Indiana Wh 4 Form 1999

What is the Indiana WH-4 Form

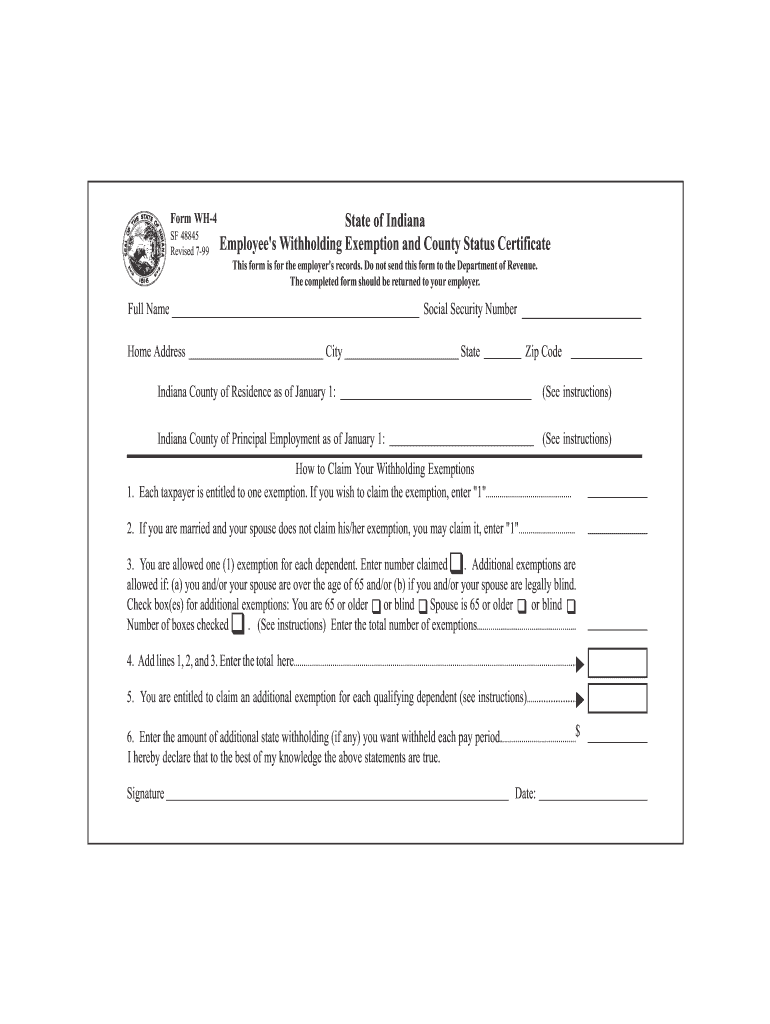

The Indiana WH-4 Form is a state-specific withholding exemption certificate used by employees in Indiana. This form allows employees to declare their withholding status and claim any exemptions from state income tax withholding. By submitting this form, employees can ensure that the correct amount of state tax is withheld from their paychecks, aligning with their financial situation and tax obligations. It is essential for both employees and employers to understand the implications of this form to maintain compliance with Indiana tax laws.

How to use the Indiana WH-4 Form

To use the Indiana WH-4 Form, employees must first obtain a copy from their employer or download it from the Indiana Department of Revenue website. After filling out the necessary information, including personal details and exemption claims, the employee should submit the completed form to their employer. Employers are responsible for keeping the form on file and using it to determine the appropriate amount of state income tax to withhold from the employee's wages. It is advisable for employees to review their withholding status annually or whenever their financial situation changes.

Steps to complete the Indiana WH-4 Form

Completing the Indiana WH-4 Form involves several straightforward steps:

- Obtain the form from your employer or the Indiana Department of Revenue.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your filing status and any exemptions you wish to claim.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Legal use of the Indiana WH-4 Form

The Indiana WH-4 Form is legally binding when completed accurately and submitted to the employer. It complies with Indiana state tax regulations, ensuring that the appropriate amount of state income tax is withheld from employee wages. Employers must retain this form for their records and use it to calculate withholding amounts. Failure to comply with the requirements of the WH-4 Form can result in penalties for both employees and employers, highlighting the importance of accurate completion and submission.

Key elements of the Indiana WH-4 Form

Several key elements are essential to understand when dealing with the Indiana WH-4 Form:

- Personal Information: This includes the employee's name, address, and Social Security number.

- Filing Status: Employees must indicate their filing status, which can affect withholding amounts.

- Exemptions: Employees can claim exemptions based on specific criteria, which can reduce their withholding amount.

- Signature: A signature is required to validate the form, confirming the accuracy of the information provided.

Form Submission Methods

The Indiana WH-4 Form can be submitted through various methods, allowing flexibility for employees. The most common submission methods include:

- In-Person: Employees can hand the completed form directly to their employer's HR or payroll department.

- Mail: If an employer allows it, employees may send the completed form via postal mail.

- Electronic Submission: Some employers may offer the option to submit the form electronically through their payroll systems.

Quick guide on how to complete indiana wh 4 1999 form

Complete Indiana Wh 4 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as it allows you to locate the right form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without hindrance. Handle Indiana Wh 4 Form on any system with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to modify and eSign Indiana Wh 4 Form effortlessly

- Locate Indiana Wh 4 Form and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your alterations.

- Select how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Adjust and eSign Indiana Wh 4 Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana wh 4 1999 form

Create this form in 5 minutes!

How to create an eSignature for the indiana wh 4 1999 form

How to generate an eSignature for the Indiana Wh 4 1999 Form online

How to make an electronic signature for your Indiana Wh 4 1999 Form in Chrome

How to create an electronic signature for putting it on the Indiana Wh 4 1999 Form in Gmail

How to create an electronic signature for the Indiana Wh 4 1999 Form straight from your smartphone

How to create an electronic signature for the Indiana Wh 4 1999 Form on iOS

How to generate an electronic signature for the Indiana Wh 4 1999 Form on Android devices

People also ask

-

What is the Indiana Wh 4 Form and why is it important?

The Indiana Wh 4 Form is a state tax withholding form that employers use to determine the amount of state income tax to withhold from employees' wages in Indiana. It is crucial for compliance with state tax regulations and ensures that the right amount is deducted from employees’ paychecks to avoid penalties.

-

How can airSlate SignNow help with the Indiana Wh 4 Form?

airSlate SignNow provides an efficient way to create, send, and eSign the Indiana Wh 4 Form digitally. This streamlines the process for both employers and employees, reducing paperwork and ensuring quicker compliance with tax requirements.

-

Is there a cost associated with using airSlate SignNow for the Indiana Wh 4 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features necessary for managing documents like the Indiana Wh 4 Form, making it a cost-effective solution for businesses of any size.

-

What features does airSlate SignNow offer for managing the Indiana Wh 4 Form?

airSlate SignNow offers features like customizable templates, electronic signatures, tracking, and secure cloud storage specifically for documents like the Indiana Wh 4 Form. These tools simplify the process and enhance overall efficiency for your business.

-

Can I integrate airSlate SignNow with other software for handling the Indiana Wh 4 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, allowing for smooth data transfer related to the Indiana Wh 4 Form. This means you can streamline your workflow and enhance productivity by connecting your HR or payroll systems.

-

What are the benefits of using airSlate SignNow for the Indiana Wh 4 Form over traditional methods?

Using airSlate SignNow for the Indiana Wh 4 Form eliminates the hassle of printing, signing, and scanning physical documents. It enhances efficiency, reduces errors, and saves time, all while ensuring that your forms remain compliant with Indiana state regulations.

-

How does eSigning work with the Indiana Wh 4 Form in airSlate SignNow?

eSigning with the Indiana Wh 4 Form in airSlate SignNow is straightforward. Once the form is prepared, you can invite signers to electronically sign it via a secure link, making the process quick and user-friendly without the need for physical meetups.

Get more for Indiana Wh 4 Form

- University of fort hare application forms 2016 pdf

- Missouri htc preliminary form

- Waiver of mandatory disclosure form

- Chartered banker mba application form the chartered

- Request reactivate form

- Transaction report form department of labor licensing and dllr maryland

- John hancock beneficiary change form

- Or 20 v form

Find out other Indiana Wh 4 Form

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement