Schedule D Instructions Form

What are the Schedule D Instructions?

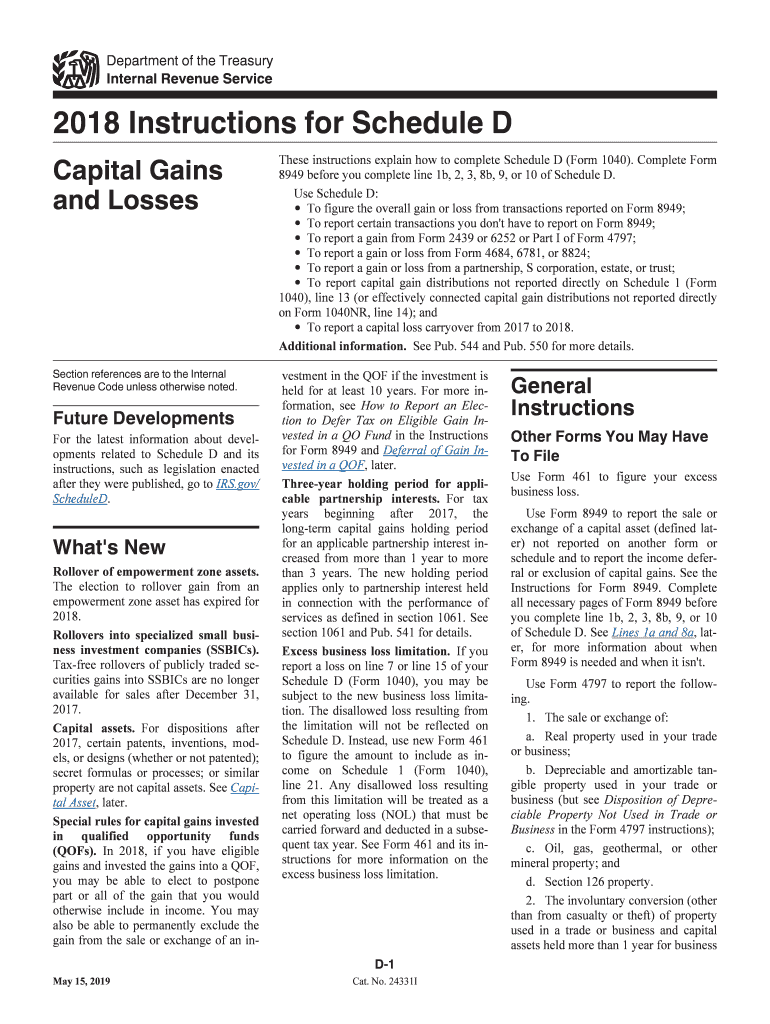

The Schedule D Instructions provide essential guidance for taxpayers who need to report capital gains and losses on their federal tax returns. This form is used in conjunction with the IRS Form 1040, allowing individuals to detail their transactions involving stocks, bonds, real estate, and other capital assets. Understanding these instructions is crucial for accurately calculating tax obligations and ensuring compliance with IRS regulations.

Steps to Complete the Schedule D Instructions

Completing the Schedule D Instructions involves several key steps:

- Gather necessary documentation: Collect all relevant records of capital gains and losses, including purchase and sale receipts, brokerage statements, and any other documentation related to asset transactions.

- Fill out the form: Start by entering your personal information at the top of the form. Then, report each capital asset transaction, detailing the date acquired, date sold, proceeds, cost basis, and resulting gain or loss.

- Calculate totals: Sum up the short-term and long-term gains and losses, as these may be taxed at different rates. Ensure that you accurately reflect any carryover losses from previous years.

- Transfer totals to Form 1040: After completing Schedule D, transfer the totals to the appropriate lines on your IRS Form 1040.

Legal Use of the Schedule D Instructions

The Schedule D Instructions are legally binding documents that taxpayers must adhere to when reporting capital gains and losses. To ensure compliance, it is important to follow the guidelines set forth by the IRS. This includes accurately reporting all transactions and maintaining proper documentation to support claims. Failure to comply with these instructions can result in penalties, including fines or additional taxes owed.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of Schedule D. Taxpayers are encouraged to refer to the IRS website for the most current instructions and updates. Key points include:

- Understanding the difference between short-term and long-term capital gains.

- Recognizing which transactions must be reported, including sales, exchanges, and certain gifts.

- Being aware of deadlines for filing Schedule D along with the overall tax return.

Filing Deadlines / Important Dates

It is essential to be aware of key deadlines when filing Schedule D. Generally, the deadline for submitting your federal tax return, including Schedule D, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also keep in mind any extensions they may apply for, which can provide additional time to file but not to pay any taxes owed.

Examples of Using the Schedule D Instructions

Utilizing the Schedule D Instructions effectively can vary based on individual circumstances. Here are a few examples:

- A taxpayer who sold stocks at a profit must report the sale on Schedule D to ensure accurate tax calculations.

- A homeowner who sold their property may need to report the sale, especially if it resulted in a capital gain.

- Individuals who have experienced losses from investments can use Schedule D to offset gains, potentially reducing their overall tax liability.

Quick guide on how to complete 8949 before you complete line 1b 2 3 8b 9 or 10 of schedule d

Complete Schedule D Instructions effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without lag. Manage Schedule D Instructions on any device using airSlate SignNow Android or iOS applications and enhance any document-driven task today.

How to modify and eSign Schedule D Instructions with ease

- Obtain Schedule D Instructions and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that function.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you prefer. Edit and eSign Schedule D Instructions and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8949 before you complete line 1b 2 3 8b 9 or 10 of schedule d

How to create an electronic signature for your 8949 Before You Complete Line 1b 2 3 8b 9 Or 10 Of Schedule D in the online mode

How to generate an electronic signature for the 8949 Before You Complete Line 1b 2 3 8b 9 Or 10 Of Schedule D in Chrome

How to generate an eSignature for signing the 8949 Before You Complete Line 1b 2 3 8b 9 Or 10 Of Schedule D in Gmail

How to create an eSignature for the 8949 Before You Complete Line 1b 2 3 8b 9 Or 10 Of Schedule D right from your smartphone

How to make an eSignature for the 8949 Before You Complete Line 1b 2 3 8b 9 Or 10 Of Schedule D on iOS devices

How to generate an electronic signature for the 8949 Before You Complete Line 1b 2 3 8b 9 Or 10 Of Schedule D on Android devices

People also ask

-

What are the key features of airSlate SignNow related to the 2019 schedule d instructions?

airSlate SignNow offers a range of features that simplify the process of completing and eSigning essential documents like the 2019 schedule d instructions. With customizable templates, users can easily create forms that meet their specific needs, ensuring compliance with IRS guidelines. Additionally, the platform provides secure document storage and tracking, making it easier to manage tax-related paperwork.

-

How can airSlate SignNow help me with filing the 2019 schedule d instructions?

Using airSlate SignNow, you can efficiently gather signatures and complete your 2019 schedule d instructions digitally. The platform allows users to streamline their documentation process, reducing the risk of errors and ensuring all necessary signatures are obtained. This results in a smoother filing experience come tax season.

-

Is airSlate SignNow cost-effective for managing my 2019 schedule d instructions?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing to manage documents like the 2019 schedule d instructions. With flexible pricing plans tailored to various business sizes, you can choose the package that best fits your needs without breaking the bank. You'll save time and resources, which can offset the costs of tax preparation.

-

What integrations does airSlate SignNow offer for improving the handling of the 2019 schedule d instructions?

airSlate SignNow integrates seamlessly with numerous applications such as Google Drive, Dropbox, and CRM systems. These integrations facilitate easy document access and sharing, allowing you to work with your chosen tools while completing your 2019 schedule d instructions. This connectivity enhances workflow efficiency and document management.

-

Can airSlate SignNow ensure the security of my 2019 schedule d instructions?

Absolutely! airSlate SignNow prioritizes the security of your documents, including sensitive ones like the 2019 schedule d instructions. With industry-standard encryption and secure cloud storage, you can rest assured that your data is protected from unauthorized access. Additionally, user authentication helps maintain control over who accesses your documents.

-

Does airSlate SignNow offer support for users with questions about the 2019 schedule d instructions?

Yes, airSlate SignNow provides dedicated customer support to assist users with queries about the 2019 schedule d instructions. Our knowledgeable support team is available through various channels, ensuring you receive timely assistance. Whether you have questions about features or technical issues, we're here to help you navigate the process.

-

What are the benefits of using airSlate SignNow for my 2019 schedule d instructions?

The primary benefits of using airSlate SignNow for your 2019 schedule d instructions include enhanced efficiency, cost savings, and improved compliance. By digitizing the signing process, you can expedite document turnaround times and reduce the chances of errors. This leads to a smoother tax filing experience and peace of mind during tax season.

Get more for Schedule D Instructions

Find out other Schedule D Instructions

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document