8974 2017-2026

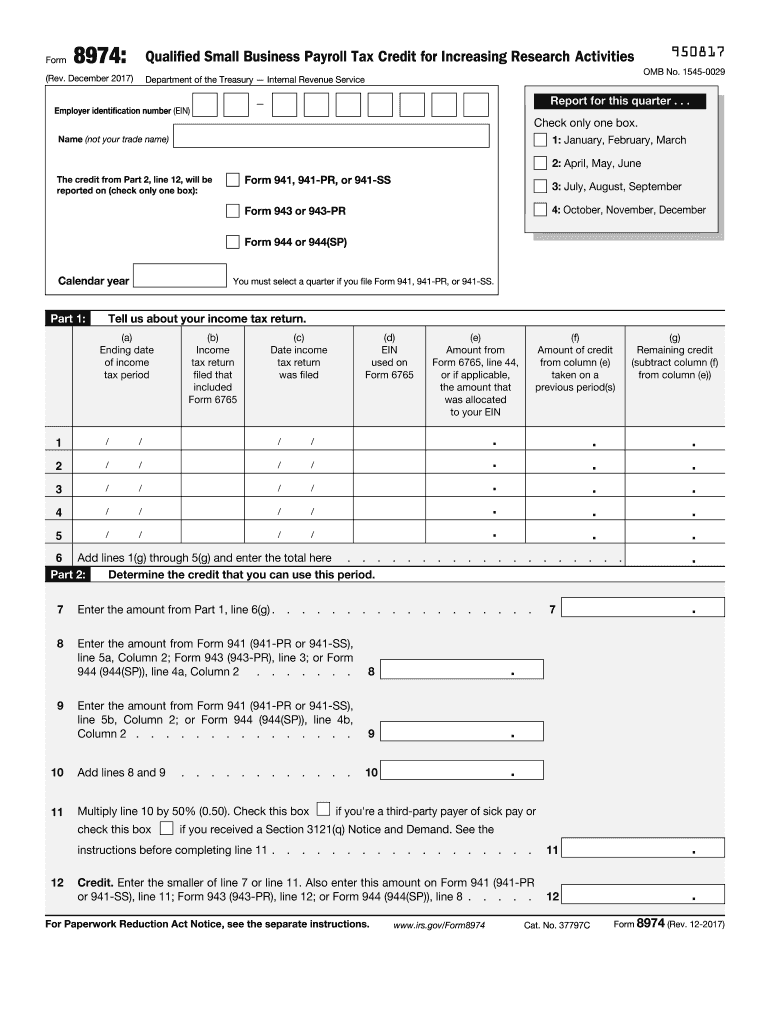

What is IRS Form 8974?

IRS Form 8974 is a tax form used by eligible employers to claim the credit for qualified sick and family leave wages paid under the Families First Coronavirus Response Act (FFCRA). This form allows businesses to report the amount of credit they are eligible to receive for providing paid leave to employees affected by the COVID-19 pandemic. The form is essential for ensuring that employers can recover some of the costs associated with these mandatory leave provisions.

How to Obtain IRS Form 8974

To obtain IRS Form 8974, you can visit the official IRS website, where the form is available for download in PDF format. It is important to ensure that you are using the most current version of the form, as updates may occur annually. Additionally, you may also find the form through tax preparation software that is compliant with IRS regulations, which can simplify the filing process.

Steps to Complete IRS Form 8974

Completing IRS Form 8974 involves several steps:

- Begin by entering your employer information, including your name, address, and Employer Identification Number (EIN).

- Calculate the total amount of qualified sick and family leave wages paid to employees during the applicable period.

- Determine the credit amount you are eligible to claim based on the wages paid and the guidelines provided by the IRS.

- Complete the required sections of the form, ensuring that all calculations are accurate and supported by documentation.

- Submit the completed form along with your payroll tax filings to the IRS.

Legal Use of IRS Form 8974

The legal use of IRS Form 8974 is governed by the regulations set forth in the FFCRA. Employers must ensure that they are compliant with the requirements for claiming the credit, which includes maintaining accurate records of the wages paid and the reasons for providing leave. Misuse of the form or incorrect claims can lead to penalties and potential audits by the IRS.

IRS Guidelines for Form 8974

The IRS provides specific guidelines for completing Form 8974, which include instructions on eligibility, the calculation of credits, and record-keeping requirements. Employers should refer to the IRS instructions accompanying the form for detailed information on how to properly complete and submit the form. Adhering to these guidelines is crucial for ensuring compliance and maximizing the benefits of the tax credit.

Filing Deadlines for IRS Form 8974

Filing deadlines for IRS Form 8974 align with the employer's payroll tax filing schedule. Employers must submit the form by the due date of their payroll tax returns, typically quarterly. It is important to keep track of these deadlines to avoid penalties and ensure timely processing of the credit claims.

Quick guide on how to complete 8974 2017 2019 form

Handle 8974 effortlessly on any gadget

Digital document management has surged in popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents quickly without delays. Manage 8974 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to modify and eSign 8974 with ease

- Locate 8974 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require you to print new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Alter and eSign 8974 while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8974 2017 2019 form

How to create an eSignature for the 8974 2017 2019 Form online

How to create an electronic signature for your 8974 2017 2019 Form in Google Chrome

How to create an electronic signature for signing the 8974 2017 2019 Form in Gmail

How to generate an electronic signature for the 8974 2017 2019 Form straight from your mobile device

How to generate an electronic signature for the 8974 2017 2019 Form on iOS devices

How to generate an eSignature for the 8974 2017 2019 Form on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to 8974?

airSlate SignNow is an innovative eSignature solution that allows businesses to send and eSign documents efficiently. With the code '8974,' users can unlock exclusive features and pricing plans tailored to their needs, making document management seamless and cost-effective.

-

How does airSlate SignNow's pricing structure work with the code 8974?

The pricing structure of airSlate SignNow is designed to be flexible and affordable. By utilizing the code '8974,' customers can access special discounts and features that enhance their document signing experience without compromising on quality.

-

What features does airSlate SignNow offer to enhance document signing?

airSlate SignNow provides a variety of features to improve the eSigning process, including customizable templates, real-time tracking, and secure cloud storage. Users who leverage the benefits associated with code '8974' can maximize these features, ensuring their documents are signed quickly and securely.

-

Can airSlate SignNow integrate with other platforms?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive, Salesforce, and more. By utilizing code '8974', users can enhance their workflow and ensure that all their tools work harmoniously together.

-

What are the benefits of using airSlate SignNow for businesses?

Using airSlate SignNow allows businesses to streamline their document management process, saving time and reducing costs. The code '8974' provides access to tailored solutions that cater to specific business needs, making it easier to manage contracts and agreements.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security, employing advanced encryption methods to protect sensitive documents during transmission and storage. With the assurance of code '8974', users can trust that their information remains confidential and secure.

-

How can I get started with airSlate SignNow using the code 8974?

Getting started with airSlate SignNow is simple. Just visit our website, enter the code '8974' during sign-up, and review the tailored plans available to you. This will provide you with a customized experience that meets your business requirements.

Get more for 8974

- Nurses and prescribing minnesota gov form

- Driver application for pat fruth trucking form

- Settlement agreement final receipt and release of liability form

- City of arkansas city kansas neighborhood service form

- Salina family healthcare center a federally qualified community salinahealth form

- 66814 employment application metal flow corporation form

- Form wc 701 state of michigan

- Employment application template pdf form

Find out other 8974

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy