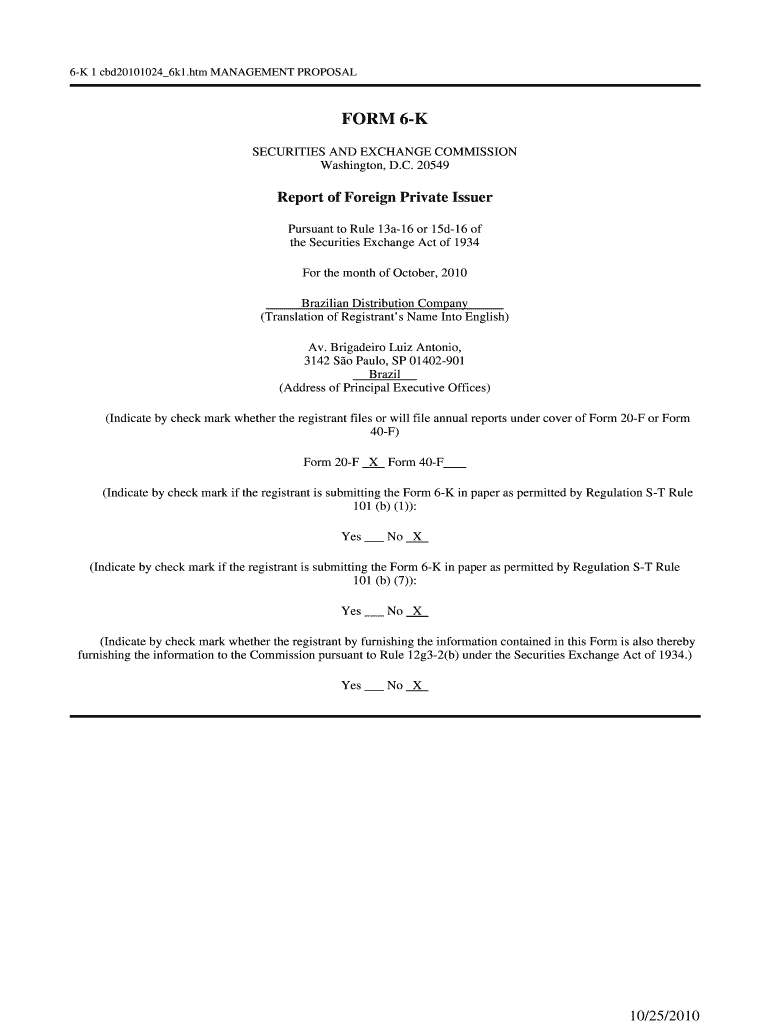

6 K 1 Cbd201010246k1 Form

What is the 6 K 1 Cbd201010246k1

The 6 K 1 Cbd201010246k1 is a specific tax form used in the United States, primarily for reporting income from partnerships, S corporations, estates, and trusts. This form is essential for taxpayers who receive income from these entities, as it outlines the income, deductions, and credits that need to be reported on individual tax returns. Understanding the details of this form is crucial for accurate tax filing and compliance with IRS regulations.

How to use the 6 K 1 Cbd201010246k1

Using the 6 K 1 Cbd201010246k1 involves several steps. First, taxpayers must receive the form from the partnership or entity that generated the income. Once received, individuals should carefully review the information provided, including income amounts and any deductions or credits. This information must then be accurately reported on the individual's tax return, typically on Form 1040. It is important to ensure that all entries match the details on the 6 K 1 to avoid discrepancies with the IRS.

Steps to complete the 6 K 1 Cbd201010246k1

Completing the 6 K 1 Cbd201010246k1 requires attention to detail. Here are the key steps:

- Obtain the form from the issuing entity.

- Fill in your personal information, including your name and tax identification number.

- Enter the income amounts as reported by the partnership or entity.

- Include any applicable deductions or credits listed on the form.

- Review the completed form for accuracy.

Legal use of the 6 K 1 Cbd201010246k1

The legal use of the 6 K 1 Cbd201010246k1 is governed by IRS regulations. Taxpayers must use this form to report income from partnerships and other entities to ensure compliance with federal tax laws. Failure to report this income can lead to penalties and interest charges. It is essential for taxpayers to retain a copy of the form for their records and to ensure that they are accurately reporting all income for tax purposes.

Filing Deadlines / Important Dates

Filing deadlines for the 6 K 1 Cbd201010246k1 align with the general tax filing deadlines in the United States. Typically, partnerships must provide the K-1 forms to their partners by March 15 for the previous tax year. Additionally, individuals must report this income on their tax returns by the April 15 deadline. It is crucial for taxpayers to be aware of these dates to avoid late filing penalties.

Who Issues the Form

The 6 K 1 Cbd201010246k1 is issued by partnerships, S corporations, estates, and trusts. These entities are responsible for preparing and distributing the form to their partners or beneficiaries, detailing the income, deductions, and credits that each individual must report on their tax returns. Understanding who issues the form helps taxpayers know where to expect this important tax document.

Quick guide on how to complete 6 k 1 cbd201010246k1

Effortlessly prepare [SKS] on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the right forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any interruptions. Manage [SKS] on any device with the airSlate SignNow applications for Android or iOS and enhance your document-related operations today.

How to edit and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 6 K 1 Cbd201010246k1

Create this form in 5 minutes!

How to create an eSignature for the 6 k 1 cbd201010246k1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 6 K 1 Cbd201010246k1?

6 K 1 Cbd201010246k1 refers to a specific product offering from airSlate SignNow that enables businesses to efficiently manage document signing and eSigning processes. This solution is designed to streamline workflows and enhance productivity by providing a user-friendly interface.

-

How does 6 K 1 Cbd201010246k1 benefit my business?

The 6 K 1 Cbd201010246k1 solution offers numerous benefits, including reduced turnaround times for document signing and improved compliance with legal standards. By utilizing this tool, businesses can enhance their operational efficiency and ensure a seamless signing experience for clients.

-

What features are included in 6 K 1 Cbd201010246k1?

6 K 1 Cbd201010246k1 includes features such as customizable templates, real-time tracking of document status, and secure cloud storage. These features are designed to simplify the signing process and provide users with comprehensive tools to manage their documents effectively.

-

Is 6 K 1 Cbd201010246k1 cost-effective?

Yes, 6 K 1 Cbd201010246k1 is a cost-effective solution for businesses of all sizes. With flexible pricing plans, it allows organizations to choose a package that fits their budget while still accessing powerful eSigning capabilities.

-

Can 6 K 1 Cbd201010246k1 integrate with other software?

Absolutely! 6 K 1 Cbd201010246k1 offers seamless integrations with various third-party applications, including CRM systems and project management tools. This ensures that businesses can incorporate eSigning into their existing workflows without any disruptions.

-

How secure is 6 K 1 Cbd201010246k1?

Security is a top priority for 6 K 1 Cbd201010246k1. The platform employs advanced encryption and authentication measures to protect sensitive documents and user data, ensuring compliance with industry standards and regulations.

-

What types of documents can I sign with 6 K 1 Cbd201010246k1?

With 6 K 1 Cbd201010246k1, you can sign a wide variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, making it versatile for different business needs.

Get more for 6 K 1 Cbd201010246k1

- Palm beach county gifted checklist form

- Oklahoma tax exempt replacement card form

- Proximity card supreme court 19915742 form

- Form i 295

- Statement of claim for cancer hospital surgical and accident expense benefits form

- Pocket guide 18 form

- What is option form

- Dizziness handicap inventory alliance rehabilitation form

Find out other 6 K 1 Cbd201010246k1

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online