Mo Dept of Revenue Form 2643a 2019-2026

What is the Mo Dept Of Revenue Form 2643a

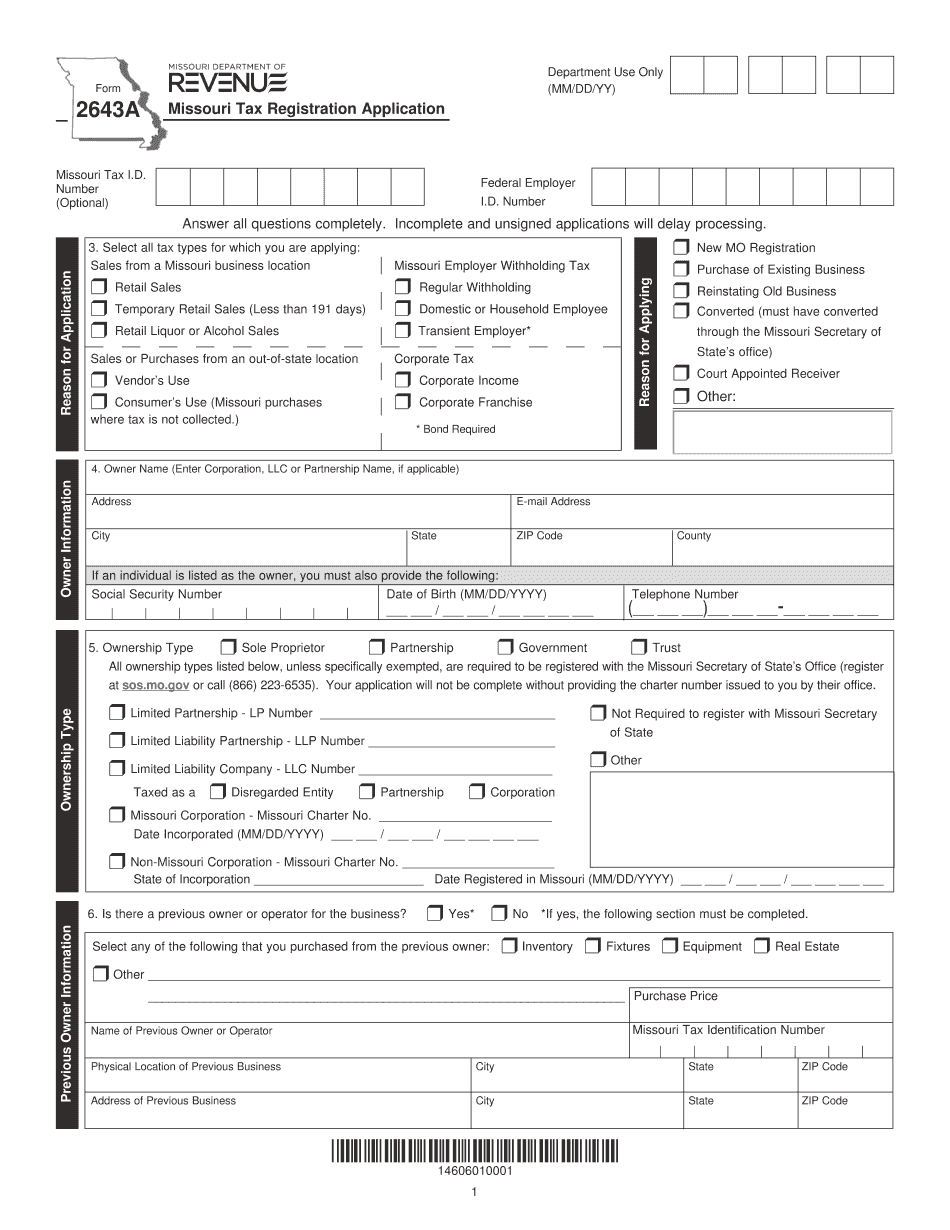

The Missouri Department of Revenue Form 2643a is a tax registration application specifically designed for businesses operating within the state. This form is essential for entities that need to register for sales tax, use tax, or other tax obligations. By completing Form 2643a, businesses can ensure compliance with Missouri tax laws and regulations, allowing them to legally collect and remit taxes. This form is particularly important for new businesses, as it establishes their tax identification with the state.

Steps to complete the Mo Dept Of Revenue Form 2643a

Completing the Missouri Form 2643a involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business, including the legal name, address, and type of entity (e.g., LLC, corporation). Next, provide details about the owners or responsible parties, including their Social Security numbers and contact information. After filling in the required sections, review the form for any errors or omissions. Finally, submit the completed form either online or via mail to the Missouri Department of Revenue, ensuring you keep a copy for your records.

Legal use of the Mo Dept Of Revenue Form 2643a

The legal use of Form 2643a is critical for businesses to operate within Missouri's tax framework. This form serves as an official declaration to the state that a business intends to collect sales tax or fulfill other tax obligations. Properly completing and submitting this form ensures that the business can legally conduct transactions that require tax collection. Additionally, compliance with the registration process helps avoid penalties and legal issues associated with operating without the necessary tax identification.

Form Submission Methods (Online / Mail / In-Person)

Businesses can submit the Missouri Form 2643a through various methods, providing flexibility based on their preferences. The online submission option is available through the Missouri Department of Revenue's website, allowing for immediate processing. Alternatively, businesses may choose to mail the completed form to the appropriate address specified on the form itself. For those who prefer face-to-face interactions, in-person submissions can be made at designated Department of Revenue offices across the state. Each method has its own processing times, so it is advisable to choose the one that best fits the business's timeline.

Required Documents

When completing the Missouri Form 2643a, several documents may be required to support the application. These typically include proof of business registration, such as articles of incorporation or a partnership agreement, depending on the business structure. Additionally, identification documents for the owners or responsible parties, such as a driver's license or Social Security card, may be necessary. Having these documents readily available can streamline the application process and ensure that all required information is submitted.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Missouri Form 2643a is crucial for businesses to maintain compliance. Generally, businesses should submit the form before commencing operations that require tax collection. It is advisable to check the Missouri Department of Revenue's website for specific deadlines, as they may vary based on the type of business or tax obligations. Missing these deadlines can result in penalties or delays in obtaining the necessary tax identification.

Eligibility Criteria

To be eligible to file the Missouri Form 2643a, businesses must meet certain criteria established by the state. This includes having a physical presence in Missouri or engaging in taxable activities within the state. Additionally, businesses must provide accurate information regarding their structure and ownership. It is essential for applicants to review the eligibility requirements carefully to ensure they qualify for registration and avoid complications during the application process.

Quick guide on how to complete sales from a missouri business location

Effortlessly Prepare Mo Dept Of Revenue Form 2643a on Any Device

Managing documents online has become increasingly favored by businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate forms and securely store them online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle Mo Dept Of Revenue Form 2643a on any device using airSlate SignNow's Android or iOS applications and enhance your document-based processes today.

How to Edit and Electronically Sign Mo Dept Of Revenue Form 2643a with Ease

- Find Mo Dept Of Revenue Form 2643a and click on Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose how you prefer to send your form—via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns over missing or lost files, tedious form searching, or mistakes that require reprinting document copies. airSlate SignNow addresses all your document management needs in just a few clicks, from any device you select. Modify and electronically sign Mo Dept Of Revenue Form 2643a to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales from a missouri business location

How to create an eSignature for your Sales From A Missouri Business Location in the online mode

How to generate an electronic signature for your Sales From A Missouri Business Location in Chrome

How to make an eSignature for signing the Sales From A Missouri Business Location in Gmail

How to create an electronic signature for the Sales From A Missouri Business Location straight from your smartphone

How to make an eSignature for the Sales From A Missouri Business Location on iOS devices

How to generate an electronic signature for the Sales From A Missouri Business Location on Android

People also ask

-

What is form 2643 for Missouri tax registration?

Form 2643 is the official document required for businesses to register for state tax obligations in Missouri. Submitting this form ensures compliance with state tax laws and allows your business to operate legally within Missouri. Understanding the purpose of form 2643 Missouri tax registration is essential for anyone starting a business in the state.

-

How do I fill out form 2643 for Missouri tax registration?

Filling out form 2643 Missouri tax registration involves providing your business details, including the entity type, tax information, and contact details. Carefully follow the instructions provided on the form to ensure accuracy and completeness. Using reliable software solutions can streamline this process and minimize errors.

-

What is the cost of submitting form 2643 for Missouri tax registration?

The cost associated with submitting form 2643 Missouri tax registration can vary based on your business type and any applicable fees. Typically, there are no direct fees for filing the form itself, but additional requirements may incur costs. It’s best to check the Missouri Department of Revenue's website for the most current information on associated costs.

-

What are the benefits of using airSlate SignNow for signing form 2643 Missouri tax registration?

Using airSlate SignNow to sign form 2643 Missouri tax registration provides a secure, efficient way to manage your documents. The platform allows you to eSign forms electronically, eliminating the need for printing or faxing. This not only saves time but also reduces the risks of paper-based errors.

-

Can I integrate airSlate SignNow with other software tools while completing form 2643 Missouri tax registration?

Yes, airSlate SignNow offers seamless integration with various productivity and accounting tools, enhancing your experience when handling form 2643 Missouri tax registration. This integration allows for easy data transfer and improves workflow efficiency by connecting your applications. Check the airSlate SignNow integrations page for compatible software.

-

How long does it take to process form 2643 Missouri tax registration?

Processing time for form 2643 Missouri tax registration can vary, typically taking several weeks depending on the volume of applications received. Factors such as submission method and completeness of the form can also affect processing times. To expedite the process, ensure all information is accurate and submit it through the preferred method.

-

Is electronic filing available for form 2643 Missouri tax registration?

Yes, electronic filing is available for form 2643 Missouri tax registration, making the process more convenient. Using electronic methods to file helps ensure faster processing and reduces the chances of errors associated with paper forms. Consider utilizing eSignature services like airSlate SignNow for a hassle-free filing experience.

Get more for Mo Dept Of Revenue Form 2643a

- 3rd party requestor recovery certificate agreement form

- Application for certificate faa faa form

- Maintenance sign off sheet form

- Review petition review petition form

- Theft deferred entry of judgment prop 36 pc 666 1 form

- Sv 120 770511692 form

- Maine income tax rate fill out ampamp sign online form

- Utah sales tax account number form

Find out other Mo Dept Of Revenue Form 2643a

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT