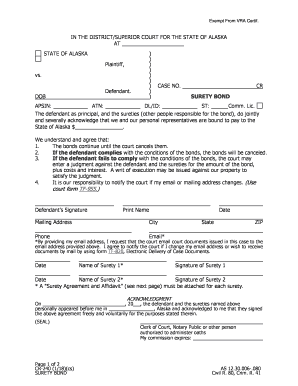

CR 240 Surety Bond 2018

What is the CR 240 Surety Bond

The CR 240 Surety Bond is a legal document that guarantees the fulfillment of certain obligations, typically related to licensing or regulatory requirements. This bond is often required by state or local governments to ensure that individuals or businesses comply with specific laws and regulations. By securing a CR 240 Surety Bond, the bondholder provides a financial guarantee that they will adhere to the terms set forth by the governing authority.

How to obtain the CR 240 Surety Bond

Obtaining a CR 240 Surety Bond involves several steps. First, individuals or businesses must identify a reputable surety bond provider. This often includes insurance companies or specialized bond agencies. After selecting a provider, applicants will need to complete an application form, which typically requires personal and financial information. The surety company will evaluate the applicant’s creditworthiness and may request additional documentation to assess risk. Once approved, the bond can be issued, and the applicant will need to pay a premium based on the bond amount and their credit profile.

Steps to complete the CR 240 Surety Bond

Completing the CR 240 Surety Bond requires careful attention to detail. The process generally includes the following steps:

- Gather necessary information, including personal identification and business details.

- Complete the bond application form provided by the surety company.

- Submit any required documentation, such as financial statements or proof of licensing.

- Review and sign the bond agreement, ensuring all terms are understood.

- Make the required premium payment to finalize the bond issuance.

Legal use of the CR 240 Surety Bond

The CR 240 Surety Bond serves a critical legal purpose by ensuring compliance with applicable laws and regulations. It is often utilized in various industries, including construction, real estate, and service sectors, where licensing is mandatory. The bond acts as a safeguard for the public and the government, providing a financial recourse in case the bondholder fails to meet their obligations. Legal enforcement of the bond can lead to claims against the bond amount if the terms are violated.

Key elements of the CR 240 Surety Bond

Several key elements define the CR 240 Surety Bond, including:

- Principal: The individual or business required to obtain the bond.

- Obligee: The entity that requires the bond, often a state or local government.

- Surety: The bonding company that issues the bond and guarantees the principal's obligations.

- Bond Amount: The financial limit of the bond, which represents the maximum liability of the surety.

- Terms and Conditions: Specific obligations the principal must adhere to, as outlined in the bond agreement.

Required Documents

To successfully obtain a CR 240 Surety Bond, applicants typically need to provide several documents, which may include:

- Completed bond application form.

- Personal identification, such as a driver's license or passport.

- Business license or registration documents.

- Financial statements or proof of income.

- Any additional documentation specified by the surety provider.

Quick guide on how to complete cr 240 surety bond

Effortlessly Prepare CR 240 Surety Bond on Any Device

Digital document management has become increasingly favored among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing access to the correct format and safe online storage. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle CR 240 Surety Bond on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and eSign CR 240 Surety Bond with Ease

- Obtain CR 240 Surety Bond and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to preserve your modifications.

- Choose your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign CR 240 Surety Bond and ensure clear communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cr 240 surety bond

Create this form in 5 minutes!

How to create an eSignature for the cr 240 surety bond

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CR 240 Surety Bond?

A CR 240 Surety Bond is a type of bond required by certain entities to ensure compliance with regulations and obligations. It serves as a guarantee that the bonded party will fulfill their contractual duties. Understanding the specifics of the CR 240 Surety Bond is crucial for businesses looking to operate legally and efficiently.

-

How much does a CR 240 Surety Bond cost?

The cost of a CR 240 Surety Bond can vary based on several factors, including the bond amount and the applicant's creditworthiness. Typically, businesses can expect to pay a percentage of the total bond amount as a premium. It's advisable to get quotes from multiple providers to find the best pricing for your CR 240 Surety Bond.

-

What are the benefits of obtaining a CR 240 Surety Bond?

Obtaining a CR 240 Surety Bond provides several benefits, including increased credibility and trust with clients and regulatory bodies. It also protects consumers by ensuring that businesses adhere to their contractual obligations. This bond can enhance your business reputation and open up new opportunities.

-

How can I apply for a CR 240 Surety Bond?

Applying for a CR 240 Surety Bond is a straightforward process. You typically need to fill out an application, provide necessary documentation, and undergo a credit check. Many surety bond providers offer online applications, making it easier for businesses to secure their CR 240 Surety Bond quickly.

-

What documents are required for a CR 240 Surety Bond?

To obtain a CR 240 Surety Bond, you will generally need to provide identification, financial statements, and details about your business operations. Some providers may also require additional documentation based on your specific situation. Ensuring you have all necessary documents ready can expedite the bonding process.

-

Can I cancel my CR 240 Surety Bond?

Yes, you can cancel your CR 240 Surety Bond, but the process may vary depending on the provider. Typically, you will need to submit a written request for cancellation. It's important to review the terms of your bond to understand any potential penalties or obligations upon cancellation.

-

Are there any specific industries that require a CR 240 Surety Bond?

Yes, certain industries, such as construction and real estate, often require a CR 240 Surety Bond to ensure compliance with local regulations. These bonds are designed to protect consumers and ensure that businesses operate within legal frameworks. If you're in a regulated industry, check if a CR 240 Surety Bond is necessary for your operations.

Get more for CR 240 Surety Bond

Find out other CR 240 Surety Bond

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free