures are collected efficiently.

-

Is there a cost associated with using airSlate SignNow for form 673?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. We provide options that allow you to send and eSign form 673 and other documents at a cost-effective rate, ensuring you can choose the plan that fits your budget.

-

Are there any additional features when using airSlate SignNow for form 673?

Absolutely! Besides eSigning form 673, airSlate SignNow includes features such as document templates, automated workflows, and real-time tracking. These tools enhance your document management experience and ensure a smooth signing process.

-

Can I collaborate with others on form 673 using airSlate SignNow?

Yes, airSlate SignNow allows for seamless collaboration on form 673 by enabling multiple users to review, comment, and sign the document. This ensures that all stakeholders are involved in the process, promoting transparency and efficient communication.

-

What integrations does airSlate SignNow offer for handling form 673?

airSlate SignNow integrates with a wide range of applications, including CRM systems, cloud storage, and productivity tools. This means you can easily manage form 673 within your existing workflows and improve overall efficiency.

-

Is airSlate SignNow secure for handling sensitive form 673 documents?

Yes, airSlate SignNow is designed with security in mind. We implement industry-standard encryption and follow strict compliance protocols to ensure that all your documents, including form 673, are protected from unauthorized access.

Get more for Form 673

- Fillable online transgender medical history form and

- State not resuscitate consent dnr form

- Membership application international society for hair restoration ishrs form

- Form authorized representative request

- Authorization request by phone for electronic checkach form

- Medicare part b annual premium reimbursement request un org form

- Patient prescriber agreement 483352480 form

- Certificate of insurance hartford life and imala com form

Find out other Form 673

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple