Wisconsin Department of Revenue Form 240 2019

What is the Wisconsin Department Of Revenue Form 240

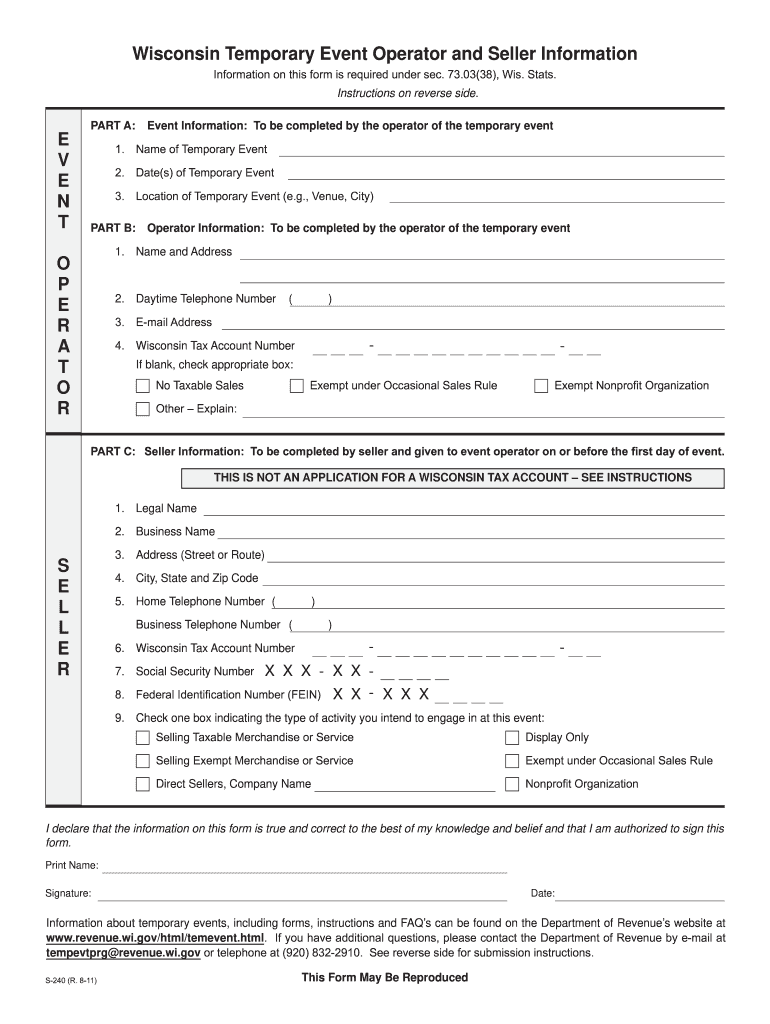

The Wisconsin Department Of Revenue Form 240 is a tax form used primarily for reporting income and calculating tax liabilities for individuals and businesses operating in Wisconsin. This form is essential for ensuring compliance with state tax regulations and is often required for various tax-related processes. It serves as a formal declaration of income, deductions, and credits, allowing taxpayers to accurately report their financial activities to the state.

How to use the Wisconsin Department Of Revenue Form 240

Using the Wisconsin Department Of Revenue Form 240 involves several key steps. First, gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax credits. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is crucial to follow the instructions provided with the form to avoid errors that could lead to penalties. Once completed, the form can be submitted either electronically or by mail, depending on your preference and the specific requirements of the Wisconsin Department of Revenue.

Steps to complete the Wisconsin Department Of Revenue Form 240

Completing the Wisconsin Department Of Revenue Form 240 requires attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including W-2s, 1099s, and receipts.

- Begin filling out the form with your personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include wages, interest, and any business income.

- List applicable deductions and credits, following the guidelines provided in the instructions.

- Review the completed form for accuracy before submission.

- Submit the form electronically through the Wisconsin Department of Revenue website or mail it to the designated address.

Legal use of the Wisconsin Department Of Revenue Form 240

The Wisconsin Department Of Revenue Form 240 is legally binding when filled out and submitted according to state regulations. To ensure its legal standing, it is essential to provide accurate information and comply with all filing requirements. Failure to do so may result in penalties or legal repercussions. Additionally, using a secure platform for electronic submission can enhance the legal validity of the form by ensuring compliance with eSignature regulations.

Key elements of the Wisconsin Department Of Revenue Form 240

Key elements of the Wisconsin Department Of Revenue Form 240 include:

- Personal identification information, such as name and Social Security number.

- Detailed reporting of income from various sources.

- Sections for claiming deductions and tax credits.

- Signature line for verification of the information provided.

- Instructions for submission and any additional documentation required.

Form Submission Methods

The Wisconsin Department Of Revenue Form 240 can be submitted through various methods. Taxpayers have the option to file electronically via the Wisconsin Department of Revenue's online portal, which is often the fastest and most efficient method. Alternatively, the form can be printed and mailed to the appropriate address. In-person submissions may also be possible at designated state offices, providing additional options for taxpayers who prefer face-to-face interactions.

Quick guide on how to complete wisconsin department of revenue form 240 2011

Effortlessly prepare Wisconsin Department Of Revenue Form 240 on any device

Digital document management has gained traction among businesses and individuals. It serves as a superb environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the proper format and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, edit, and electronically sign your documents swiftly without delays. Manage Wisconsin Department Of Revenue Form 240 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Wisconsin Department Of Revenue Form 240 effortlessly

- Find Wisconsin Department Of Revenue Form 240 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Wisconsin Department Of Revenue Form 240 and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin department of revenue form 240 2011

Create this form in 5 minutes!

How to create an eSignature for the wisconsin department of revenue form 240 2011

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Wisconsin Department Of Revenue Form 240 used for?

The Wisconsin Department Of Revenue Form 240 is used for reporting specific tax information to the state. It's essential for ensuring compliance with Wisconsin tax laws. Properly filling out this form can help avoid penalties and streamline your tax reporting process.

-

How can I complete the Wisconsin Department Of Revenue Form 240 electronically?

You can complete the Wisconsin Department Of Revenue Form 240 electronically using airSlate SignNow. Our platform allows you to easily fill out and eSign the form, ensuring a smooth and straightforward submission process. Take advantage of our user-friendly interface to save time and reduce errors.

-

Are there any costs associated with using airSlate SignNow for the Wisconsin Department Of Revenue Form 240?

Yes, while airSlate SignNow offers a cost-effective solution, there may be subscription fees depending on your plan. We provide various pricing tiers to suit different business needs. Consider the value of efficient document management when evaluating costs associated with the Wisconsin Department Of Revenue Form 240.

-

What features does airSlate SignNow offer for the Wisconsin Department Of Revenue Form 240?

airSlate SignNow provides robust features for the Wisconsin Department Of Revenue Form 240, including customizable templates, secure eSigning, and document tracking. These tools simplify the process and ensure that your forms are signed and submitted accurately. With our solutions, manage your tax documents with confidence.

-

Can airSlate SignNow help with filing deadlines for the Wisconsin Department Of Revenue Form 240?

Absolutely! airSlate SignNow helps you stay organized and aware of key filing deadlines for the Wisconsin Department Of Revenue Form 240. You can set reminders and track your document status to ensure timely submission. Staying on top of your deadlines is crucial to avoid late fees and compliance issues.

-

Does airSlate SignNow integrate with other accounting software for the Wisconsin Department Of Revenue Form 240?

Yes, airSlate SignNow offers integrations with various accounting software, facilitating a seamless workflow for the Wisconsin Department Of Revenue Form 240. Our platform can connect with systems like QuickBooks and Xero to streamline your document handling. Simplifying your processes can signNowly enhance efficiency.

-

What benefits does eSigning the Wisconsin Department Of Revenue Form 240 via airSlate SignNow offer?

eSigning the Wisconsin Department Of Revenue Form 240 through airSlate SignNow streamlines the signing process, saving you time and reducing paperwork. With advanced security measures in place, your documents remain protected throughout the process. Additionally, you receive instant notifications once your forms are signed, enhancing your workflow.

Get more for Wisconsin Department Of Revenue Form 240

Find out other Wisconsin Department Of Revenue Form 240

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer