Form MI 1040CR 7 Michigan Home Heating Credit Claim 2023-2026

Understanding the 5713 Form

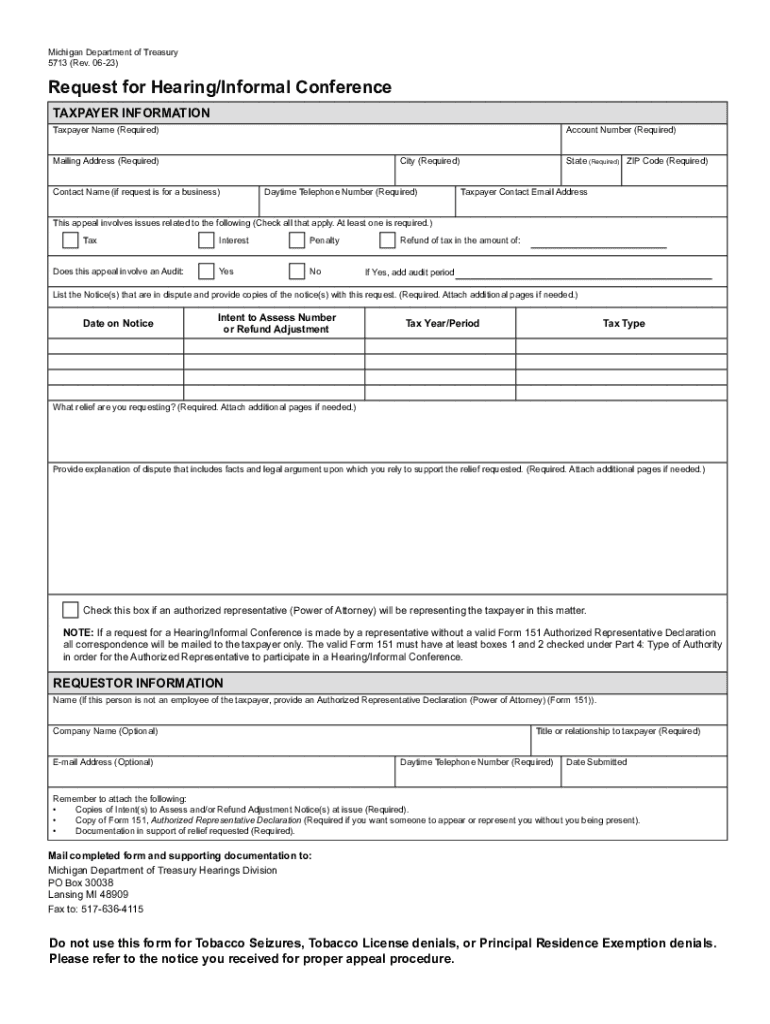

The 5713 form, also known as the 5713 request, is a document used primarily in Michigan for submitting a request for an informal conference. This form is essential for taxpayers who wish to appeal decisions made by the Michigan Department of Treasury regarding property assessments or tax disputes. The purpose of the form is to facilitate communication between the taxpayer and the department, allowing for a more streamlined resolution process.

Steps to Complete the 5713 Form

Completing the 5713 form requires careful attention to detail to ensure all necessary information is provided. Here are the steps to follow:

- Download the Form: Access the 5713 form download from the official Michigan Department of Treasury website.

- Fill in Personal Information: Include your name, address, and contact information at the top of the form.

- Provide Tax Information: Enter relevant details about your property, including the property tax identification number and the assessed value.

- State Your Case: Clearly outline the reasons for your request for an informal conference, providing any supporting documentation if necessary.

- Review and Sign: Ensure all information is accurate, then sign and date the form before submission.

Obtaining the 5713 Form

The 5713 form can be easily obtained through a few different methods. The most straightforward way is to download it directly from the Michigan Department of Treasury's website. Alternatively, you can request a physical copy by contacting their office. It is advisable to ensure you have the most current version of the form to avoid any issues during the submission process.

Eligibility Criteria for the 5713 Form

To be eligible to submit the 5713 form, taxpayers must meet certain criteria. Primarily, the form is intended for individuals who have received a property tax assessment from the Michigan Department of Treasury that they believe is incorrect. Additionally, the request for an informal conference must be made within a specific timeframe following the receipt of the assessment notice, typically within a designated number of days. It is important to review the eligibility requirements to ensure compliance.

Legal Use of the 5713 Form

The 5713 form serves a legal purpose in the context of property tax assessments in Michigan. By submitting this form, taxpayers formally request an informal conference to discuss their tax assessment with the Michigan Department of Treasury. This process is part of the legal framework that allows taxpayers to appeal decisions made by tax authorities, ensuring that they have a fair opportunity to present their case and seek resolution.

Filing Deadlines for the 5713 Form

Timeliness is crucial when submitting the 5713 form. Taxpayers must adhere to specific filing deadlines to ensure their request for an informal conference is considered. Generally, the form must be submitted within a certain number of days from the date of the property tax assessment notice. It is advisable to check the exact deadlines for the current tax year to avoid missing the opportunity to appeal.

Quick guide on how to complete form mi 1040cr 7 michigan home heating credit claim

Complete Form MI 1040CR 7 Michigan Home Heating Credit Claim seamlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the right form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Handle Form MI 1040CR 7 Michigan Home Heating Credit Claim on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and eSign Form MI 1040CR 7 Michigan Home Heating Credit Claim effortlessly

- Locate Form MI 1040CR 7 Michigan Home Heating Credit Claim and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choice. Edit and eSign Form MI 1040CR 7 Michigan Home Heating Credit Claim while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mi 1040cr 7 michigan home heating credit claim

Create this form in 5 minutes!

How to create an eSignature for the form mi 1040cr 7 michigan home heating credit claim

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5713 form download and why is it important?

The 5713 form download is a crucial document for businesses that need to report specific financial information. It ensures compliance with regulatory requirements and helps maintain accurate records. By using airSlate SignNow, you can easily download and manage this form, streamlining your documentation process.

-

How can I access the 5713 form download through airSlate SignNow?

To access the 5713 form download, simply log into your airSlate SignNow account and navigate to the document library. You can search for the form by name or category, making it easy to find and download. Our platform is designed for user-friendliness, ensuring you can get the documents you need quickly.

-

Is there a cost associated with the 5713 form download?

The 5713 form download is included in your airSlate SignNow subscription, which offers various pricing plans to fit your business needs. We provide a cost-effective solution that allows unlimited access to essential forms and eSigning capabilities. Check our pricing page for more details on plans and features.

-

What features does airSlate SignNow offer for managing the 5713 form download?

airSlate SignNow offers a range of features for managing the 5713 form download, including eSigning, document sharing, and secure storage. You can easily collaborate with team members and track the status of your documents in real-time. Our platform enhances productivity and ensures your forms are always accessible.

-

Can I integrate airSlate SignNow with other applications for the 5713 form download?

Yes, airSlate SignNow supports integrations with various applications, allowing you to streamline your workflow when handling the 5713 form download. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to enhance your document management process. This integration capability helps you work more efficiently.

-

What are the benefits of using airSlate SignNow for the 5713 form download?

Using airSlate SignNow for the 5713 form download provides numerous benefits, including time savings, enhanced security, and improved compliance. Our platform simplifies the eSigning process, allowing you to complete transactions faster. Additionally, your documents are securely stored and easily retrievable whenever needed.

-

Is the 5713 form download available for mobile users?

Absolutely! The 5713 form download is accessible via the airSlate SignNow mobile app, allowing you to manage your documents on the go. Whether you're in the office or out in the field, you can easily download, sign, and share forms from your mobile device. This flexibility enhances your productivity.

Get more for Form MI 1040CR 7 Michigan Home Heating Credit Claim

- Texas pay rent form

- Texas vacate form

- 30 day notice to terminate month to month lease residential from landlord to tenant texas form

- Notice terminate lease form

- 30 day notice to terminate month to month lease for residential from tenant to landlord texas form

- Notice terminate form

- Texas rent pay form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497327591 form

Find out other Form MI 1040CR 7 Michigan Home Heating Credit Claim

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors