Wh4 2018-2026

What is the Wh4

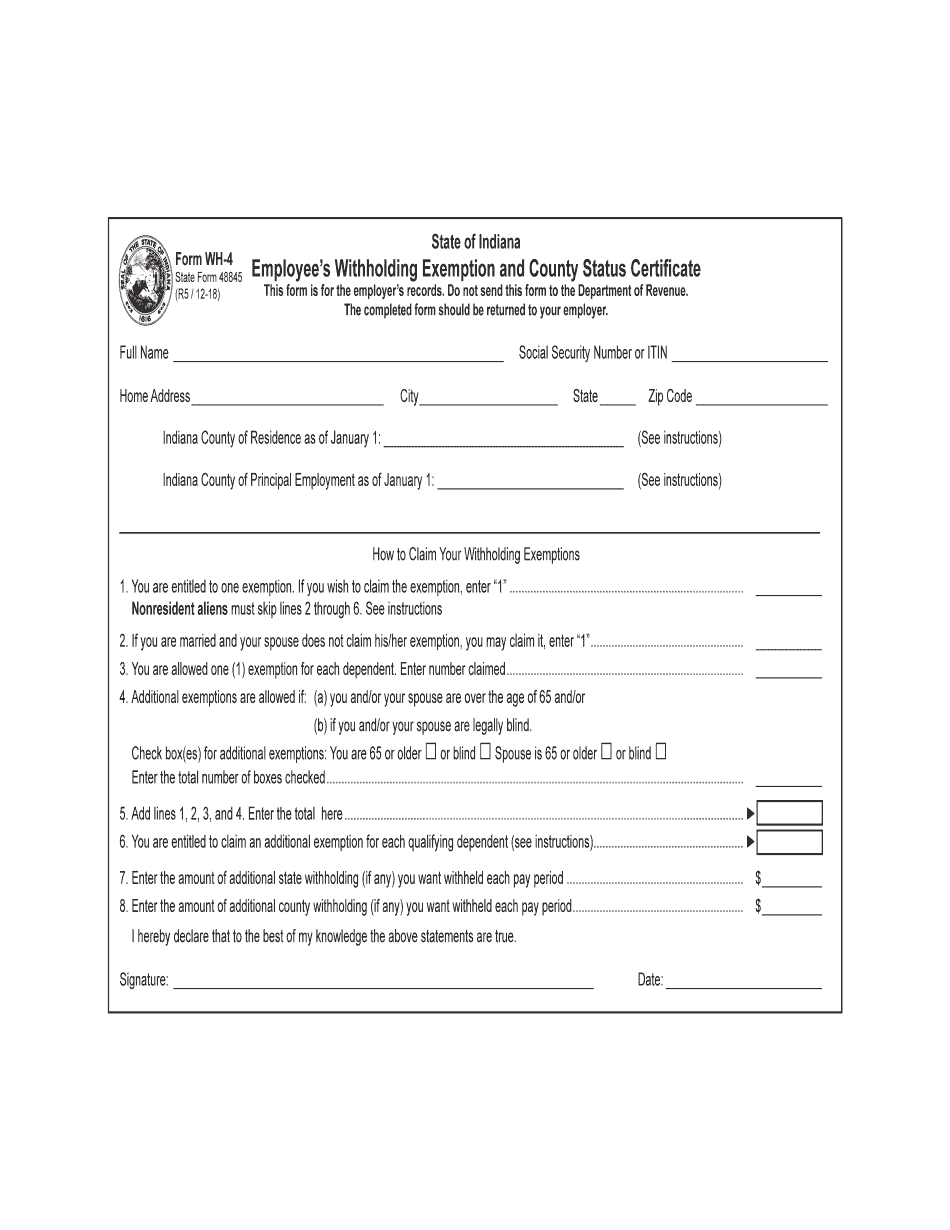

The Indiana WH-4 form is a state tax withholding form that allows employees to indicate their exemptions and the amount of state income tax to be withheld from their paychecks. This form is essential for ensuring that the correct amount of tax is deducted based on individual circumstances, such as marital status and number of dependents. By filling out the WH-4 accurately, employees can manage their tax liabilities more effectively and avoid underpayment or overpayment of state taxes.

How to use the Wh4

To use the Indiana WH-4 form, an employee must first obtain a copy from their employer or download it from the Indiana Department of Revenue website. After filling out the required information, including personal details and exemption claims, the employee submits the form to their employer. It is important to review the completed form for accuracy to ensure that the correct withholding amount is applied. Employees should also keep a copy for their records.

Steps to complete the Wh4

Completing the Indiana WH-4 form involves several straightforward steps:

- Obtain the WH-4 form from your employer or the Indiana Department of Revenue.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your filing status (single, married, etc.) and the number of exemptions you are claiming.

- Sign and date the form to validate your submission.

- Submit the completed form to your employer for processing.

Legal use of the Wh4

The Indiana WH-4 form is legally binding once submitted to an employer. It must be filled out accurately to ensure compliance with state tax laws. Any false claims or inaccuracies can lead to penalties, including fines or additional tax liabilities. Employers are required to maintain the confidentiality of the information provided and must use it solely for the purpose of withholding state income tax from employee wages.

Key elements of the Wh4

Several key elements define the Indiana WH-4 form:

- Personal Information: Essential details such as name, address, and Social Security number.

- Filing Status: Indicates whether the employee is single, married, or head of household.

- Exemptions: The number of exemptions claimed, which affects the withholding amount.

- Signature: The employee's signature is required to validate the form.

Form Submission Methods

The Indiana WH-4 form can be submitted to employers in various ways. Typically, employees can hand-deliver the completed form directly to their payroll department. Alternatively, the form may be submitted via email or fax, depending on the employer's policies. It is advisable to check with the employer for specific submission guidelines to ensure that the form is received and processed promptly.

Quick guide on how to complete home addresscitystatezip code

Prepare Wh4 seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Wh4 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Wh4 effortlessly

- Locate Wh4 and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize relevant portions of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and select the Done button to save your changes.

- Choose your preferred method to deliver your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choice. Modify and eSign Wh4 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct home addresscitystatezip code

Create this form in 5 minutes!

How to create an eSignature for the home addresscitystatezip code

How to make an eSignature for the Home Addresscitystatezip Code in the online mode

How to generate an eSignature for your Home Addresscitystatezip Code in Chrome

How to create an eSignature for putting it on the Home Addresscitystatezip Code in Gmail

How to create an electronic signature for the Home Addresscitystatezip Code from your smart phone

How to create an electronic signature for the Home Addresscitystatezip Code on iOS devices

How to make an electronic signature for the Home Addresscitystatezip Code on Android

People also ask

-

What is airSlate SignNow and how does it relate to Wh4?

airSlate SignNow is a powerful eSignature solution that empowers businesses to send and eSign documents seamlessly. With its user-friendly interface and robust features, it simplifies document management and enhances workflow efficiency. Wh4 refers to the unique identifier for our platform, ensuring you get the specific tools tailored for your business needs.

-

How much does airSlate SignNow cost for Wh4 users?

Pricing for airSlate SignNow is designed to be cost-effective, especially for Wh4 users. We offer a variety of plans to fit different business sizes, starting from a basic plan to advanced options that include additional features. You can choose the plan that best suits your organization’s needs and budget.

-

What features does airSlate SignNow offer for Wh4 customers?

airSlate SignNow provides a range of features tailored for Wh4 customers, including unlimited eSignatures, document templates, and advanced security measures. These features help streamline the signing process and ensure that your documents are secure and accessible. Additionally, customizable workflows allow you to automate tasks and improve efficiency.

-

Can airSlate SignNow integrate with other tools for Wh4 users?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms, making it an excellent choice for Wh4 users. You can easily connect it with popular applications such as Google Drive, Salesforce, and Microsoft Office. This versatility allows you to enhance your document workflows and improve productivity.

-

What are the benefits of using airSlate SignNow for Wh4?

Using airSlate SignNow provides numerous benefits for Wh4 customers, including reduced turnaround times for document signing and enhanced collaboration. The platform is designed to be user-friendly, enabling quick adoption by team members. Additionally, its cost-effective pricing helps reduce operational expenses while maximizing efficiency.

-

Is airSlate SignNow secure for Wh4 document management?

Absolutely! airSlate SignNow prioritizes security for all users, including Wh4 customers. Our platform employs advanced encryption methods and complies with industry standards to protect sensitive information. You can trust that your documents and signatures are secure throughout the signing process.

-

How can Wh4 users get started with airSlate SignNow?

Getting started with airSlate SignNow is simple for Wh4 users. You can sign up for a free trial to explore the platform's features and capabilities. Once you're ready, choose a plan that fits your business needs, and you can start sending and signing documents in no time!

Get more for Wh4

- Section 11 pre trip vehicle inspection test section 11 pre trip vehicle inspection test this section covers l l l l l l l form

- Bestuurdersverklaringgericht aan abn amro bank n v form

- In the iowa district court for county upon the petition of response form

- New structures and additions commercial plans checklist form

- 26 rec connect school age program annual application form

- Pre construction package fy26 form

- Prince william county preconstruction package form

- Local option transient rental tax rates dr 15tdt r 794941115 form

Find out other Wh4

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online