Credit Application West End Roofing, Siding & Windows 2013

Understanding the Credit Application for Businesses

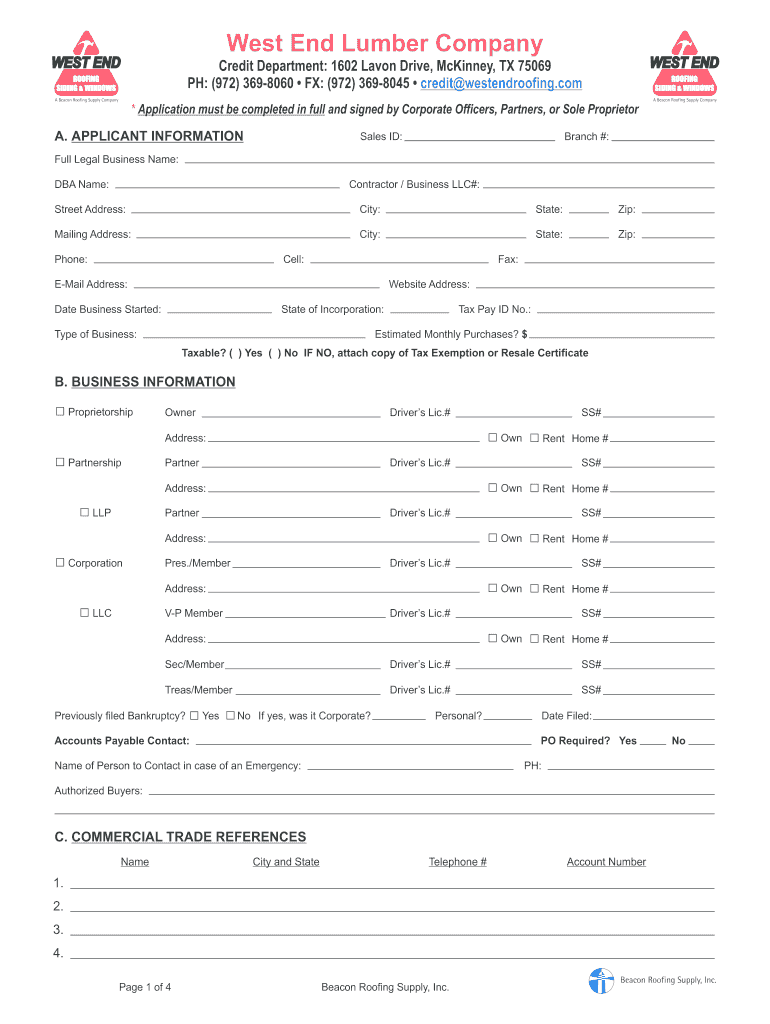

The credit application for businesses is a formal document that allows companies to request credit from lenders or suppliers. This application typically includes essential information about the business, such as its legal structure, financial history, and creditworthiness. By providing this information, businesses can facilitate the approval process for loans or credit lines, enabling them to manage cash flow and invest in growth opportunities.

Steps to Complete the Credit Application

Completing a credit application involves several key steps to ensure accuracy and completeness. First, gather necessary documentation, including financial statements, tax returns, and business identification details. Next, fill out the application form carefully, providing all requested information, such as business name, address, and ownership structure. Be prepared to disclose any outstanding debts and payment history. Finally, review the application for errors before submission to enhance the chances of approval.

Key Elements of the Credit Application

A well-structured credit application includes several critical elements. These typically feature the business's legal name, contact information, and the names of the owners or principal officers. Financial information is also crucial, including annual revenue, net income, and existing liabilities. Additionally, the application may require a personal guarantee from the owners, which adds a layer of security for the lender.

Eligibility Criteria for Credit Applications

Eligibility for a credit application varies based on the lender's requirements. Generally, lenders assess the business's credit history, financial stability, and industry type. New businesses may face stricter scrutiny, as they lack an established credit history. Additionally, personal credit scores of the owners may influence the application, especially for smaller businesses or startups seeking funding.

Legal Use of the Credit Application

The credit application must comply with relevant laws and regulations to ensure its legal validity. This includes adhering to the Fair Credit Reporting Act (FCRA), which governs how credit information is collected and used. Businesses should also be aware of state-specific regulations that may affect the credit application process. Proper legal compliance protects both the applicant and the lender from potential disputes or violations.

Digital vs. Paper Version of the Credit Application

Businesses can choose between digital and paper versions of the credit application. Digital applications offer convenience, allowing for easy submission and tracking. They often include features such as electronic signatures, which streamline the process. Conversely, paper applications may be preferred by businesses that require physical documentation for their records. Regardless of the format, ensuring that all information is accurate and complete is essential for a successful application.

Examples of Using the Credit Application

Businesses use credit applications in various scenarios, such as applying for a business loan, establishing trade credit with suppliers, or securing financing for equipment purchases. For instance, a construction company may fill out a credit application to obtain materials on credit, allowing it to manage cash flow while completing projects. Each use case highlights the importance of providing accurate information to foster trust and facilitate approval.

Quick guide on how to complete credit application west end roofing siding amp windows

Manage Credit Application West End Roofing, Siding & Windows effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Handle Credit Application West End Roofing, Siding & Windows on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to modify and eSign Credit Application West End Roofing, Siding & Windows with ease

- Obtain Credit Application West End Roofing, Siding & Windows and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Craft your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to deliver your form, either via email, SMS, or a shared link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, and mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Credit Application West End Roofing, Siding & Windows to guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct credit application west end roofing siding amp windows

Create this form in 5 minutes!

How to create an eSignature for the credit application west end roofing siding amp windows

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit application business pdf?

A credit application business pdf is a standardized document that businesses use to assess the creditworthiness of potential clients. This PDF format allows for easy sharing and signing, ensuring that all necessary information is collected efficiently.

-

How can airSlate SignNow help with credit application business pdfs?

airSlate SignNow streamlines the process of sending and eSigning credit application business pdfs. Our platform allows you to create, customize, and manage these documents effortlessly, ensuring a smooth experience for both you and your clients.

-

What are the pricing options for using airSlate SignNow for credit application business pdfs?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, which provide access to features specifically designed for managing credit application business pdfs.

-

Are there any integrations available for credit application business pdfs?

Yes, airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow for credit application business pdfs. You can connect with CRM systems, cloud storage services, and more to streamline document management.

-

What features does airSlate SignNow offer for credit application business pdfs?

airSlate SignNow provides a range of features for credit application business pdfs, including customizable templates, real-time tracking, and secure eSigning. These tools help ensure that your documents are processed quickly and securely.

-

Can I customize my credit application business pdf using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your credit application business pdf to fit your specific business needs. You can add your branding, modify fields, and include any additional information required for your application process.

-

Is it secure to send credit application business pdfs through airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We use advanced encryption and authentication measures to ensure that your credit application business pdfs are sent and stored securely, protecting sensitive information.

Get more for Credit Application West End Roofing, Siding & Windows

- Correction deed form

- Ncbe campf required alabama state bar admission office form

- Alabama firearms form

- Pua alabama form

- Eviction notice notice of termination of tenancy for form

- Arkansas motion discovery form

- Name changes pro bono attorney application arkansas form

- Reference index vv supreme court of the united states form

Find out other Credit Application West End Roofing, Siding & Windows

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors