Homestead Tax Credit and ExemptionIowa Department of 2024-2026

What is the Iowa Homestead Tax Credit?

The Iowa Homestead Tax Credit is a property tax relief program designed to assist homeowners in reducing their property tax burden. This credit is available to individuals who own and occupy a residential property in Iowa. The program aims to provide financial relief to homeowners, making housing more affordable while encouraging homeownership within the state.

To qualify for the Iowa Homestead Tax Credit, applicants must meet specific eligibility criteria, including ownership and residency requirements. The credit amount can vary based on the assessed value of the property, with the potential to significantly lower annual property taxes for qualifying homeowners.

Eligibility Criteria for the Iowa Homestead Tax Credit

To be eligible for the Iowa Homestead Tax Credit, applicants must meet several requirements:

- The applicant must be the owner of the property and occupy it as their primary residence.

- The property must be classified as residential for tax purposes.

- Applicants must meet income guidelines set by the state, which may affect the credit amount.

It is essential to review these criteria carefully to ensure compliance and maximize the benefits of the homestead tax credit.

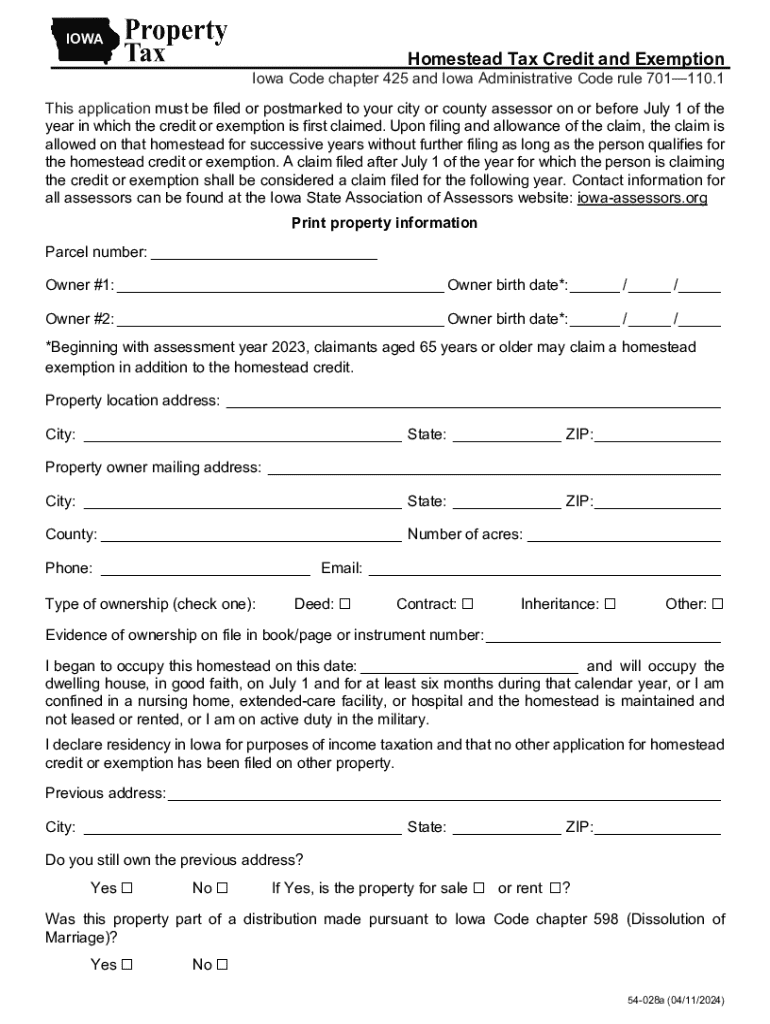

Steps to Complete the Iowa Homestead Tax Credit Form

Filing for the Iowa Homestead Tax Credit involves a straightforward process. Here are the steps to complete the application:

- Obtain the Iowa Homestead Tax Credit form, which can be accessed through the Iowa Department of Revenue website or local county assessor's office.

- Fill out the form with accurate information, including property details and personal identification.

- Submit the completed form to your local county assessor's office by the specified deadline, which is typically April 1 of the assessment year.

Following these steps ensures that your application is processed efficiently, allowing you to receive the credit in a timely manner.

Form Submission Methods for the Iowa Homestead Tax Credit

There are several methods available for submitting the Iowa Homestead Tax Credit form:

- Online Submission: Some counties may offer online submission options through their official websites.

- Mail: Applicants can print the completed form and mail it to their local county assessor's office.

- In-Person: Individuals may also choose to deliver the form in person at their county assessor's office.

Choosing the method that best suits your needs can help streamline the application process.

Required Documents for the Iowa Homestead Tax Credit

When applying for the Iowa Homestead Tax Credit, certain documents may be required to support your application. Commonly required documents include:

- Proof of ownership, such as a deed or mortgage statement.

- Identification, such as a driver's license or state ID.

- Any additional documents specified by your local county assessor's office.

Ensuring that you have all necessary documentation can help prevent delays in processing your application.

Important Filing Deadlines for the Iowa Homestead Tax Credit

Staying aware of filing deadlines is crucial for homeowners seeking the Iowa Homestead Tax Credit. The primary deadline for submitting the application is April 1 of the assessment year. Late applications may not be considered for that tax year, so it is essential to adhere to this timeline to benefit from the credit.

Additionally, homeowners should check with their local county assessor's office for any specific deadlines or additional requirements that may apply.

Quick guide on how to complete homestead tax credit and exemptioniowa department of

Complete Homestead Tax Credit And ExemptionIowa Department Of effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Homestead Tax Credit And ExemptionIowa Department Of on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The easiest way to alter and eSign Homestead Tax Credit And ExemptionIowa Department Of without hassle

- Obtain Homestead Tax Credit And ExemptionIowa Department Of and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing out new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Homestead Tax Credit And ExemptionIowa Department Of while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct homestead tax credit and exemptioniowa department of

Create this form in 5 minutes!

How to create an eSignature for the homestead tax credit and exemptioniowa department of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Iowa homestead tax credit?

The Iowa homestead tax credit is a property tax benefit available to eligible homeowners in Iowa. It reduces the taxable value of a home, resulting in lower property taxes. To qualify, homeowners must meet specific criteria, including residency and ownership requirements.

-

How do I apply for the Iowa homestead tax credit?

To apply for the Iowa homestead tax credit, you need to complete an application form and submit it to your local county assessor's office. The application must be filed by July 1st of the assessment year. Ensure you provide all necessary documentation to support your eligibility.

-

What are the eligibility requirements for the Iowa homestead tax credit?

Eligibility for the Iowa homestead tax credit includes being the owner of the property, residing in the home, and being a resident of Iowa. Additionally, you must not have claimed the credit on any other property. Specific income limits may also apply.

-

How much can I save with the Iowa homestead tax credit?

The savings from the Iowa homestead tax credit can vary based on the assessed value of your property and local tax rates. On average, homeowners can see a reduction in their property taxes, making it a valuable benefit for eligible residents. It's advisable to check with your local assessor for specific savings estimates.

-

Can I receive the Iowa homestead tax credit if I rent my home?

No, the Iowa homestead tax credit is only available to homeowners who occupy their property as their primary residence. Renters do not qualify for this tax credit, as it is designed to benefit those who own and live in their homes. Homeownership is a key requirement for eligibility.

-

Is the Iowa homestead tax credit renewable each year?

Yes, once you are approved for the Iowa homestead tax credit, it typically renews automatically each year as long as you continue to meet the eligibility requirements. However, it is essential to notify your local assessor if there are any changes in your ownership or residency status.

-

How does the Iowa homestead tax credit affect my property taxes?

The Iowa homestead tax credit directly reduces the taxable value of your property, which in turn lowers your property tax bill. This can provide signNow savings for homeowners, making it an essential benefit for those eligible. Understanding how it impacts your taxes can help you budget more effectively.

Get more for Homestead Tax Credit And ExemptionIowa Department Of

Find out other Homestead Tax Credit And ExemptionIowa Department Of

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement