Assets KpmgcontentdamRepublic of the Philippines for BIR BCS Use Only Estate Tax 2021-2026

Understanding the 2118 EA BIR Form

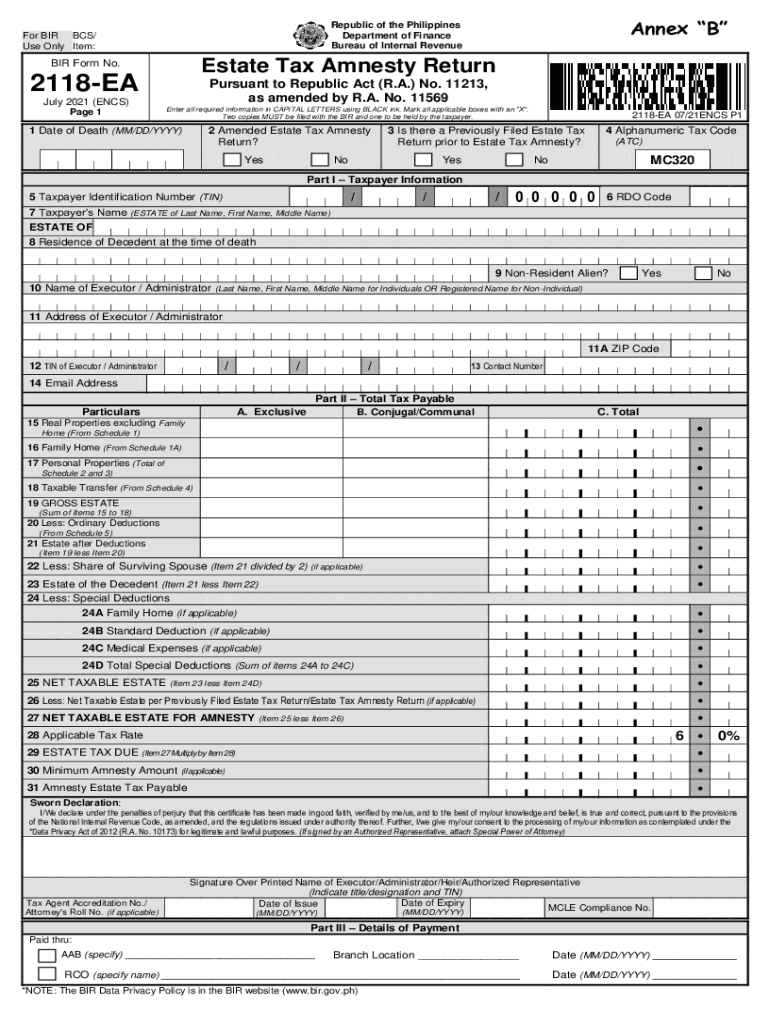

The 2118 EA BIR form is an essential document used in the Philippines for estate tax amnesty purposes. This form allows individuals to declare their estate and settle any estate tax liabilities with the Bureau of Internal Revenue (BIR). It is particularly relevant for those who wish to benefit from the estate tax amnesty program, which provides a chance to settle unpaid estate taxes without penalties.

Steps to Complete the 2118 EA BIR Form

Filling out the 2118 EA BIR form requires careful attention to detail. Here are the steps to complete the form:

- Gather necessary documents, including proof of estate value, identification, and previous tax returns.

- Fill in the personal information section, ensuring accuracy in names, addresses, and identification numbers.

- Detail the assets and liabilities of the estate, providing valuations and descriptions of each item.

- Calculate the total estate tax due based on the current tax rates and exemptions.

- Review the completed form for accuracy before submission.

Required Documents for Filing the 2118 EA BIR Form

When filing the 2118 EA BIR form, specific documents are required to support the information provided. These include:

- Death certificate of the deceased.

- Proof of ownership for all assets listed in the estate.

- Valuation reports or appraisals for real estate and other significant assets.

- Identification documents of the estate administrator or executor.

Filing Deadlines for the 2118 EA BIR Form

It is crucial to be aware of the filing deadlines for the 2118 EA BIR form to avoid penalties. The estate tax amnesty program typically has specific periods during which the form must be submitted. Ensure to check the latest announcements from the BIR for any updates on deadlines.

Legal Use of the 2118 EA BIR Form

The 2118 EA BIR form is legally binding and serves as a declaration of the estate's tax obligations. Properly completing and submitting this form is essential for compliance with Philippine tax laws, and it protects the estate from potential legal issues related to unpaid taxes.

Penalties for Non-Compliance with the 2118 EA BIR Form

Failure to file the 2118 EA BIR form by the deadline or providing inaccurate information can result in penalties. These may include fines and interest on unpaid taxes. Understanding the importance of timely and accurate filing can help mitigate these risks.

Quick guide on how to complete assets kpmgcontentdamrepublic of the philippines for bir bcs use only estate tax

Effortlessly Prepare Assets kpmgcontentdamRepublic Of The Philippines For BIR BCS Use Only Estate Tax on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Assets kpmgcontentdamRepublic Of The Philippines For BIR BCS Use Only Estate Tax on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to Edit and eSign Assets kpmgcontentdamRepublic Of The Philippines For BIR BCS Use Only Estate Tax with Ease

- Locate Assets kpmgcontentdamRepublic Of The Philippines For BIR BCS Use Only Estate Tax and click Get Form to begin.

- Utilize the tools available to complete your form.

- Select important parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Edit and eSign Assets kpmgcontentdamRepublic Of The Philippines For BIR BCS Use Only Estate Tax and maintain effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct assets kpmgcontentdamrepublic of the philippines for bir bcs use only estate tax

Create this form in 5 minutes!

How to create an eSignature for the assets kpmgcontentdamrepublic of the philippines for bir bcs use only estate tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2118 ea bir form excel?

The 2118 ea bir form excel is a digital template designed for easy completion and submission of tax-related documents. It simplifies the process of filling out necessary information, ensuring accuracy and compliance with tax regulations.

-

How can airSlate SignNow help with the 2118 ea bir form excel?

airSlate SignNow allows users to easily upload, fill out, and eSign the 2118 ea bir form excel. This streamlines the document management process, making it more efficient and reducing the risk of errors.

-

Is there a cost associated with using the 2118 ea bir form excel on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to the 2118 ea bir form excel. These plans are designed to be cost-effective, providing businesses with a valuable solution for document management.

-

What features does airSlate SignNow offer for the 2118 ea bir form excel?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and secure cloud storage for the 2118 ea bir form excel. These features enhance user experience and ensure that documents are handled securely.

-

Can I integrate airSlate SignNow with other applications for the 2118 ea bir form excel?

Absolutely! airSlate SignNow offers integrations with various applications, allowing users to seamlessly manage the 2118 ea bir form excel alongside other tools they use. This enhances productivity and streamlines workflows.

-

What are the benefits of using the 2118 ea bir form excel with airSlate SignNow?

Using the 2118 ea bir form excel with airSlate SignNow provides numerous benefits, including time savings, improved accuracy, and enhanced security. It allows businesses to focus on their core activities while ensuring compliance with tax requirements.

-

Is the 2118 ea bir form excel easy to use?

Yes, the 2118 ea bir form excel is designed to be user-friendly. With airSlate SignNow's intuitive interface, users can easily navigate the form, fill it out, and eSign it without any technical expertise.

Get more for Assets kpmgcontentdamRepublic Of The Philippines For BIR BCS Use Only Estate Tax

- Oswestry low back pain disability index questionnaire 042314 form

- Khesari lal fill form

- Hawaii advance health care directive fillable form

- Satisfaction judgment 5370817 form

- Presidential volunteer service award community service log rhumc form

- Msh claim form 448997538

- Pwgsc 2480 form

- Enquiries district hrp annexure f gde 0001 app form

Find out other Assets kpmgcontentdamRepublic Of The Philippines For BIR BCS Use Only Estate Tax

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement