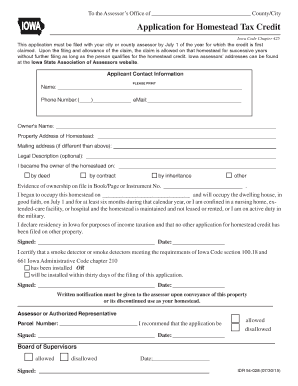

Application for Homestead Tax Credit 54 028 2015

What is the Application For Homestead Tax Credit 54 028

The Application For Homestead Tax Credit 54 028 is a specific form used by homeowners in the United States to apply for a homestead tax credit. This credit is designed to reduce the property tax burden for eligible homeowners, typically based on income and the value of the property. The form collects essential information about the applicant, including personal details, property information, and eligibility criteria. By submitting this application, homeowners can potentially receive significant savings on their property taxes, making homeownership more affordable.

How to use the Application For Homestead Tax Credit 54 028

Using the Application For Homestead Tax Credit 54 028 involves several straightforward steps to ensure accurate completion. First, gather all necessary information, including your income details, property tax information, and any supporting documents that verify your eligibility. Next, carefully fill out the form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the application according to your state’s guidelines, which may include online submission, mailing, or in-person delivery to the appropriate tax office.

Steps to complete the Application For Homestead Tax Credit 54 028

Completing the Application For Homestead Tax Credit 54 028 requires careful attention to detail. Follow these steps for successful submission:

- Gather necessary documents, including proof of income, property tax statements, and identification.

- Obtain the form from your local tax authority or download it from the official website.

- Fill in personal information, including your name, address, and contact details.

- Provide information about your property, including its assessed value and any exemptions you may already have.

- Detail your income sources and amounts, ensuring you meet the eligibility criteria.

- Review the completed form for accuracy and completeness.

- Submit the form as directed, keeping a copy for your records.

Eligibility Criteria

To qualify for the homestead tax credit using the Application For Homestead Tax Credit 54 028, applicants must meet specific eligibility criteria. Generally, these criteria include:

- The applicant must be the owner of the property and occupy it as their primary residence.

- Income limits may apply, which vary by state and determine eligibility based on the applicant's total household income.

- The property must not exceed a certain assessed value, which is also determined by state regulations.

- Some states may have additional requirements, such as age restrictions or disability status.

Required Documents

When completing the Application For Homestead Tax Credit 54 028, several documents are typically required to verify eligibility. These may include:

- Proof of identity, such as a driver's license or state ID.

- Documentation of income, including pay stubs, tax returns, or Social Security statements.

- Property tax statements that detail the assessed value of the property.

- Any additional forms or documentation required by your state’s tax authority.

Form Submission Methods

The Application For Homestead Tax Credit 54 028 can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state tax authority's website, if available.

- Mailing the completed form to the designated tax office address.

- In-person submission at local tax offices or designated government buildings.

Quick guide on how to complete application for homestead tax credit 54 028

Prepare Application For Homestead Tax Credit 54 028 effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents rapidly without any holdups. Manage Application For Homestead Tax Credit 54 028 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign Application For Homestead Tax Credit 54 028 without any hassle

- Locate Application For Homestead Tax Credit 54 028 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review the details and click on the Done button to finalize your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Application For Homestead Tax Credit 54 028 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for homestead tax credit 54 028

Create this form in 5 minutes!

How to create an eSignature for the application for homestead tax credit 54 028

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Homestead Tax Credit 54 028?

The Application For Homestead Tax Credit 54 028 is a form that allows eligible homeowners to apply for tax credits on their property taxes. This application helps reduce the financial burden on homeowners by providing tax relief based on specific criteria. Understanding this application is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with the Application For Homestead Tax Credit 54 028?

airSlate SignNow streamlines the process of completing and submitting the Application For Homestead Tax Credit 54 028. With our easy-to-use platform, you can fill out the form electronically, eSign it, and send it directly to the relevant authorities. This saves time and ensures that your application is submitted accurately.

-

What are the pricing options for using airSlate SignNow for the Application For Homestead Tax Credit 54 028?

airSlate SignNow offers various pricing plans to suit different needs, starting from a free trial to premium subscriptions. Each plan provides access to features that facilitate the completion of the Application For Homestead Tax Credit 54 028. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the Application For Homestead Tax Credit 54 028?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the experience of completing the Application For Homestead Tax Credit 54 028. These features ensure that your application is not only easy to fill out but also secure and compliant with regulations.

-

Are there any benefits to using airSlate SignNow for the Application For Homestead Tax Credit 54 028?

Using airSlate SignNow for the Application For Homestead Tax Credit 54 028 offers numerous benefits, including increased efficiency and reduced paperwork. Our platform allows you to manage your documents digitally, which can lead to faster processing times for your application. Additionally, you can access your documents anytime, anywhere.

-

Can I integrate airSlate SignNow with other tools for the Application For Homestead Tax Credit 54 028?

Yes, airSlate SignNow integrates seamlessly with various applications and tools, enhancing your workflow when dealing with the Application For Homestead Tax Credit 54 028. Whether you use CRM systems, cloud storage, or other document management tools, our integrations help streamline the entire process.

-

Is airSlate SignNow secure for submitting the Application For Homestead Tax Credit 54 028?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Application For Homestead Tax Credit 54 028 is protected. We use advanced encryption and secure servers to safeguard your data, giving you peace of mind when submitting sensitive information.

Get more for Application For Homestead Tax Credit 54 028

- California 4 h youth development program annual project report ucanr form

- Personal data and emergency contact form

- Life threatening allergy plan fillable form

- Audreturns gtcounty org form

- Payroll repayment agreement template form

- Revised form sg 32 permanent missions to the united nations un

- Form 541 t california allocation of estimated tax payments to

- 580 2039 6 listing of child care staff membershousehold members missouri department of health and senior services form

Find out other Application For Homestead Tax Credit 54 028

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free