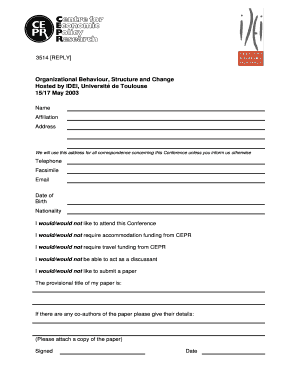

3514 REPLY Form

What is the 3514 REPLY

The 3514 REPLY is a specific form used in various administrative and legal contexts, primarily in the United States. It serves as a response mechanism to inquiries or requests from government agencies or organizations. This form is essential for individuals or businesses who need to provide information or clarification regarding a previously submitted document or request.

How to use the 3514 REPLY

Using the 3514 REPLY involves a straightforward process. First, ensure that you have received a request that necessitates a response. Carefully read the instructions provided with the request to understand the specific information needed. Complete the 3514 REPLY by accurately filling in the required sections, ensuring that all information is current and relevant. Once completed, submit the form as directed, either online or via mail, depending on the guidelines provided.

Steps to complete the 3514 REPLY

Completing the 3514 REPLY involves several key steps:

- Review the request: Understand what information is being sought.

- Gather necessary documents: Collect any supporting documents that may be required.

- Fill out the form: Provide accurate and complete information in all required fields.

- Double-check your entries: Ensure there are no errors or omissions.

- Submit the form: Follow the specified submission method, whether online, by mail, or in person.

Legal use of the 3514 REPLY

The 3514 REPLY is legally recognized as a formal response to inquiries from government entities. It is important to use this form correctly to ensure compliance with legal requirements. Failure to respond appropriately can lead to penalties or complications in administrative processes. Always consult with a legal professional if unsure about the implications of submitting this form.

Key elements of the 3514 REPLY

Key elements of the 3514 REPLY include:

- Identification information: Personal or business details that identify the respondent.

- Response section: A clear and concise answer to the inquiry posed.

- Supporting documentation: Any relevant documents that substantiate the response.

- Signature: A signature may be required to validate the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the 3514 REPLY can vary based on the context in which it is used. It is crucial to adhere to any specified deadlines to avoid penalties. Typically, deadlines will be outlined in the request that prompted the submission of the 3514 REPLY. Always check for any updates or changes to deadlines that may occur.

Quick guide on how to complete 3514 reply

Complete [SKS] effortlessly on any gadget

Online document management has gained traction among enterprises and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the features necessary to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Employ the tools we offer to fill out your document.

- Highlight important sections of the documents or black out sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 3514 REPLY

Create this form in 5 minutes!

How to create an eSignature for the 3514 reply

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 3514 REPLY and how does it work with airSlate SignNow?

3514 REPLY is a feature within airSlate SignNow that allows users to efficiently manage document responses. It streamlines the process of collecting signatures and feedback, ensuring that all parties can easily interact with the documents. By utilizing 3514 REPLY, businesses can enhance their workflow and improve communication.

-

What are the pricing options for using 3514 REPLY with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that include access to the 3514 REPLY feature. Depending on your business needs, you can choose from various subscription tiers that provide different levels of functionality. This ensures that you can find a cost-effective solution that fits your budget while leveraging the benefits of 3514 REPLY.

-

What features does 3514 REPLY offer to enhance document management?

The 3514 REPLY feature includes tools for tracking document status, automated reminders, and customizable templates. These features help streamline the signing process and ensure that documents are completed in a timely manner. By using 3514 REPLY, businesses can signNowly reduce turnaround times and improve efficiency.

-

How can 3514 REPLY benefit my business?

Implementing 3514 REPLY can lead to increased productivity and reduced administrative burdens. It allows for faster document turnaround and enhances collaboration among team members and clients. By utilizing this feature, businesses can focus more on their core activities while ensuring that document management is seamless.

-

Can I integrate 3514 REPLY with other software tools?

Yes, 3514 REPLY can be integrated with various software applications to enhance your workflow. airSlate SignNow supports integrations with popular tools like CRM systems, project management software, and cloud storage services. This flexibility allows you to create a cohesive digital ecosystem that maximizes efficiency.

-

Is 3514 REPLY secure for handling sensitive documents?

Absolutely, 3514 REPLY is designed with security in mind. airSlate SignNow employs advanced encryption and compliance measures to protect your documents and data. You can confidently use 3514 REPLY knowing that your sensitive information is safeguarded against unauthorized access.

-

What types of documents can I manage with 3514 REPLY?

With 3514 REPLY, you can manage a wide range of documents, including contracts, agreements, and forms. The feature is versatile and can accommodate various document types, making it suitable for different industries. This flexibility ensures that you can handle all your document needs efficiently.

Get more for 3514 REPLY

Find out other 3514 REPLY

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple