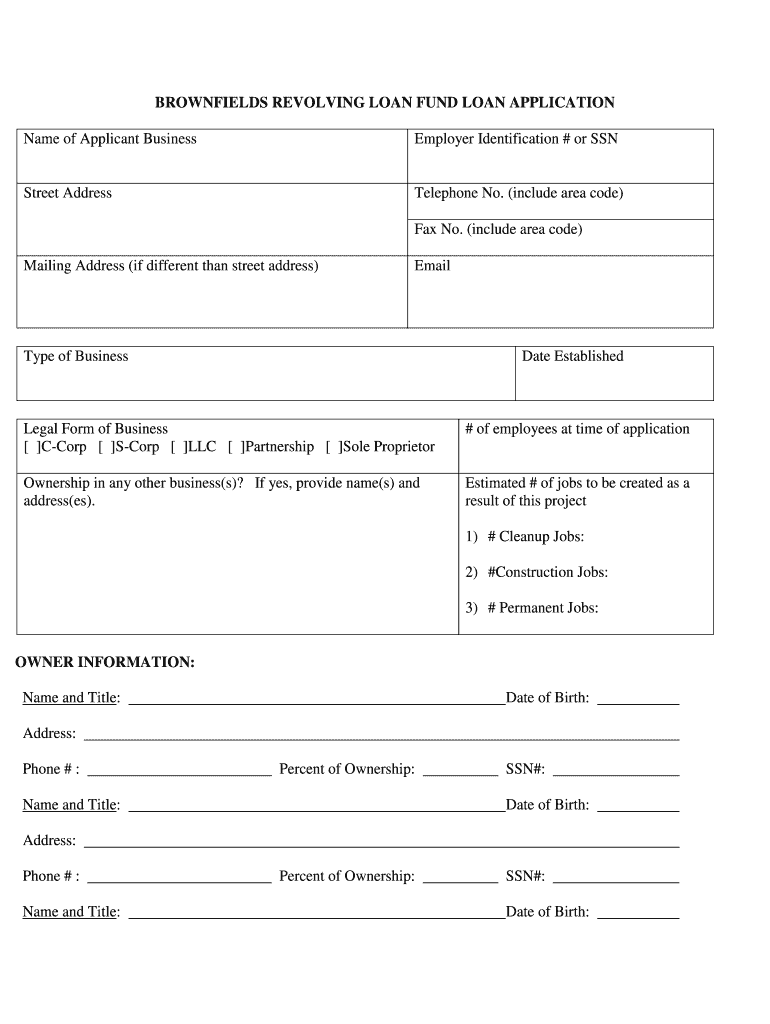

BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION Form

What is the Brownfields Revolving Loan Fund Loan Application

The Brownfields Revolving Loan Fund Loan Application is a formal request used by businesses and organizations seeking financial assistance to clean up contaminated properties known as brownfields. These sites often pose environmental hazards and can hinder economic development. The application is part of a program designed to provide low-interest loans to facilitate the assessment and remediation of these properties, ultimately transforming them into viable spaces for redevelopment.

Key Elements of the Brownfields Revolving Loan Fund Loan Application

When completing the Brownfields Revolving Loan Fund Loan Application, several key elements must be included to ensure a comprehensive submission. These elements typically encompass:

- Project Description: A detailed overview of the site, including its history, current condition, and the proposed cleanup activities.

- Financial Information: Documentation of the applicant's financial status, including income statements and balance sheets, to demonstrate the ability to repay the loan.

- Environmental Assessment: Results from environmental assessments that identify contaminants and outline necessary remediation strategies.

- Community Benefits: An explanation of how the project will benefit the local community, such as job creation or improved public health.

Steps to Complete the Brownfields Revolving Loan Fund Loan Application

Completing the Brownfields Revolving Loan Fund Loan Application involves a series of steps to ensure accuracy and compliance. The process generally includes:

- Gather Required Documents: Collect all necessary documents, including financial records and environmental assessments.

- Fill Out the Application Form: Carefully complete the application form, ensuring all sections are filled out accurately.

- Review and Edit: Review the application for any errors or omissions. It may be beneficial to have a colleague or advisor provide feedback.

- Submit the Application: Submit the completed application along with all required documentation through the designated submission method.

Eligibility Criteria for the Brownfields Revolving Loan Fund Loan Application

To qualify for the Brownfields Revolving Loan Fund Loan, applicants must meet specific eligibility criteria. These typically include:

- Location: The property must be located in a designated brownfield area as defined by local or state authorities.

- Ownership: The applicant must have legal ownership or control of the property in question.

- Financial Viability: Applicants must demonstrate financial stability and the ability to repay the loan.

- Project Feasibility: The proposed cleanup project must be feasible and supported by a sound remediation plan.

How to Obtain the Brownfields Revolving Loan Fund Loan Application

The Brownfields Revolving Loan Fund Loan Application can typically be obtained through state or local environmental agencies that administer the program. Applicants may access the form via the agency's website or by contacting their office directly. It is essential to ensure that the most current version of the application is used to avoid any potential issues during submission.

Form Submission Methods

Applicants can submit the Brownfields Revolving Loan Fund Loan Application through various methods, depending on the guidelines set by the administering agency. Common submission methods include:

- Online Submission: Many agencies offer an online portal for electronic submission of applications.

- Mail Submission: Applicants may also send a printed copy of the application and supporting documents via postal service.

- In-Person Submission: Some applicants may prefer to deliver their application directly to the agency's office for confirmation of receipt.

Quick guide on how to complete brownfields revolving loan fund loan application

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize essential sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and electronically sign [SKS] and ensure excellent communication at every stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION

Create this form in 5 minutes!

How to create an eSignature for the brownfields revolving loan fund loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION?

The BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION is a financial tool designed to assist businesses in funding the cleanup and redevelopment of brownfield sites. This application streamlines the process of obtaining loans specifically for environmental remediation projects, making it easier for businesses to access necessary funds.

-

How can I apply for the BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION?

To apply for the BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION, you can visit our website and fill out the online application form. Ensure you have all required documentation ready, as this will expedite the review process and help you secure funding more quickly.

-

What are the eligibility requirements for the BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION?

Eligibility for the BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION typically includes being a business entity with a project focused on brownfield redevelopment. Additional criteria may apply, so it's important to review the specific requirements outlined on our website before applying.

-

What are the benefits of using the BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION?

The BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION offers several benefits, including access to low-interest loans and flexible repayment terms. This funding can signNowly reduce the financial burden on businesses looking to rehabilitate contaminated properties and promote community revitalization.

-

Are there any fees associated with the BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION?

While the BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION is designed to be cost-effective, there may be nominal fees associated with the application process. It's advisable to review the fee structure on our website or contact our support team for detailed information.

-

How long does it take to process the BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION?

The processing time for the BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION can vary based on the completeness of your application and documentation. Generally, you can expect a response within a few weeks, but we encourage applicants to submit all required materials to expedite the process.

-

Can the BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION be integrated with other financial tools?

Yes, the BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION can be integrated with various financial management tools to streamline your funding process. This integration allows for better tracking of loan usage and financial reporting, enhancing your overall project management.

Get more for BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION

Find out other BROWNFIELDS REVOLVING LOAN FUND LOAN APPLICATION

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement