RPD 41329 Sustainable Building Tax Credit Claim Form 2013

What is the RPD 41329 Sustainable Building Tax Credit Claim Form

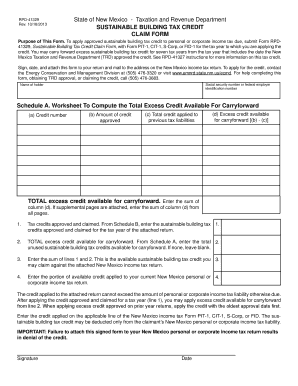

The RPD 41329 Sustainable Building Tax Credit Claim Form is a specific document used by taxpayers in the United States to claim tax credits for investments made in sustainable building projects. This form is essential for individuals and businesses that have undertaken qualifying improvements, allowing them to benefit from tax incentives designed to promote environmentally friendly construction practices. By completing this form, taxpayers can report their eligible expenses and request the corresponding tax credits from the state tax authority.

How to use the RPD 41329 Sustainable Building Tax Credit Claim Form

Using the RPD 41329 involves several steps to ensure accurate completion and submission. First, gather all necessary documentation that supports your claim, such as receipts for materials and labor costs related to sustainable building improvements. Next, carefully fill out each section of the form, providing detailed information about your project, including the type of improvements made and the associated costs. After completing the form, review it for accuracy before submitting it to the appropriate tax authority, either online or by mail, as specified in the form's instructions.

Steps to complete the RPD 41329 Sustainable Building Tax Credit Claim Form

Completing the RPD 41329 requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Gather supporting documents such as invoices, contracts, and proof of payment related to the sustainable building project.

- Fill out your personal or business information, including your name, address, and taxpayer identification number.

- Detail the specific sustainable improvements made, including descriptions and costs for each item.

- Calculate the total eligible expenses and the corresponding tax credit amount based on the guidelines provided.

- Review the completed form for any errors or omissions before submission.

Eligibility Criteria

To qualify for the tax credits associated with the RPD 41329, certain eligibility criteria must be met. Generally, the improvements must meet specific sustainability standards and be completed within the designated tax year. Additionally, the taxpayer must be the owner or lessee of the property where the improvements were made. It is essential to review the detailed eligibility requirements outlined by the state tax authority to ensure compliance and maximize the potential tax benefits.

Required Documents

When submitting the RPD 41329, it is crucial to include all required documents that validate your claim. These documents typically include:

- Receipts and invoices for materials and labor used in the sustainable building project.

- Contracts or agreements with contractors or service providers involved in the improvements.

- Any additional documentation that demonstrates compliance with sustainability standards.

Ensuring that all required documents are included will help facilitate a smoother review process by the tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the RPD 41329 are critical to ensure that taxpayers do not miss out on potential tax credits. Typically, the form must be submitted by a specific date following the end of the tax year in which the improvements were made. It is advisable to check the state tax authority's website or contact them directly for the exact deadlines and any updates that may affect the submission timeline.

Quick guide on how to complete rpd 41329 sustainable building tax credit claim form

Complete RPD 41329 Sustainable Building Tax Credit Claim Form seamlessly on any device

Online document administration has gained traction among both businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can acquire the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle RPD 41329 Sustainable Building Tax Credit Claim Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The most efficient way to alter and eSign RPD 41329 Sustainable Building Tax Credit Claim Form effortlessly

- Find RPD 41329 Sustainable Building Tax Credit Claim Form and click Get Form to commence.

- Utilize the tools we provide to finalize your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses your requirements in document management with just a few clicks from any device you prefer. Edit and eSign RPD 41329 Sustainable Building Tax Credit Claim Form and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rpd 41329 sustainable building tax credit claim form

Create this form in 5 minutes!

How to create an eSignature for the rpd 41329 sustainable building tax credit claim form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RPD 41329 Sustainable Building Tax Credit Claim Form?

The RPD 41329 Sustainable Building Tax Credit Claim Form is a document used to apply for tax credits related to sustainable building practices. This form helps businesses and individuals claim benefits for energy-efficient improvements made to their properties. Understanding how to properly fill out this form can maximize your tax savings.

-

How can airSlate SignNow assist with the RPD 41329 Sustainable Building Tax Credit Claim Form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the RPD 41329 Sustainable Building Tax Credit Claim Form. Our solution streamlines the process, ensuring that your documents are securely signed and submitted on time. This efficiency can help you focus on your sustainable building projects.

-

What are the pricing options for using airSlate SignNow for the RPD 41329 Sustainable Building Tax Credit Claim Form?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and teams. You can choose a plan that fits your budget while ensuring you have access to all the necessary features for managing the RPD 41329 Sustainable Building Tax Credit Claim Form. Check our website for the latest pricing details.

-

What features does airSlate SignNow offer for the RPD 41329 Sustainable Building Tax Credit Claim Form?

With airSlate SignNow, you can easily create, edit, and send the RPD 41329 Sustainable Building Tax Credit Claim Form. Our platform includes features like templates, automated reminders, and secure cloud storage, making it simple to manage your documents efficiently. These features enhance your workflow and ensure compliance.

-

Are there any benefits to using airSlate SignNow for the RPD 41329 Sustainable Building Tax Credit Claim Form?

Using airSlate SignNow for the RPD 41329 Sustainable Building Tax Credit Claim Form offers numerous benefits, including time savings and increased accuracy. Our platform reduces the risk of errors and ensures that your forms are completed correctly. Additionally, you can track the status of your submissions in real-time.

-

Can I integrate airSlate SignNow with other tools for the RPD 41329 Sustainable Building Tax Credit Claim Form?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to enhance your workflow when handling the RPD 41329 Sustainable Building Tax Credit Claim Form. Whether you use CRM systems, project management tools, or cloud storage services, our integrations help streamline your document management process.

-

Is airSlate SignNow secure for handling the RPD 41329 Sustainable Building Tax Credit Claim Form?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your RPD 41329 Sustainable Building Tax Credit Claim Form and other documents are protected. We use advanced encryption and secure storage solutions to safeguard your sensitive information, giving you peace of mind while you manage your documents.

Get more for RPD 41329 Sustainable Building Tax Credit Claim Form

- 2019 2020 independent under 24 montclair state university form

- Template for submission to purdue security and risk form

- Head startearly head start eligibility verification region10 form

- Imperial community college district disciplinary action form

- Statement of work template form

- Financial aid office 5100 sierra college blvd form

- Dependent verification form usc aiken

- Office of financial aid 471 university parkway aiken sc 29801 8036413476 fax 8036436840 email stuaid usca web usca form

Find out other RPD 41329 Sustainable Building Tax Credit Claim Form

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF