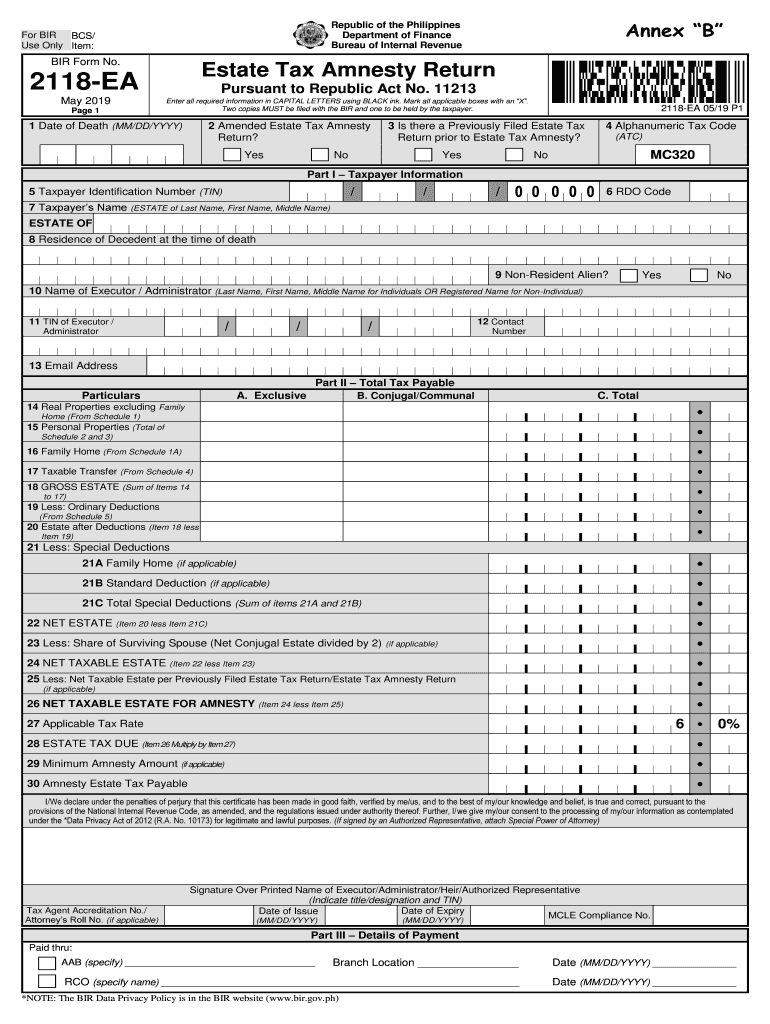

Bir Form 2118 Ea 2019

What is the Bir Form 2118 Ea

The Bir Form 2118 Ea, also known as the estate tax amnesty return form, is a crucial document used in the United States for reporting estate taxes. This form allows individuals or estates to declare their tax liabilities and seek amnesty under specific provisions set forth by tax authorities. It is particularly relevant for estates that may have previously overlooked tax obligations, offering a chance to rectify these matters without facing severe penalties.

How to use the Bir Form 2118 Ea

Using the Bir Form 2118 Ea involves several key steps. First, individuals must gather all necessary information about the estate, including assets, liabilities, and any previous tax filings. Once the information is compiled, the form can be filled out accurately, ensuring that all details are correct to avoid complications. After completing the form, it must be submitted to the appropriate tax authority, either online or through traditional mail, depending on the specific requirements.

Steps to complete the Bir Form 2118 Ea

Completing the Bir Form 2118 Ea requires careful attention to detail. Here are the essential steps:

- Gather all relevant financial documents related to the estate.

- Accurately fill out the form, ensuring all fields are completed.

- Calculate the total estate tax liability based on the provided information.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate tax authority by the designated deadline.

Legal use of the Bir Form 2118 Ea

The legal use of the Bir Form 2118 Ea is governed by specific tax regulations. To be considered valid, the form must be filled out accurately and submitted within the designated time frame. It serves as a declaration of estate tax liabilities and can protect the filer from potential legal repercussions associated with non-compliance. Understanding the legal implications is essential for ensuring that the form is used correctly and effectively.

Required Documents

When preparing to fill out the Bir Form 2118 Ea, certain documents are necessary to support the information provided. These may include:

- Death certificate of the decedent.

- Documentation of all assets, including property and financial accounts.

- Records of any outstanding debts or liabilities.

- Previous tax returns if applicable.

Form Submission Methods

The Bir Form 2118 Ea can be submitted through various methods, depending on the preferences of the filer and the requirements of the tax authority. Common submission methods include:

- Online submission through the tax authority's official portal.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at local tax offices, if available.

Quick guide on how to complete bir form 2118 ea

Complete Bir Form 2118 Ea seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Bir Form 2118 Ea on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Bir Form 2118 Ea with ease

- Find Bir Form 2118 Ea and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to distribute your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require new copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Bir Form 2118 Ea and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bir form 2118 ea

Create this form in 5 minutes!

How to create an eSignature for the bir form 2118 ea

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the bir form 2118 ea and how is it used?

The bir form 2118 ea is a tax document utilized for reporting specific financial transactions. It is essential for compliance with tax regulations and can be easily generated using airSlate SignNow's platform. With our eSigning solutions, you can streamline the completion and submission of the bir form 2118 ea.

-

How can airSlate SignNow help me with the bir form 2118 ea?

airSlate SignNow simplifies the process of managing the bir form 2118 ea by providing an intuitive interface for document creation and eSigning. You can quickly customize the form to meet your needs, ensuring compliance and accuracy in tax reporting. Our platform enhances collaboration and saves you time in managing these vital documents.

-

Is airSlate SignNow cost-effective for handling bir form 2118 ea?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to manage the bir form 2118 ea. Our pricing plans are designed to suit various business sizes, allowing you to access all features without breaking the bank. Additionally, the efficiency gained in processing documents translates into savings on labor costs.

-

What features does airSlate SignNow offer for the bir form 2118 ea?

airSlate SignNow offers a range of features for the bir form 2118 ea, including customizable templates, real-time collaboration, and secure eSigning capabilities. These features ensure that you can efficiently prepare and finalize your documents while maintaining compliance and security. Furthermore, you can track the status of each form for efficient management.

-

Can I integrate airSlate SignNow with other software for the bir form 2118 ea?

Absolutely! airSlate SignNow can integrate seamlessly with various software applications to enhance your workflow for the bir form 2118 ea. Whether you are using CRM systems, cloud storage solutions, or accounting software, our integration options ensure that you can manage documents efficiently across platforms.

-

What benefits does airSlate SignNow provide when using the bir form 2118 ea?

Using airSlate SignNow for the bir form 2118 ea offers several benefits, including increased efficiency, improved document security, and enhanced collaboration. The ability to eSign documents quickly reduces turnaround times and aids in staying compliant with tax regulations. Additionally, you can access your documents anytime, anywhere.

-

How secure is the eSigning process for the bir form 2118 ea with airSlate SignNow?

The eSigning process for the bir form 2118 ea on airSlate SignNow is highly secure, employing advanced encryption and compliance with industry standards. We prioritize safeguarding your sensitive information and ensure that all signatures are legally binding. You can rest assured that your data is protected throughout the process.

Get more for Bir Form 2118 Ea

- Tc 90cb renter refund application circuit breaker forms ampamp publications

- Tc 569a ownership statement forms ampamp publications 625163003

- Zoning use certificate application city of pompano beach form

- Tc 69 utah state business and tax registration form

- Tc 40r utah recycling market development zones tax credit forms ampamp publications

- 2022 utah tc 40 individual income tax return forms ampamp publications

- Revised jee main 2022 dates for april blogbyjuscom form

- Hartford circle offering statementmortgage law form

Find out other Bir Form 2118 Ea

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile