Pit Rc New Mexico Rebate Credit 2013

What is the Pit Rc New Mexico Rebate Credit

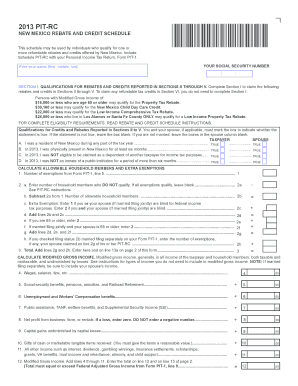

The 2016 Pit Rc New Mexico Rebate Credit is a tax benefit designed to provide financial relief to eligible residents of New Mexico. This rebate is available to individuals who meet specific income criteria and have filed their state income tax returns. The purpose of the rebate is to help offset the costs of living and to support low- to moderate-income households within the state.

Eligibility Criteria

To qualify for the Pit Rc New Mexico Rebate Credit, applicants must meet certain eligibility requirements. These typically include:

- Being a resident of New Mexico for the entire tax year.

- Filing a New Mexico personal income tax return.

- Meeting specific income thresholds set by the state.

It is essential to review the latest guidelines from the New Mexico Taxation and Revenue Department to ensure compliance with all eligibility criteria.

Steps to Complete the Pit Rc New Mexico Rebate Credit

Completing the Pit Rc New Mexico Rebate Credit involves several steps:

- Gather necessary documents, including your New Mexico income tax return and proof of residency.

- Determine your eligibility based on income requirements.

- Fill out the appropriate sections on your New Mexico tax return related to the rebate credit.

- Submit your tax return by the designated filing deadline.

Following these steps will help ensure that you properly apply for the rebate credit.

Required Documents

When applying for the Pit Rc New Mexico Rebate Credit, you need to provide specific documents to support your application. These documents may include:

- Your completed New Mexico personal income tax return.

- Proof of income, such as W-2 forms or 1099 statements.

- Identification documents to verify residency.

Having these documents ready will streamline the application process and help avoid delays.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Pit Rc New Mexico Rebate Credit. Typically, the deadline for submitting your New Mexico income tax return is April fifteenth. However, specific dates may vary, so it is advisable to check the New Mexico Taxation and Revenue Department's website for the most current information.

How to Obtain the Pit Rc New Mexico Rebate Credit

To obtain the Pit Rc New Mexico Rebate Credit, individuals must complete their New Mexico income tax return and indicate their eligibility for the rebate credit. This can be done through various methods, including online tax filing services or by mailing a paper return. Ensure that you follow all instructions carefully to maximize your chances of receiving the rebate.

Create this form in 5 minutes or less

Find and fill out the correct pit rc new mexico rebate credit

Create this form in 5 minutes!

How to create an eSignature for the pit rc new mexico rebate credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2016 PIT RC New Mexico rebate credit?

The 2016 PIT RC New Mexico rebate credit is a tax credit designed to provide financial relief to eligible residents in New Mexico. This credit can help reduce your tax liability, making it easier for individuals and families to manage their finances. Understanding this credit is essential for maximizing your tax benefits.

-

How can I apply for the 2016 PIT RC New Mexico rebate credit?

To apply for the 2016 PIT RC New Mexico rebate credit, you need to complete the appropriate tax forms when filing your state income tax return. Ensure that you meet the eligibility requirements and provide all necessary documentation. This process can be simplified with the right tools, such as airSlate SignNow.

-

What are the eligibility requirements for the 2016 PIT RC New Mexico rebate credit?

Eligibility for the 2016 PIT RC New Mexico rebate credit typically includes being a resident of New Mexico and meeting specific income thresholds. It's important to review the guidelines set by the New Mexico Taxation and Revenue Department to ensure you qualify. Consulting with a tax professional can also provide clarity on your eligibility.

-

How does airSlate SignNow help with the 2016 PIT RC New Mexico rebate credit process?

airSlate SignNow streamlines the document signing and submission process, making it easier to manage your tax forms related to the 2016 PIT RC New Mexico rebate credit. With its user-friendly interface, you can quickly eSign necessary documents and ensure they are submitted on time. This efficiency can help you focus on maximizing your tax benefits.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like those related to the 2016 PIT RC New Mexico rebate credit. These tools enhance productivity and ensure that your documents are handled securely and efficiently. This can signNowly reduce the stress associated with tax season.

-

Is airSlate SignNow cost-effective for managing tax documents?

Yes, airSlate SignNow is a cost-effective solution for managing tax documents, including those related to the 2016 PIT RC New Mexico rebate credit. With various pricing plans available, businesses and individuals can choose an option that fits their budget while still accessing powerful features. This affordability makes it an attractive choice for anyone looking to simplify their tax processes.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow can be integrated with various tax preparation software, enhancing your ability to manage documents related to the 2016 PIT RC New Mexico rebate credit. This integration allows for seamless data transfer and document handling, making your tax preparation process more efficient. Check the integration options available to find the best fit for your needs.

Get more for Pit Rc New Mexico Rebate Credit

Find out other Pit Rc New Mexico Rebate Credit

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online