Form 700SchC 2023-2026

What is the Form 700SchC

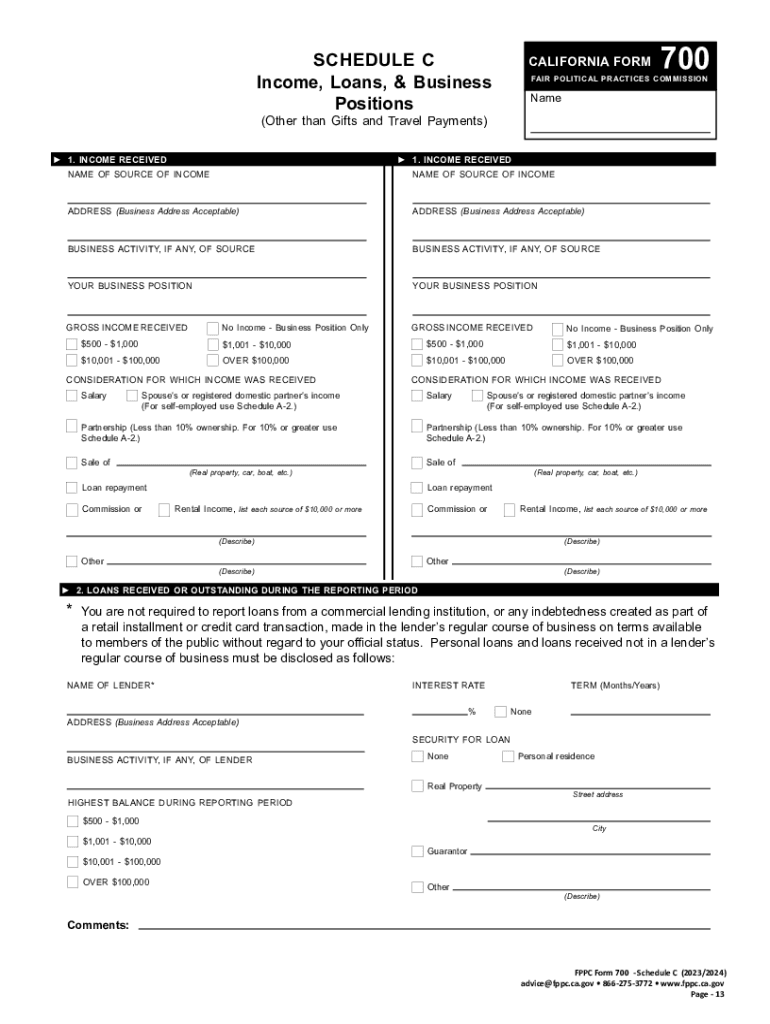

The Form 700SchC is a tax form used in the United States for reporting income and expenses related to business activities. It is typically filed by self-employed individuals or sole proprietors to detail their business earnings and deductions. This form is an integral part of the tax return process, allowing taxpayers to accurately report their financial activities to the Internal Revenue Service (IRS).

How to use the Form 700SchC

Using the Form 700SchC involves several steps to ensure accurate reporting of business income and expenses. Taxpayers must first gather all relevant financial documents, including income statements, receipts for expenses, and any other supporting materials. Once the necessary information is compiled, individuals can begin filling out the form, ensuring to categorize income and expenses correctly. After completion, the form should be attached to the main tax return and submitted to the IRS.

Steps to complete the Form 700SchC

Completing the Form 700SchC requires careful attention to detail. Here are the essential steps:

- Gather all financial documents related to your business.

- Fill out your business name and address at the top of the form.

- Report your total income from all business activities.

- List all deductible expenses, ensuring they are categorized correctly.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Review the form for accuracy before submission.

Key elements of the Form 700SchC

Several key elements are crucial when filling out the Form 700SchC. These include:

- Business Information: This section requires the name and address of the business.

- Income Reporting: Taxpayers must detail all forms of income generated by the business.

- Expense Categories: Expenses should be categorized into specific types, such as advertising, utilities, and supplies.

- Net Profit or Loss Calculation: This final figure determines the taxable income from the business.

Filing Deadlines / Important Dates

Filing deadlines for the Form 700SchC align with the general tax return deadlines. Typically, the form must be submitted by April fifteenth of each year for the preceding tax year. If additional time is needed, taxpayers can apply for an extension, but it is essential to ensure that any taxes owed are paid by the original deadline to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 700SchC. Taxpayers should refer to the IRS instructions for the form, which outline acceptable expense categories, documentation requirements, and any updates to regulations. Adhering to these guidelines is critical for compliance and to avoid potential audits or penalties.

Quick guide on how to complete form 700schc

Complete Form 700SchC effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the correct form and store it securely online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage Form 700SchC on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to modify and electronically sign Form 700SchC with ease

- Obtain Form 700SchC and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Don’t worry about lost or misplaced documents, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 700SchC and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 700schc

Create this form in 5 minutes!

How to create an eSignature for the form 700schc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 700SchC and how can airSlate SignNow help?

Form 700SchC is a tax form used for reporting income and expenses for sole proprietorships. airSlate SignNow simplifies the process of completing and eSigning Form 700SchC by providing an intuitive platform that allows users to fill out and send documents securely and efficiently.

-

How much does it cost to use airSlate SignNow for Form 700SchC?

airSlate SignNow offers various pricing plans to accommodate different business needs. Users can choose from monthly or annual subscriptions, with options that provide access to features specifically designed for managing documents like Form 700SchC at a cost-effective rate.

-

What features does airSlate SignNow offer for managing Form 700SchC?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These tools streamline the process of preparing and submitting Form 700SchC, ensuring that users can manage their documents efficiently.

-

Can I integrate airSlate SignNow with other software for Form 700SchC?

Yes, airSlate SignNow offers seamless integrations with various applications, including CRM and accounting software. This allows users to easily import data and manage their Form 700SchC alongside other business processes, enhancing overall productivity.

-

Is airSlate SignNow secure for handling sensitive information on Form 700SchC?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Users can confidently handle sensitive information related to Form 700SchC, knowing that their data is protected throughout the signing process.

-

How does airSlate SignNow improve the efficiency of submitting Form 700SchC?

By utilizing airSlate SignNow, users can eliminate the need for printing, scanning, and mailing documents. The platform allows for quick eSigning and instant delivery of Form 700SchC, signNowly reducing the time spent on document management.

-

What support options are available for users of airSlate SignNow when dealing with Form 700SchC?

airSlate SignNow provides comprehensive customer support, including live chat, email assistance, and a detailed knowledge base. Users can easily find help with any questions or issues related to Form 700SchC, ensuring a smooth experience.

Get more for Form 700SchC

- English for marketing pdf form

- Print 1095 a from marketplace form

- Brazos county homestead exemption form

- Dhs release of information form

- Annual tb screening questionnaire form

- Application for temporary disconnection of electricity connection form

- Iep at a glance template form

- Mandibular function impairment questionnaire form

Find out other Form 700SchC

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast