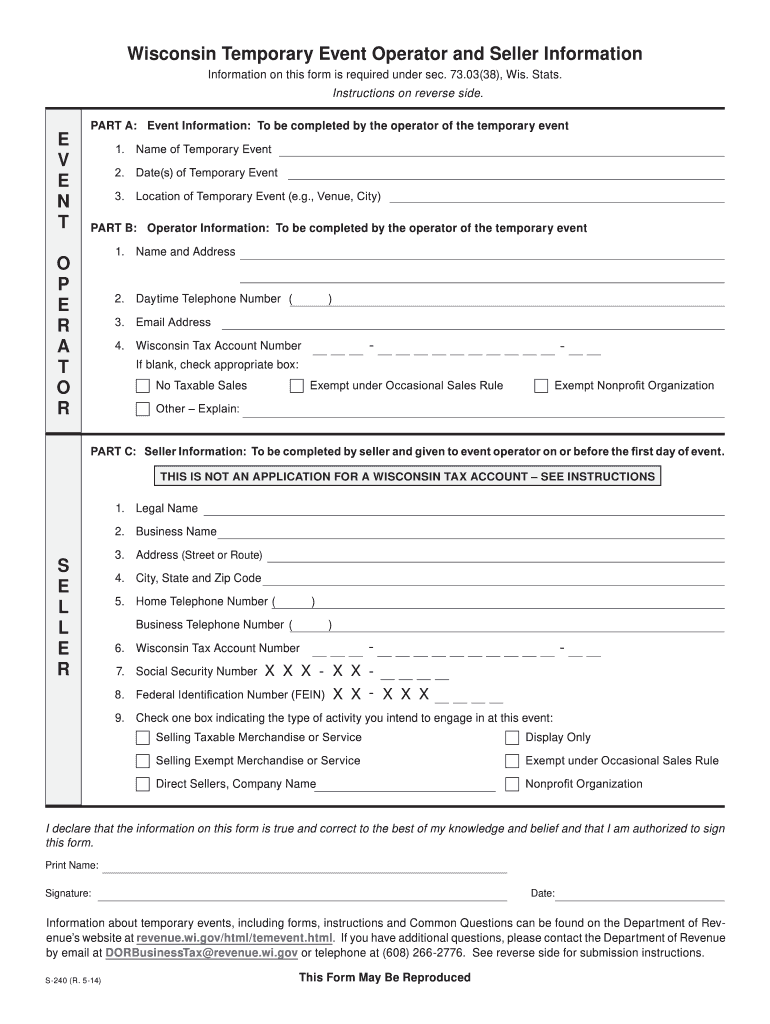

Wisconsin Department of Revenue Form 240 2014

What is the Wisconsin Department Of Revenue Form 240

The Wisconsin Department of Revenue Form 240 is a tax form used primarily for reporting various types of income, deductions, and credits for individuals and businesses within the state. This form is essential for ensuring compliance with state tax laws and for accurately calculating tax liabilities. It is particularly relevant for those who have specific tax situations that require detailed reporting, such as self-employed individuals or those claiming certain tax credits.

Steps to complete the Wisconsin Department Of Revenue Form 240

Completing the Wisconsin Department of Revenue Form 240 involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements, receipts for deductions, and any relevant tax forms from previous years. Next, carefully read the instructions provided with the form to understand the requirements for each section. Fill out the form methodically, ensuring all information is accurate and complete. After completing the form, review it for any errors or omissions before submitting it to the Wisconsin Department of Revenue.

How to obtain the Wisconsin Department Of Revenue Form 240

The Wisconsin Department of Revenue Form 240 can be obtained directly from the Wisconsin Department of Revenue's official website. The form is typically available for download in PDF format, allowing users to print it for completion. Additionally, individuals may request a physical copy of the form by contacting the department's customer service or visiting a local office. It is advisable to ensure that you are using the most current version of the form to avoid any issues with filing.

Legal use of the Wisconsin Department Of Revenue Form 240

The legal use of the Wisconsin Department of Revenue Form 240 is governed by state tax laws and regulations. To ensure that the form is legally binding, it must be completed accurately and submitted by the designated deadlines. Additionally, electronic signatures are acceptable if using a compliant eSignature platform, which can enhance the security and validity of the submission. Understanding the legal implications of the information provided on the form is crucial for avoiding penalties or audits from the state.

Form Submission Methods (Online / Mail / In-Person)

The Wisconsin Department of Revenue Form 240 can be submitted through various methods, providing flexibility for taxpayers. It can be filed online through the department's e-filing system, which is often the fastest option. Alternatively, individuals can mail the completed form to the appropriate address specified in the instructions. For those who prefer in-person submissions, visiting a local Wisconsin Department of Revenue office is also an option. Each method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin Department of Revenue Form 240 are critical for compliance. Typically, the form must be submitted by April 15 for individual tax returns, aligning with federal tax deadlines. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing situations. It is essential to stay informed about any changes to these deadlines to avoid late fees or penalties.

Quick guide on how to complete wisconsin department of revenue form 240 2014

Effortlessly prepare Wisconsin Department Of Revenue Form 240 on any device

Managing documents online has become favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly, without delays. Handle Wisconsin Department Of Revenue Form 240 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

Easily modify and eSign Wisconsin Department Of Revenue Form 240 without difficulty

- Obtain Wisconsin Department Of Revenue Form 240 and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or redact sensitive details using tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature with the Sign function, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors necessitating new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Modify and eSign Wisconsin Department Of Revenue Form 240 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin department of revenue form 240 2014

Create this form in 5 minutes!

How to create an eSignature for the wisconsin department of revenue form 240 2014

How to generate an eSignature for your Wisconsin Department Of Revenue Form 240 2014 in the online mode

How to make an eSignature for the Wisconsin Department Of Revenue Form 240 2014 in Google Chrome

How to generate an eSignature for putting it on the Wisconsin Department Of Revenue Form 240 2014 in Gmail

How to generate an eSignature for the Wisconsin Department Of Revenue Form 240 2014 from your mobile device

How to generate an eSignature for the Wisconsin Department Of Revenue Form 240 2014 on iOS

How to generate an eSignature for the Wisconsin Department Of Revenue Form 240 2014 on Android OS

People also ask

-

What is the Wisconsin Department Of Revenue Form 240?

The Wisconsin Department Of Revenue Form 240 is a tax form used for purposes such as claiming a credit for taxes paid to other states. This form is essential for ensuring compliance with Wisconsin tax laws and allows taxpayers to accurately report their financial information.

-

How can airSlate SignNow help me with the Wisconsin Department Of Revenue Form 240?

airSlate SignNow allows users to easily upload, edit, and eSign the Wisconsin Department Of Revenue Form 240, streamlining the entire process. With our user-friendly interface, you can complete your tax forms quickly and securely.

-

Is there a cost associated with using airSlate SignNow for the Wisconsin Department Of Revenue Form 240?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Whether you're an individual or a large organization, you can choose a plan that fits your budget while ensuring seamless eSigning of the Wisconsin Department Of Revenue Form 240.

-

What features does airSlate SignNow offer for completing the Wisconsin Department Of Revenue Form 240?

AirSlate SignNow provides features such as customizable templates, cloud storage integration, and mobile access to facilitate the filling and signing of the Wisconsin Department Of Revenue Form 240. These features enhance productivity and ensure that you can manage your documents from anywhere.

-

Are there any benefits to using airSlate SignNow for the Wisconsin Department Of Revenue Form 240?

Using airSlate SignNow to manage the Wisconsin Department Of Revenue Form 240 signNowly reduces the time spent on paperwork, offering a more efficient solution. Additionally, our platform ensures the security of your documents while maintaining compliance with legal standards.

-

Can I integrate airSlate SignNow with other software to manage the Wisconsin Department Of Revenue Form 240?

Absolutely! airSlate SignNow offers integrations with various third-party applications that make managing the Wisconsin Department Of Revenue Form 240 more efficient. This enables users to streamline their workflow and reduce errors associated with manual data entry.

-

How secure is airSlate SignNow when handling the Wisconsin Department Of Revenue Form 240?

AirSlate SignNow prioritizes customer security and employs industry-standard encryption protocols to protect your documents, including the Wisconsin Department Of Revenue Form 240. You can trust that your sensitive financial information remains safe and confidential.

Get more for Wisconsin Department Of Revenue Form 240

- Contract to buy and sell residential clean form

- Application for replacement naturalizationcitizen form

- Combinable crops passport version 0221 issued 2 form

- Www uscourts govservices formsfeesu s court of federal claims fee scheduleunited states courts

- Order for ignition interlock exemptions and removing title form

- Mentoring questionnaire pdf form

- Sample employment contract agreement form

- Pmk form

Find out other Wisconsin Department Of Revenue Form 240

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter